Summary

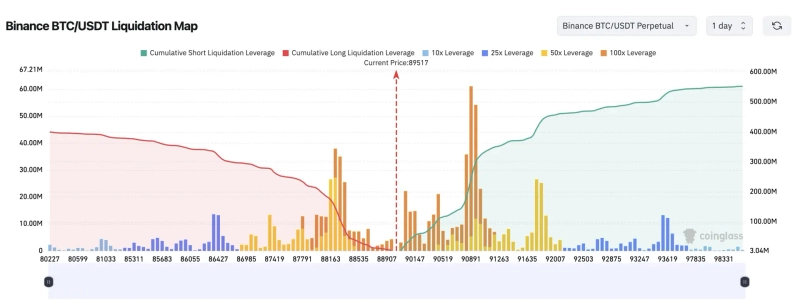

- CoinGlass said that if Bitcoin breaks above $91,000, short positions worth about $1.034bn are estimated to be liquidated.

- It added that if Bitcoin falls through $88,000, long positions worth about $638m are projected to be forcibly liquidated.

- The market is facing greater liquidation risk on a move higher—an “upside pressure”—and Bitcoin is trading at $89,620.

As Bitcoin (BTC) pauses to catch its breath while eyeing a return above $90,000, large-scale liquidations are expected depending on the next price move. In particular, a rebound could trigger sizable liquidations among short sellers, warranting caution over heightened volatility.

According to crypto data analytics platform CoinGlass on the 23rd, as of the 22nd (local time), if Bitcoin breaks above $91,000, short positions worth about $1.034bn (about KRW 1.5tn) on major centralized exchanges (CEXs) are estimated to be liquidated.

Conversely, if the decline deepens and the $88,000 level gives way, long positions—bets on a rise—worth about $638m (about KRW 900bn) are projected to be forcibly liquidated. In effect, the market is facing much greater “upside pressure,” with potential liquidation volume far larger on a move up than on a move down.

On the day, Bitcoin was trading at $89,620 on Binance’s Tether (USDT) market, down 0.4% from the previous day.

![Two-day relief rally as Greenland tensions ease… Tesla surges [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/3fdba95e-9847-4c13-b13d-ba4b16d949bd.webp?w=250)