Editor's PiCK

US Bitcoin ETFs swing to net outflows after five sessions...$400 million pulled

공유하기

Summary

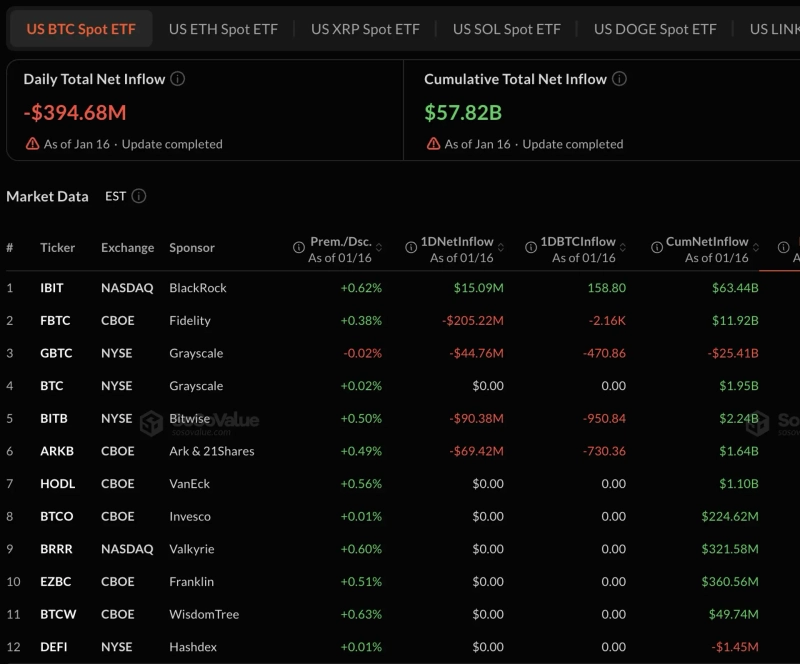

- US spot Bitcoin ETFs ended a four-day streak of net inflows and turned lower as roughly $400 million in large-scale outflows was recorded.

- Heavy net outflows were seen from Fidelity FBTC, Bitwise BITB, ARK 21Shares ARKB, and Grayscale GBTC, signaling a hit to investor sentiment.

- Meanwhile, only BlackRock IBIT posted net inflows of $15.09 million, while seven funds including VanEck HODL, Valkyrie BRRR, and Franklin Templeton EZBC were flat.

US spot Bitcoin exchange-traded funds (ETFs) turned lower after logging large fund outflows. After four consecutive days of net inflows, roughly $400 million exited in a single day.

According to SosoValue, a crypto-asset data analytics platform, total net outflows of $394.68 million were recorded across 12 US spot Bitcoin ETFs on the 16th (local time).

Fidelity led the exodus. Fidelity’s FBTC saw net outflows of $205.22 million in a single day, accounting for more than half of the total. It was followed by Bitwise’s BITB with $90.38 million and ARK 21Shares’ ARKB with $69.42 million. Grayscale’s GBTC also posted net outflows of $44.76 million.

By contrast, BlackRock was the only issuer to see inflows. BlackRock’s IBIT recorded net inflows of $15.09 million. The remaining seven funds—including VanEck (HODL), Valkyrie (BRRR), and Franklin Templeton (EZBC)—were flat with no meaningful inflows or outflows.