Editor's PiCK

[Analysis] "Bitcoin faces persistent overhead selling pressure…market structure entering an improvement phase"

공유하기

Summary

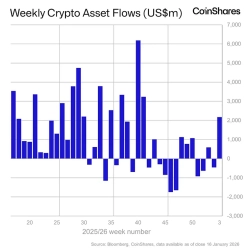

- The report said Bitcoin is seeing a gradual improvement in market structure after a short-term pullback, as leverage overhang eases amid strong spot demand.

- It noted that a short squeeze, short-position liquidations, and open interest normalization emerged during the rally, easing the previously excessive derivatives positioning burden.

- However, it said overhead selling pressure remains as Bitcoin enters the $93,000–$110,000 long-term holder supply zone, though declining profit-taking supply is increasing the likelihood of absorbing overhead supply.

An analysis suggests that while Bitcoin (BTC) has undergone a short-term pullback, easing leverage overhang is gradually improving market structure.

According to crypto (digital asset) news outlet Odaily on the 19th, Bitfinex Alpha said in a recent report that “supported by strong spot demand, Bitcoin briefly broke through the $94,000–$95,000 resistance zone and rose as high as $97,850 intraday on the 14th, marking its highest level in more than two months.” It added that “even if this breakout was temporary, it is a constructive move in that leverage pressure has eased and the market environment has been cleared out.”

The report explained that a meaningful short squeeze occurred during the rally. On a single-day basis, it saw the largest short-position liquidation in roughly 100 days, and open interest has entered a normalization phase. With profit-taking in leveraged long positions and the unwinding of short positions occurring simultaneously, it assessed that the excessive burden from derivatives positioning has eased.

Still, it said overhead selling pressure remains. Bitcoin has now entered a supply zone driven by long-term holders (LTH), estimated at $93,000–$110,000. This price range has historically capped rebounds, and long-term holders are still showing a net-selling trend.

However, the pace of selling has slowed significantly. On a weekly basis, realized profit-taking volume has fallen to about 12,800 BTC recently from levels that exceeded 100,000 BTC per week at the cycle peak. Bitfinex analyzed that with seasonal factors in the first quarter and improved order flow compared with the past, the likelihood is rising that the market can absorb overhead supply.

The report added: “For a stable breakout above this supply zone, long-term holder selling pressure needs to ease further,” and “in that case, the door could open to a more sustained rebound and another attempt at an all-time high.”

![[Analysis] "Bitcoin faces persistent overhead selling pressure…market structure entering an improvement phase"](https://media.bloomingbit.io/PROD/news/b3c6eb17-c7ef-4e44-ba30-5e119f9c1086.webp?w=250)