Editor's PiCK

[Analysis] "Bitcoin signals a structural shift ahead of the CLARITY Act…a 'wait-and-hold' stance taking hold"

공유하기

Summary

- XWIN Research Japan said that ahead of deliberations on the CLARITY Act, the Bitcoin market has entered a medium- to long-term transition phase rather than a short-term event-driven phase.

- Net inflows to exchanges and the SOPR indicator point to limited profit-taking and low on-chain spending, indicating the market is in a "phase of waiting and patience," not defense.

- The contributor said the CLARITY Act could accelerate Bitcoin’s incorporation into the U.S. financial system, with a structural shift underway from a speculative trading asset to an institution-led long-term holding asset.

As the U.S. Congress ramps up discussions on regulation for virtual assets (cryptocurrencies), the Bitcoin (BTC) market is seeing structural changes toward integration into the regulated mainstream emerge ahead of short-term price swings.

On the 13th (local time), XWIN Research Japan, a contributor to CryptoQuant, pointed to the U.S. Senate Banking Committee’s plan to take up the 'CLARITY Act'—a virtual-asset market structure bill—on the 15th, and assessed the current market as being in a medium- to long-term transition phase rather than a short-term event-driven phase. While prices have remained relatively stable, the analysis said on-chain indicators already show shifts in investor behavior.

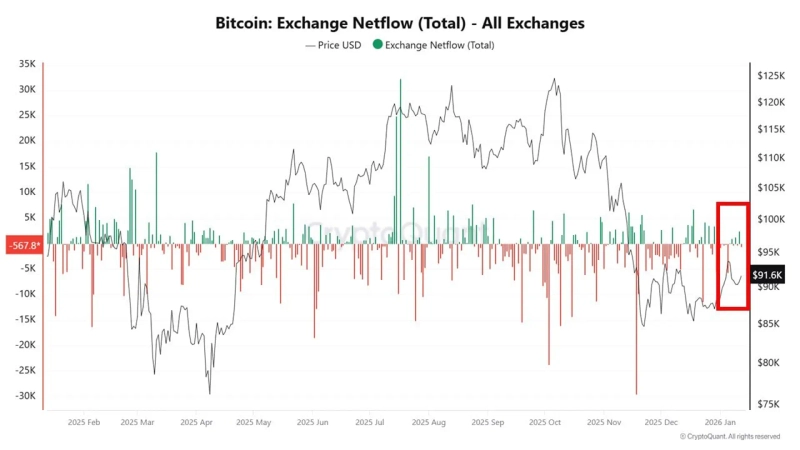

XWIN Research Japan first highlighted net inflows to exchanges as a key signal. "Generally, when regulatory uncertainty increases, investors tend to deposit Bitcoin to exchanges in preparation for selling. However, ahead of discussions on the CLARITY Act, the rise in net inflows to exchanges has remained limited," it said. This suggests market participants are not shrinking positions by treating the legislative process as an immediate risk event.

The on-chain profitability indicator SOPR (Spent Output Profit Ratio) also supports the same interpretation. SOPR indicates whether moved coins were spent at a profit or at a loss, and it is currently holding around 1 or slightly below. This implies not only limited profit-taking but also subdued on-chain spending overall, indicating Bitcoin is not moving actively.

Taking these indicators together, XWIN Research Japan diagnosed the current market not as a defensive phase but as a "phase of waiting and patience." Investors are opting to hold Bitcoin until regulatory clarity is secured rather than respond to short-term volatility, it said, adding that the overall investment horizon is gradually lengthening.

The contributor also said, "The CLARITY Act could go beyond a simple policy discussion and become a symbolic milestone for Bitcoin’s incorporation into the U.S. financial system as a regulated digital commodity." Such changes are being reflected in on-chain data ahead of prices, and a structural shift is underway in which Bitcoin’s character is evolving from a speculative trading asset to an institution-led long-term holding asset.

![[Analysis] "Bitcoin signals a structural shift ahead of the CLARITY Act…a 'wait-and-hold' stance taking hold"](https://media.bloomingbit.io/PROD/news/9ef01ab4-72f4-4245-af60-11bcd4720838.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US December Consumer Price Index (CPI), etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[New York Stock Market Briefing] Rises across the board despite Trump–Powell clash… Dow, S&P 500 hit record highs](https://media.bloomingbit.io/PROD/news/a0be4ef5-47ed-4383-adeb-91d687739b74.webp?w=250)