Bitcoin trading sideways… Santa rally hopes amid variables such as rate cuts

Summary

- It reported that Bitcoin prices have recently continued a sideways trend amid variables such as interest rate cuts and global trade conflicts.

- Experts said that whether the U.S. will make additional interest rate cuts is the market's key variable and that attention should be paid to spot ETF listings and other integration into the regulated sector.

- Global investment institutions said there is a year-end Santa rally possibility and viewed the recent decline as a buying opportunity.

Uptober expectation fails… falls below 170 million won

Repeated ups and downs following global trade conflicts

Volatility increases amid U.S. financial instability and others

Whether there will be additional rate cuts is the key variable

Citibank "Up to $132,000 by year-end"

Inclusion into the regulated sector such as spot ETF listings

Buying opportunities from Santa rally-driven dip

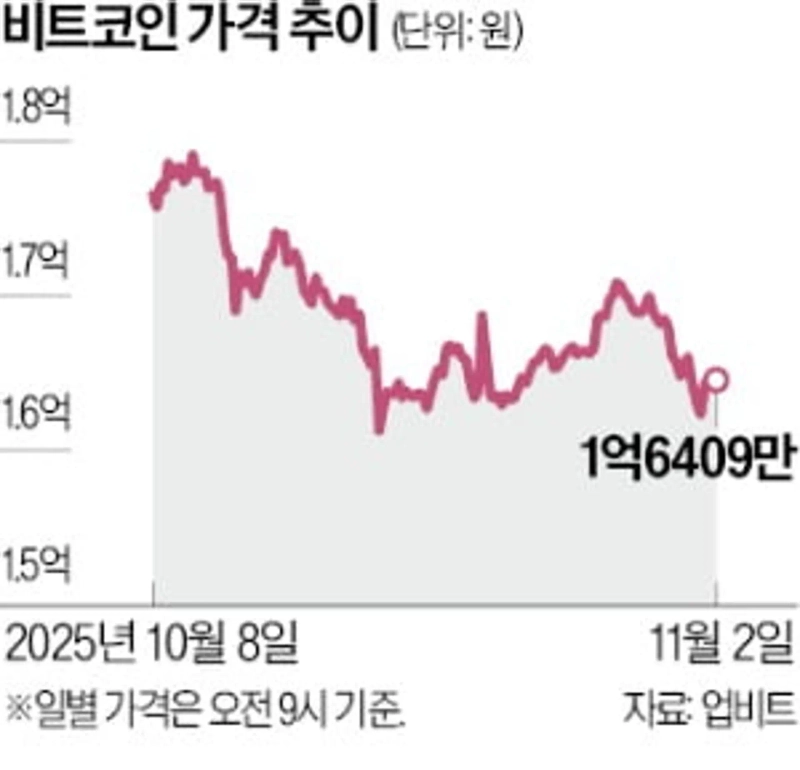

Bitcoin prices have continued to trade sideways without a clear direction. The initial seasonal expectation of 'Uptober (Up+October)' failed to materialize, and complex variables such as global trade conflicts and interest rate cuts have affected the market. While there is anticipation for a year-end 'Santa rally', experts advise monitoring key factors such as whether there will be additional rate cuts and the listing of altcoin exchange-traded funds (ETFs).

◇Uptober bypassed for the first time in 7 years

According to domestic cryptocurrency exchange Upbit on the 4th, Bitcoin prices recently fell below 170 million won. They rose to the 178 million won level on the 8th but dropped to the 160 million won level after the 15th. In overseas markets, based on CoinMarketCap, Bitcoin has been trading around $110,000.

Typically, October often sees Bitcoin prices rise, which investors call 'Uptober' based on seasonal patterns. Bitcoin has closed higher in October 9 times out of the past 10 years. Bitcoin was setting new all-time highs daily earlier last month, raising expectations. In particular, when the U.S. federal government was temporarily shut down, investors worried about a weaker dollar moved toward gold and Bitcoin, known as 'digital gold.' However, Bitcoin retreated after hitting an all-time high of $126,200 on the 6th of last month. This year, the Uptober phenomenon did not continue for the first time since 2018. Still, despite October's decline, Bitcoin's year-to-date value is still more than 16% higher.

The re-ignition of global trade conflicts also hindered performance. When U.S. President Donald Trump signaled intentions to resume a tariff war with China, Bitcoin slipped below $110,000, and major altcoins such as Ethereum, XRP (formerly Ripple), and Solana also fell. Added to this, regional U.S. banks' bad loan problems and other financial instabilities increased market volatility.

However, after the U.S.-China summit at the end of last month eased tensions, prices regained stability. President Trump and President Xi Jinping agreed on reducing U.S. tariffs on China by 10 percentage points, temporarily waiving controls on rare earth exports from China, and expanding purchases of U.S. agricultural products. This was seen as giving relief to global risk asset markets generally.

The Federal Reserve (Fed) cutting the policy rate by 0.25 percentage points at the October Federal Open Market Committee (FOMC) also acted as a positive factor. A representative of a virtual asset exchange forecasted, "Bitcoin is likely to continue fluctuating around $110,000 for the time being."

◇ The key is additional rate cuts

The market views whether the U.S. will cut rates further as the key variable. Contrary to initial expectations, the lower likelihood of a rate cut at the December FOMC has become a burden. Fed Chair Powell implemented a 0.25 percentage point cut at this meeting but drew a line by saying, "An additional cut by year-end is not a foregone conclusion." This was taken as a warning to a market that had been continuing a global liquidity rally.

Inflationary pressures have not been completely resolved. Powell explained, "Measured by the Consumer Price Index (CPI), inflation has fallen significantly from its mid-2022 peak but still exceeds the target of 2%." He added, "Tariff increases have pushed up prices for some items, but this is likely a temporary shock."

◇ Acceleration of integration into the regulated sector

Experts view the acceleration of virtual assets' integration into the regulated sector positively. Following spot Bitcoin ETFs, ETFs with Solana, Litecoin, and Hedera as underlying assets have recently been listed one after another on U.S. exchanges, marking the start of an 'altcoin ETF era.' The U.S. Securities and Exchange Commission (SEC) significantly simplified the listing procedures for spot crypto ETFs in September, which was a direct background. Accordingly, institutional capital inflows into the market are expected to accelerate.

After the approval of spot Bitcoin and Ethereum ETFs, institutional interest surged, and more companies are holding these assets directly. Global investment banks have also issued optimistic forecasts. Citibank said, "As 'digital gold,' Bitcoin has strong institutional demand," and predicted, "It will rise to $132,000 by year-end and to $181,000 in a year." Jeffrey Kendrick, an analyst at Standard Chartered (SC), said, "Investment sentiment has improved with the easing of U.S.-China tensions," and "Absent any major negative shock, it is unlikely that Bitcoin will fall below $100,000 again."

VanEck said in a recent report, "The recent decline is only a temporary correction," and evaluated it as "a buying opportunity ahead of the year-end 'Santa rally.'"

Reporter Hyunju Jang blacksea@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)