Editor's PiCK

Crypto Fear & Greed Index shifts to 'Neutral'…Market sentiment shows first sign of improvement since October

공유하기

- The Crypto Fear & Greed Index shifted to the Neutral stage, indicating that investor sentiment is mildly recovering for the first time since October.

- After the severe declines in the Bitcoin and altcoin markets, investor sentiment has moved out of extreme fear but still lacks conviction about the direction.

- It reported that external factors such as geopolitical issues and the liquidity environment are analyzed to have a significant impact on investor sentiment and the market's future direction.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

The fear-and-greed index, which indicates investor sentiment for virtual assets (cryptocurrencies), has returned to the neutral range, signaling a gradual recovery of market sentiment that had been subdued for a long time.

On the 5th (local time), Cointelegraph cited CoinMarketCap's 'Crypto Fear & Greed Index,' which recorded 40 as of the previous day, moving it into the 'Neutral' stage. This is the first time the index has recovered to a neutral level since October. Earlier, the index fell to 10 at one point in November, indicating this year's lowest level of 'Extreme Fear.'

The sharp cooling of investor sentiment was largely due to the rapid market correction in October. At that time, Bitcoin plunged shortly after reaching an all-time high of $125,000, falling to around the $80,000 level, with a decline of about 35%. The altcoin market suffered an even greater shock. The market capitalization of altcoins excluding Bitcoin and Ethereum plunged by about 33% in a single day.

Since then, the market has moved out of the extreme fear phase and has shown a gradual recovery in sentiment. However, the fact that the index remains in the neutral range means investors still lack conviction about the market's direction. Some expect that the worst phase is over ahead of 2026, but it is judged too early for a full-scale shift to optimism.

External factors are also at play. Over the weekend, news of U.S. military action in Venezuela highlighted geopolitical tensions. President Donald Trump announced that a large-scale military operation had been carried out against Venezuela, and repercussions were expected in international financial markets. Typically, risk assets react sensitively to geopolitical shocks, but Bitcoin's price remained relatively stable.

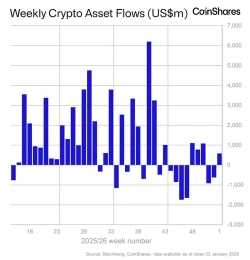

Market interpretations are mixed. Some analysts believe the impact on virtual asset prices will be limited, while others urge caution, saying it is necessary to observe the reaction of traditional assets after U.S. financial markets open. Whether the investor sentiment that has entered the neutral range will lead to a rise or become subdued again depends, for the time being, on external factors and the liquidity environment.