APEC accommodation fees surged 20-fold… October inflation rate highest in 15 months

Summary

- The Bank of Korea said the consumer price index rose 2.4% in October.

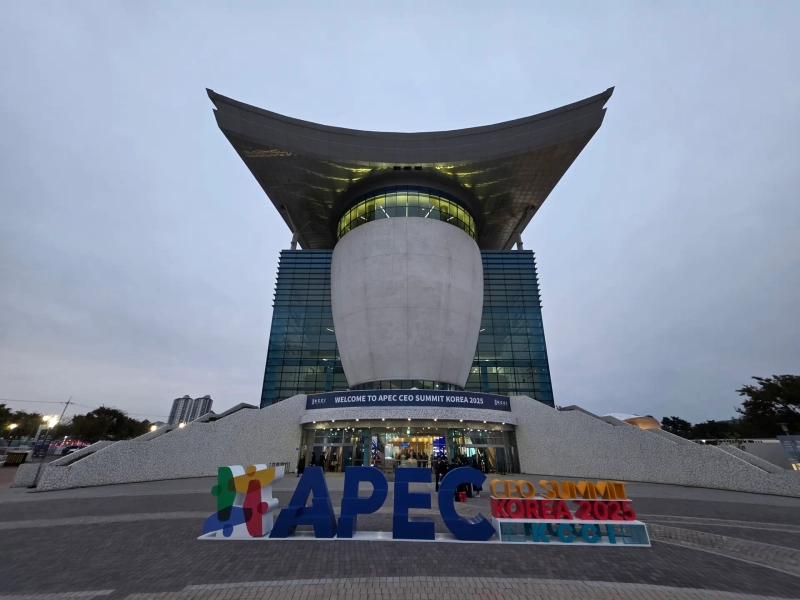

- APEC-period accommodation fees surged by up to 20-fold, highlighting instability in service prices.

- The Bank of Korea projected that future inflation will stabilize around 2% at the end of this year and early next year.

The Bank of Korea attributed last month’s inflation rate of 2.4% to rising service prices such as travel·accommodation. It analyzed that travel demand from both domestic and foreign visitors increased significantly due to the long Chuseok holiday and APEC. In fact, accommodation prices during the APEC period rose by nearly 20-fold, showing instability.

Kim Ung, the Bank of Korea deputy governor, held a meeting to review price developments at the BOK headquarters on Namdaemun-ro in Seoul on the 4th and examined recent price conditions and future trends. Kim said of October’s inflation rate (2.4%), "Some service prices such as travel·accommodation have risen, and prices of petroleum products and agricultural, livestock and fishery products have also increased."

According to consumer price trends released by the National Data Office, the price increase rate for petroleum products rose from 2.3% in September to 4.8%, more than doubling. Agricultural, livestock and fishery products rose from 1.9% to 3.1%. Core prices, including travel and accommodation, rose from 2.0% to 2.2%.

Regarding future price trends, they forecast prices will stabilize again around 2%. Kim said, "Considering lower oil price levels compared to last year and expectations of a slowdown in travel service prices, year-end and early next year’s inflation rate will stabilize around 2%," adding, "However, given increased volatility in exchange rates and oil prices, we will review the detailed inflation outlook path in the November outlook."

Reporter Kang Jin-kyu josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)