Editor's PiCK

Dimon warns political pressure on Fed would push rates higher [Fed Watch]

공유하기

Summary

- Jamie Dimon said political pressure on the Fed would push up inflation and interest rates.

- Executives at JPMorgan Chase and Bank of New York Mellon said undermining Fed independence could severely damage the US economic outlook and global economic stability.

- Former and current Fed chiefs and leading-country central bank heads said monetary policy independence is a core pillar of price stability and financial and economic stability.

“No actions that undermine central bank independence”

“Political pressure on the Fed would lift inflation and rates”

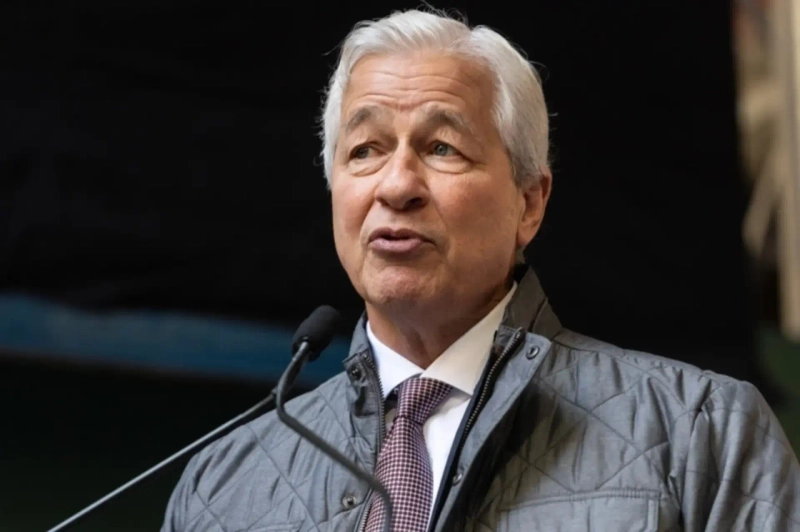

Jamie Dimon, CEO of JPMorgan Chase, warned that political interference with the US central bank (the Fed) would instead push interest rates higher.

On the 13th (local time), after JPMorgan Chase’s earnings release for the fourth quarter of last year, Dimon told reporters—regarding the Justice Department’s issuance of a subpoena to the Fed—that “any action that undermines the independence of the central bank is not a good idea.” He added, “If political pressure is applied to the Fed, inflation and interest rates could rise, producing the exact opposite outcome of President Donald Trump’s goal of lowering rates.”

The remarks came shortly after Fed Chair Jerome Powell disclosed over the weekend that he is under a Justice Department investigation. As a leading figure on Wall Street, Dimon has for months publicly and privately defended Powell and the Fed from political interference.

Dimon, however, drew a line in saying he does not agree with every Fed decision. “I don’t think the Fed is perfect, and I believe it has made mistakes,” he said, adding that he has “great respect for Chair Powell.”

The comments are seen as reaffirming that top Wall Street executives, regardless of their personal views on the current rate policy, publicly support the central bank’s independence itself.

President Trump has repeatedly urged Powell and the Fed to cut rates, judging that rate reductions could stimulate the economy and reduce the burden of home purchases. Tensions escalated further after Powell said he is facing the possibility of criminal charges. Powell also noted that he feels he is under political pressure because he did not cut rates to the level President Trump wants.

The administration is also pursuing an effort to remove Fed Governor Lisa Cook, a matter currently under review at the US Supreme Court.

JPMorgan Chase CFO Jeremy Barnum said the same day, “If investors lose confidence in the Fed’s independence, it could severely damage not only the outlook for the US economy but also overall global economic stability.”

Robin Vince, CEO of Bank of New York Mellon, likewise stressed that the Trump administration’s pressure on the Fed is backfiring and that central bank independence is essential for stability in the bond market as well.

Powell said he received a grand jury subpoena from the Justice Department in connection with his congressional testimony last summer regarding the renovation project at the Fed’s headquarters building.

Former Fed chiefs who served under both Democratic and Republican administrations—including Alan Greenspan, Ben Bernanke and Janet Yellen—defended Powell and the Fed, calling the probe “an unprecedented attempt to undermine the independence of monetary policy through political influence.”

In addition, central bank heads from the ECB as well as the United Kingdom, Sweden, Denmark, Switzerland, Australia, Canada, South Korea, and Brazil issued a joint statement backing Powell. They said, “Central bank independence is a core pillar of price stability and financial and economic stability in the public interest.”

New York=Park Shin-young, correspondent nyusos@hankyung.com

![[Market] Bitcoin tops $96,000 for the first time in two months…short-covering demand grows as inflation steadies](https://media.bloomingbit.io/PROD/news/9d8918a1-728c-412c-9379-d557b0c7f291.webp?w=250)

![Dimon warns political pressure on Fed would push rates higher [Fed Watch]](https://media.bloomingbit.io/PROD/news/temp/temp-5be6b1eb-5cd4-452d-9acf-1e64df19507b.webp?w=250)

![[Market] Bitcoin Reclaims the $95,000 Level… Strengthens on Trump’s Pressure on the Fed to Cut Rates](https://media.bloomingbit.io/PROD/news/2b2de1cf-346c-4306-abd8-9d9c089041d3.webp?w=250)