Editor's PiCK

[Analysis] "Bitcoin ETF inflows stabilizing…Institutional investors are returning"

공유하기

Summary

- Glassnode said fund flows into US spot Bitcoin ETFs have turned to an uptrend, with institutional investors becoming active again.

- It reported that alongside Bitcoin’s price gains, profit-taking pressure has eased and selling pressure—centered on long-term holders (LTH)—is entering a depletion phase.

- It said the recovery in Bitcoin futures open interest (OI) after deleveraging is being read as signs of renewed buying demand in the derivatives market and improving risk appetite.

An analysis suggests that institutional investors have recently resumed investing in Bitcoin (BTC).

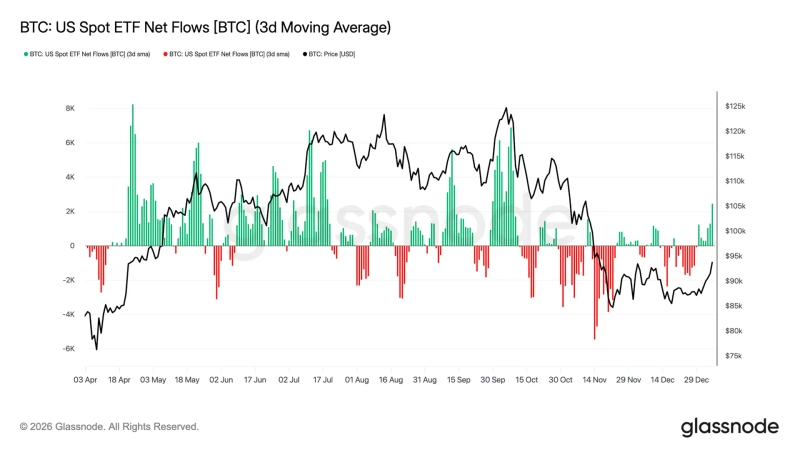

On-chain analytics firm Glassnode said in its weekly report on the 7th (local time) that “early signs are emerging that participation by institutional investors is becoming active again, judging by fund flows into US spot Bitcoin exchange-traded funds (ETFs).” Glassnode noted that “(Bitcoin ETFs) saw prolonged net outflows and weak investor sentiment through the end of last year,” adding that “(however) in recent weeks, as prices have stabilized and rebounded, inflows are clearly reversing.”

Glassnode emphasized that “the direction of (ETF) fund flows has clearly turned to an uptrend.” It said that “this shift means institution-led spot demand is being re-established not as a source of sell-side liquidity but as constructive upward momentum,” and added that “as the market gradually enters a stabilization phase in the new year, (institutional demand) is likely to act as a factor providing structural support to the downside.”

The analysis also says profit-taking pressure is easing. Glassnode explained that “in the first week of this year, Bitcoin broke out of a range around $87,000 and rose into the $94,000 range,” and that “the advance reflects a clear easing of profit-taking pressure across the market.”

It continued, “as of the end of last month, the 7-day moving average of realized profits plunged to about $183.80 million per day,” calling it “a sharp decline from the elevated daily profit-taking level of more than $1 billion observed throughout the fourth quarter of last year.” It added that “the deceleration in realized profits suggests that selling pressure—centered on long-term holders (LTH)—is entering a depletion phase.”

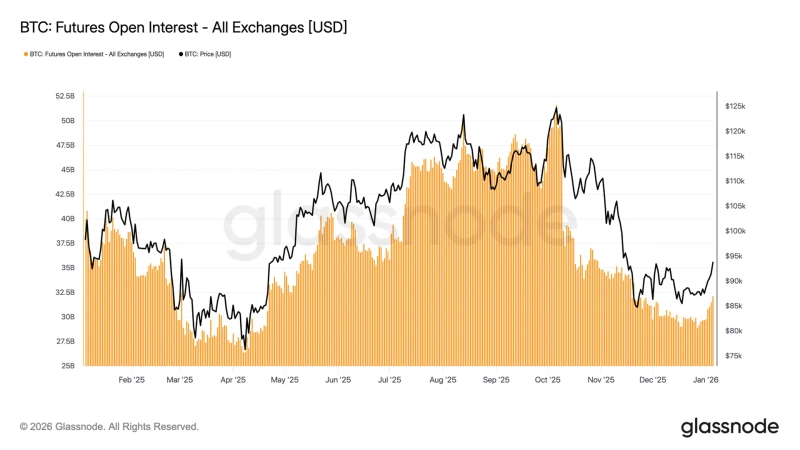

It also addressed open interest (OI) trends. Glassnode analyzed that “the size of (Bitcoin) futures open interest has started to recover after the sharp deleveraging at the end of last year,” meaning that “derivatives market participants’ willingness to reallocate into risk assets is increasing again.” It added, “signs of renewed expansion in open interest indicate a localized improvement in risk appetite,” and said this “can be interpreted as a signal that buying demand is forming again within the derivatives market.”

![Rotation from semiconductors to traditional industries… major indexes finish mixed [New York stock market briefing]](https://media.bloomingbit.io/PROD/news/9ce8e39b-78c8-4364-9ddf-31a2eb36e4f5.webp?w=250)