Editor's PiCK

A sweeping 2026 altcoin outlook…A chance to ride the crypto industry’s megatrends? [Kang Min-seung’s Altcoin Now]

공유하기

Summary

- Experts said stablecoins and RWAs are emerging as megatrends, and alongside an expansion in DeFi TVL, Ethereum and Solana are likely to benefit as core infrastructure.

- Reports said that through 2026 the digital-asset market will continue a structural transition amid progress in institutionalization and improved liquidity, while heightened volatility and regulatory risk remain key variables.

- Analysts noted rising stablecoin dominance and a range-bound box pattern in altcoins, and said the middle to late part of this year could be a potential accumulation window for Bitcoin, Ethereum, and blue-chip altcoins.

Stablecoins and RWA tokenization megatrends

Infrastructure competition centered on Ethereum and Solana comes into focus

The overall digital-asset market is undergoing structural reshuffling

Expectations for 2026 remain intact amid near-term volatility

Experts say that expectations are building this year for a structural reshuffle across the board—spanning decentralized finance (DeFi), privacy and prediction markets—anchored around stablecoins and real-world asset (RWA) tokenization. Still, with the possibility of heightened volatility lingering in the near term, the broader trend is seen as tilting toward cautious optimism.

Stablecoins and RWA tokenization megatrends…Ethereum and Solana seen as prime beneficiaries

Analysts say stablecoins and RWA tokenization are an unstoppable megatrend this year, with Ethereum (ETH) and Solana (SOL) likely to be the biggest beneficiaries.

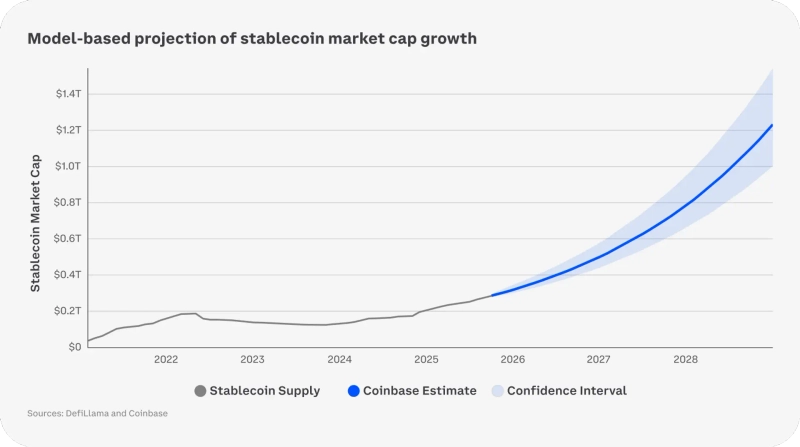

Global digital-asset (cryptocurrency) exchange Coinbase forecast that “stablecoins are a core use case of the digital-asset ecosystem and will expand in utility, with market capitalization reaching about $1.2 trillion by end-2028.” On DefiLlama, stablecoin market cap stands at $307.5 billion. Coinbase added that “RWA drew major attention last year, and tokenized equities are only just entering an early stage,” noting that “they increase capital efficiency and enable higher leverage than traditional finance. Rapid growth is expected ahead.”

Global asset manager 21Shares also projected that by year-end, stablecoin circulation and the size of the RWA market could be roughly triple (about $1 trillion) and 10x (about $500 billion), respectively. Accordingly, DeFi total value locked (TVL) could expand to about $300 billion by year-end—roughly double the current level (about $150 billion). Forecasts also suggest DeFi use cases will broaden, led by decentralized perpetual futures exchanges (Perp DEX).

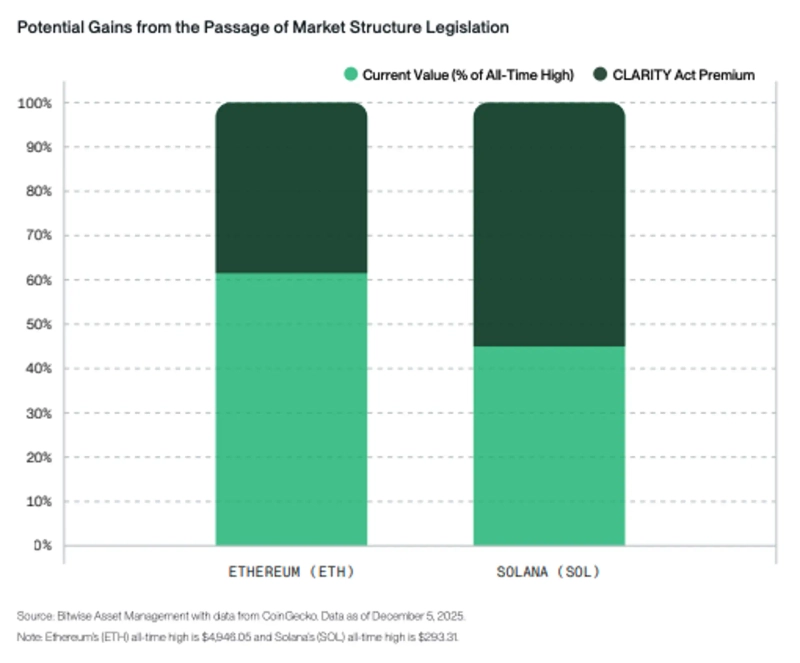

A bullish outlook for Ethereum and Solana is also being raised. In a research report, global asset manager Bitwise said, “With the spread of stablecoin and RWA projects this year, Ethereum will reinforce its presence as core infrastructure.” It added, “Solana, too, is likely to see qualitative expansion of its ecosystem as infrastructure and application projects such as Render take hold.” Render is a decentralized GPU rendering network that uses Solana.

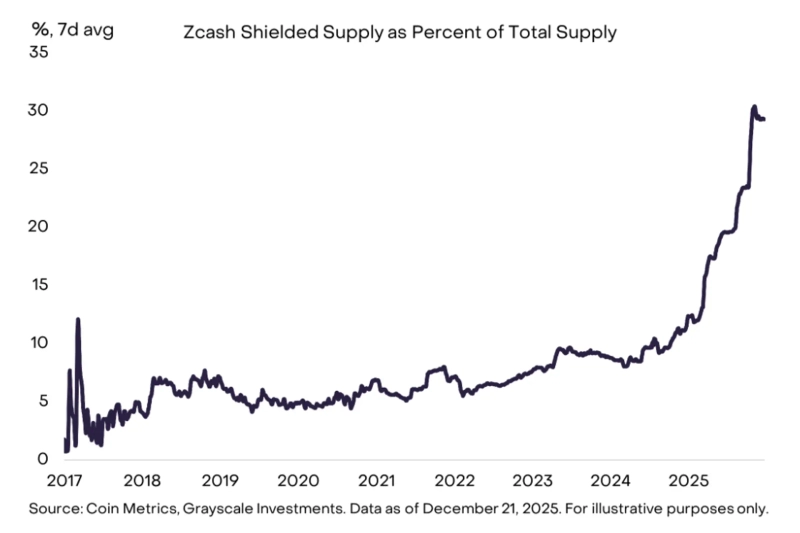

Will privacy coins stay strong…Banking and regulatory risks put to the test

As structural demand for privacy coins expands, friction with the regulatory environment is seen as the key variable this year. Among privacy coins last year, Zcash (ZEC) surged 861% for the most notable performance, while Monero (XMR) and Dash (DASH) rose 123% and 12%, respectively.

U.S. venture capital firm Andreessen Horowitz (a16z) said, “In a blockchain market where differentiation based only on fees or performance has become difficult, privacy is emerging as a new competitive factor,” adding, “Users are increasingly choosing networks with stronger privacy.” Cypherpunk, which strategically accumulates ZEC, assessed that “privacy blockchains could serve as a means of countering excessive transparency in legacy financial infrastructure in the AI era.”

Still, experts cite regulatory risk as the key variable while acknowledging the sustainability of performance. Jason Fernandez, co-founder of AdRunum, said, “In the short term, tighter regulation can spur privacy demand, but over the medium to long term it’s hard to rule out potential clashes with banks and authorities.” Crypto exchange KuCoin also said “regulatory risk and the macro environment could affect future returns of privacy coins.”

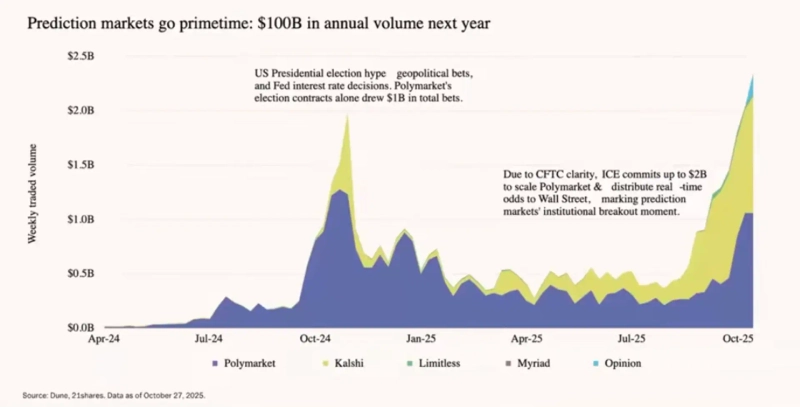

Prediction-market volume seen reaching $100 billion…Institutionalization and AI convergence in focus

Rapid growth potential for decentralized prediction platforms such as Polymarket is also being discussed this year. 21Shares analyzed that “as macro uncertainty—such as rates and geopolitics—widens this year, annual prediction-market trading volume could approach $100 billion,” adding that “if regulation by the U.S. Commodity Futures Trading Commission (CFTC) is eased, major institutional investors are also likely to begin investing directly.”

Attention is also focusing on the potential convergence of artificial intelligence (AI) and prediction markets. Andy Hall, a Stanford University professor of political economics and an a16z research advisor, said, “This year prediction markets will become larger and more sophisticated, and odds will reflect in real time not only elections but complex social phenomena,” adding, “If AI agents analyze vast amounts of information, prediction accuracy will improve, and structural changes could emerge in trading competitiveness within prediction markets.”

In particular, stablecoins are described as becoming the core settlement and liquidity instrument in prediction markets. As an alternative to minimizing outcome disputes, decentralized governance and large language model (LLM)-based oracles could function as decision-making entities. Oracles are a technology that delivers web and real-world data from outside the blockchain into the network, drawing attention as a way to improve trust in prediction markets.

2026 digital-asset market: ‘cautious optimism’…Volatility watch amid structural reshuffling

Experts say that this year the digital-asset market is seeing both expectations for further institutionalization and liquidity shifts, and warnings about near-term volatility.

In its annual report, Coinbase said, “This year the altcoin market is in a phase of structural transition as expanding institutional adoption intersects with maturing infrastructure,” adding, “The clearer the regulatory framework becomes, the greater the role digital assets will play in the core financial system.” It added, “While the overall view is close to cautious optimism, the possibility of heightened volatility remains a risk factor.”

Global asset manager VanEck also forecast that “2026 is more likely to be a consolidation and stagnation phase (preparing for a move higher) than a period of sharp rally or collapse.” It added, “Leverage in the digital-asset market has been unwound to a significant extent recently, and on-chain activity is also showing gradual signs of improvement,” noting, “If financial conditions ease, digital assets could be the biggest beneficiaries. We maintain a buy stance on Bitcoin.”

Crypto strategist Michaël van de Poppe said, “Recent easing of U.S. banks’ supplementary leverage ratio (SLR) and a short-term liquidity management stance signal liquidity provision ahead,” adding, “If a new pro-Trump Fed chair is appointed in May, the pace of rate cuts could accelerate further. That could create a favorable environment for risk assets broadly.” He added, “Altcoins are at the tail end of a long bear market that has lasted four years, and strength in gold and silver is raising expectations for a rebound in digital assets,” and said, “This year, Bitcoin, Ethereum and blue-chip altcoins are likely to lead the market.”

Improvement in the regulatory environment is also cited as a key variable that will shape this year’s market direction. The CLARITY Act, which addresses the overall regulatory framework for the digital-asset industry, is set to enter full review starting with discussions at the U.S. Senate Banking Committee on the 15th. If consensus is reached, the possibility of moving to a vote in the first half is also being mentioned. Previously, Paul Atkins, chair of the U.S. Securities and Exchange Commission (SEC), also said institutional rulemaking related to digital assets would get into full swing this year.

Still, the market is also discussing the possibility of heightened volatility for the time being. Crypto analyst Benjamin Cowen said, “Stablecoin dominance, which broke above its October–December highs last year, suggests it may rise further over the coming months,” adding, “The crypto market may see a short-term bounce through this summer, but downside pressure is expected to be significant, making uncertainty management important.” Cowen said, “If Ethereum, after its short-term rebound, fails to reclaim key support within a month or two, it is likely to continue retracing,” but added, “The middle to late part of this year could become a potential accumulation window for Bitcoin and altcoins.”

Crypto data analytics firm Santiment said, “As the new year begins, optimism is forming again in the market, but Bitcoin has yet to show a clear direction around the psychological threshold of $90,000, and Ethereum likewise has not yet shown a clear direction around the $3,500 zone.” It added, “Meme coin Pepe (PEPE) surged 41% just last week, but this is a standalone spike rather than a broad-based market rise, and is interpreted as a signal of rising volatility,” and analyzed that “the altcoin market is likely to remain range-bound for the time being, with rebounds and pullbacks repeating.”

Kang Min-seung, Bloomingbit reporter minriver@bloomingbit.io

![A sweeping 2026 altcoin outlook…A chance to ride the crypto industry’s megatrends? [Kang Min-seung’s Altcoin Now]](https://media.bloomingbit.io/PROD/news/f4257e44-43e1-4669-96d3-ec8ab56cbde3.webp?w=250)