Editor's PiCK

[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets

Summary

- The government and the National Tax Service said they are pursuing a plan to introduce comprehensive taxation of crypto-asset-related income, including airdrops and staking.

- The overhaul could be announced in July and crypto-asset taxation is expected to be fully implemented from January next year.

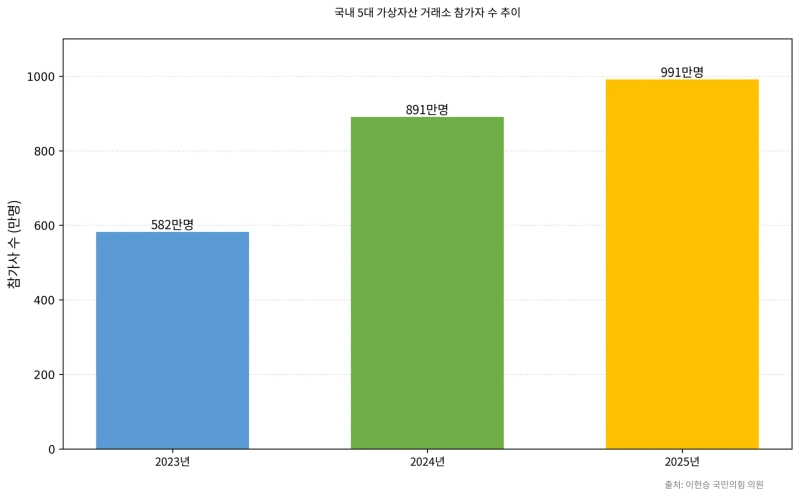

- The number of participants at Korea’s five largest crypto-asset exchanges increased by about 70% over the past two years, heightening the need to refine the tax framework.

Introducing a ‘comprehensive approach’ to crypto-asset taxation

Airdrops and staking also subject to tax

Benchmarking tax regimes in Japan and other major countries

Likely to be announced in July... to take effect from January next year

The government is pushing a plan to bring income related to crypto assets (cryptocurrencies)—including airdrops (free token distributions) and staking (tokens)—into the tax framework. With the crypto-asset market expanding rapidly, the policy is to codify the tax basis for special types of transactions.

According to relevant ministries on the 2nd, the National Tax Service (NTS) commissioned a research study late last year to overhaul the crypto-asset taxation system. At the core of the study is a review of adopting a “comprehensive approach” specifically for crypto-asset taxation. Under a comprehensive approach, even items not explicitly listed in the law are treated as taxable if they constitute an economic benefit.

The NTS plans to wrap up the study in the first half of this year. A government official said, “We have largely settled on introducing a comprehensive approach to crypto-asset taxation,” adding, “We are reviewing whether legislative amendments are required. As soon as the research concludes, we will begin inter-ministerial discussions.”

“Administrative inefficiency would arise”

Tax authorities are pursuing a comprehensive approach because they believe there are blind spots in the crypto-asset taxation system. Korea’s Income Tax Act applies a “positive list” approach, meaning in principle only income explicitly specified in the law can be taxed. Income from crypto assets stemming from new blockchain technologies—such as airdrops and staking—would therefore need to be listed one by one in the statute to clearly establish a basis for taxation.

The NTS believes administrative inefficiency would increase if a positive list approach were applied to crypto-asset taxation as well. An NTS official explained, “(Under current law) when it is unclear whether a new transaction type constitutes income arising from transfers or lending—categories listed as taxable—there are difficulties that require tax guidelines or an authoritative interpretation.” In other words, the taxability would have to be determined case by case each time taxes are assessed.

Major countries such as the United States and Japan have already systematized crypto-asset taxation. In particular, Japan has drawn the NTS’s attention. Japan applies a positive list approach under its Income Tax Act and taxes airdrops and staking based on the “time of reward.” The NTS is said to have recently contacted local tax authorities in Tokyo, Japan, to discuss crypto-asset taxation.

The government also offered an interpretation four years ago that airdrops could be subject to tax. According to the National Tax Law Information System, the Ministry of Economy and Finance stated in 2022 that “transferring crypto assets to another person free of charge constitutes a ‘gift’ under the Inheritance and Gift Tax Act,” and interpreted that “gift tax is imposed on the recipient who receives the crypto assets free of charge.”

Possible announcement this July

If legislative amendments are necessary, there is also a possibility that the overhaul will be announced in July this year. That is because domestic crypto-asset taxation is scheduled to be fully implemented from January next year, requiring the legal framework to be finalized within this year. The government announces tax law amendments every July and applies them from the following year.

Authorities are moving quickly to refine the tax framework in tandem with a rise in the number of crypto investors. According to materials the Financial Supervisory Service recently submitted to Rep. Lee Heon-seung of the People Power Party, the number of participants at Korea’s five largest crypto-asset exchanges, including Bithumb and Upbit, rose about 70% over the past two years—from approximately 5.82 million in 2023 to about 9.91 million last year.

Experts also say the tax framework overhaul is urgent. In a recent report, Kim Gap-rae, a senior research fellow at the Korea Capital Market Institute, pointed out that “the lack of clarity in Korea’s tax regime regarding airdrops—an inherent tax issue unique to crypto assets—is very significant,” adding that “if the system is not refined, tax ambiguity could cause confusion among market participants.”

Oh Moon-sung, a professor in the Department of Tax Accounting at Hanyang Women’s University, said, “Under the current crypto-asset taxation system, tax equity issues could emerge,” adding, “Authorities need to classify crypto-asset-related income in detail.”

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)