Summary

- "It said international gold prices' sharp swings continue, and that a short-term adjustment is possible."

- "It stated that domestic gold prices have a high divergence rate compared with international prices, and that when investing one needs to check the price benchmark and divergence rate."

- "Experts emphasized that when investing in gold, choosing international price-based products and risk management strategies are important."

Forecasts from different institutions also vary

Beware of international prices and the divergence rate

Also check which price benchmark is being followed

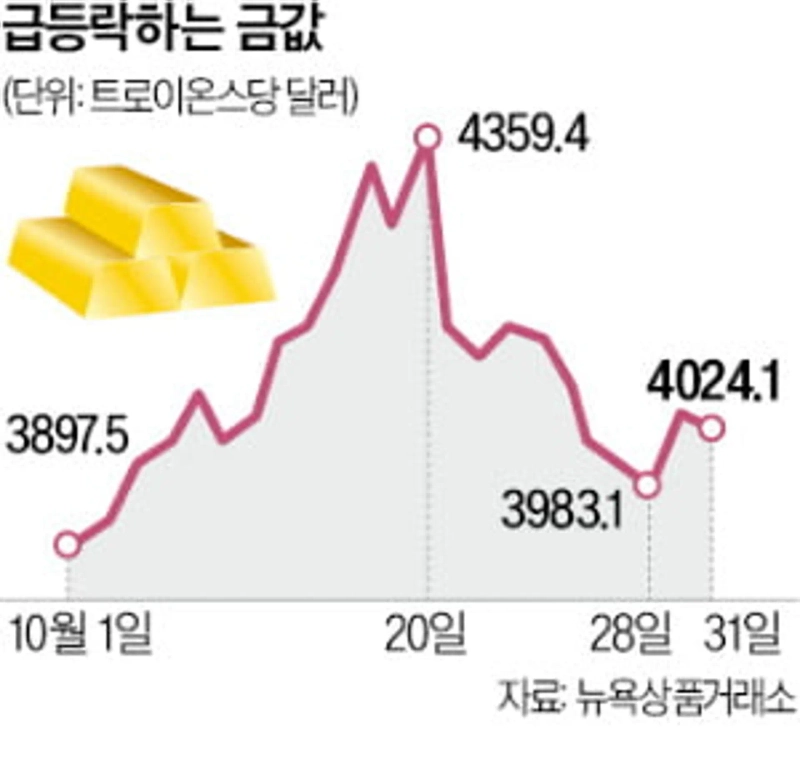

International gold prices have been repeating sharp rises and falls. As expectations of negotiations grew ahead of the US-China summit, gold, which had fallen below the $4,000 level, recently rebounded. It could undergo a short-term correction, but some predict it could rise to around $5,000 next year.

According to the New York Mercantile Exchange on the 4th, gold futures traded around $4,300 per troy ounce on the 20th of last month and then fluctuated around the $4,000 level. On the 28th, ahead of the US-China summit, the $4,000 level broke. Generally, when geopolitical uncertainty decreases, preference for risk assets like stocks expands over safe-haven assets like gold. John Reed, market strategist at the World Gold Council (WGC), said, "Central bank gold buying is not as strong as before," and diagnosed, "This adjustment could actually be a phase welcomed by professional investors."

However, on the 29th it rose 0.9% in one day and recovered the $4,000 level. Analysts say that because the recent decline was large, there was strong bargain-hunting demand.

There are also forecasts that gold prices will fall in the short term. Citigroup said in a recent report, "Progress in US-China negotiations and expectations for the end of the US government shutdown are weakening the momentum for gold price increases," and predicted, "An adjustment to $3,800 per troy ounce could come within a few weeks."

HSBC and Bank of America each projected next year's gold price at $5,000 per troy ounce. This is because if the US central bank (Fed) proceeds with additional rate cuts, dollar weakness could strengthen preference for safe-haven assets like gold.

Interest in gold investment remains high in the domestic market as well. There are warnings that attention is needed to the price divergence rate, as domestic gold prices recently showed levels more than 10% higher than international prices. The price divergence rate is the ratio that shows how much domestic gold prices differ from international gold prices. According to the Korea Exchange, in mid-last month domestic spot gold prices were 218,000 won per g, exceeding the won-converted international gold price (193,000 won) by more than 13%.

Experts emphasize that when considering gold investment, you must check "which price benchmark is being followed." This is because products such as gold exchange-traded funds (ETFs) or funds may base themselves on domestic gold prices or follow international gold prices (dollar-denominated). Domestic gold prices can easily overheat in the short term due to exchange rates, taxation, and supply and demand, but in the long term they converge to international prices according to the "law of one price." Accordingly, the Financial Supervisory Service recently recommended, "When making investment decisions, refer to the divergence rate between domestic and international gold prices," and issued a consumer warning (advisory).

The market consensus is that even if gold goes through a short-term adjustment, it remains a valid asset for hedging against risk amid increasing global volatility. A financial sector official advised, "In short-term rapid-rise periods, rather than chasing purchases, staggered buying, managing exchange rate risk, and a portfolio focused on products based on international prices are advantageous."

Reporter Mi-hyun Cho mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)