Coin mining company's 'AI transformation'… 'Tenbagger' noticed by Korean retail investors [Hot Pick! Overseas Stocks]

Summary

- Iren said it shifted from Bitcoin mining to an AI cloud business, and its stock price surged 994% in six months.

- A large AI computing contract with Microsoft and rapid business transition have attracted market attention, and domestic investors have been buying heavily recently.

- However, concerns have been raised about the large-scale investment needed for the cloud transition and data center contract rates, and the low proportion of cloud revenue, among other risk factors.

Iren that signed a 10 trillion-won contract with MS

Stock price up 1178% since April this year

May announcement switching to 'neo-cloud' was the catalyst

Still 95% of revenue is from Bitcoin mining

"Need 35 billion dollars for cloud transition" concerns too

Iren, which transformed from a Bitcoin mining company into an artificial intelligence (AI) cloud operator, climbed its stock price 994% in six months, becoming a 'tenbagger (a stock that rose more than tenfold)'. Amid the AI boom, companies have faced shortages of computing equipment and power, and Iren's swift transition is seen as having shone. Korean retail investors who have been buying the company's stock heavily since September are also earning high returns.

MS and a 13 trillion-won supply contract... recent 6-month return 994%

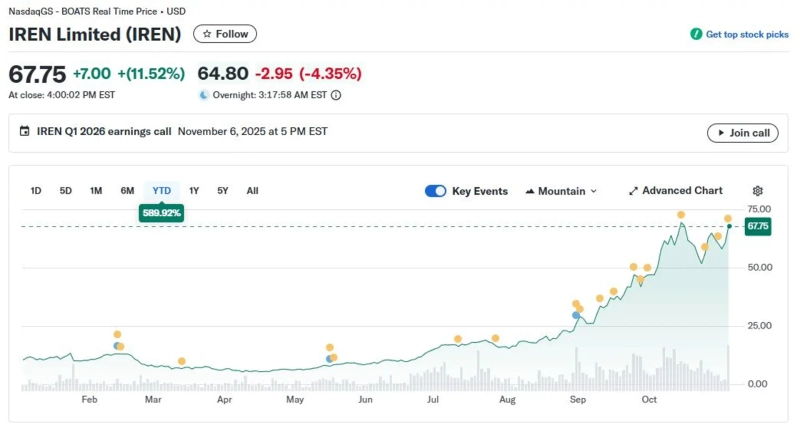

On the 3rd (local time) in the U.S. New York market, Iren closed at 67.75 dollars, up 11.52%. It approached the record high of 69.56 dollars recorded on the 14th, and the recent one-month return is 17.32%. Iren's stock rose 994.51% over the past six months, making it one of the most outstanding performers on the Nasdaq. The return since this year's low (April 8) is 1178%.

Iren announced before the market opened on the 3rd that it had signed a $9.7 billion (about 9.7 trillion won) AI computing contract with Microsoft. Microsoft can use Iren's 200-megawatt (MW) of graphics processing units (GPU) at its Childress, Texas data center for AI computing through 2030. Microsoft will pay 20% of the $9.7 billion upfront, and Iren will invest $5.8 billion to purchase NVIDIA GB300 chips and other equipment from Dell Technologies.

Korean retail investors who have been heavily buying Iren since September are also seeing gains. According to the Korea Securities Depository on the 4th, domestic investors have net-bought $616.04 million worth of Iren shares since September. It is the second-most net-bought foreign stock in the same period after NVIDIA ($737.33 million). Among 26,063 Iren investors who linked their accounts to Naver Pay's 'My Assets' service, the average purchase price converted to won is 75,813 won, and they are estimated to have an average return of 28.39%.

Transition from Bitcoin mining to 'neo-cloud'

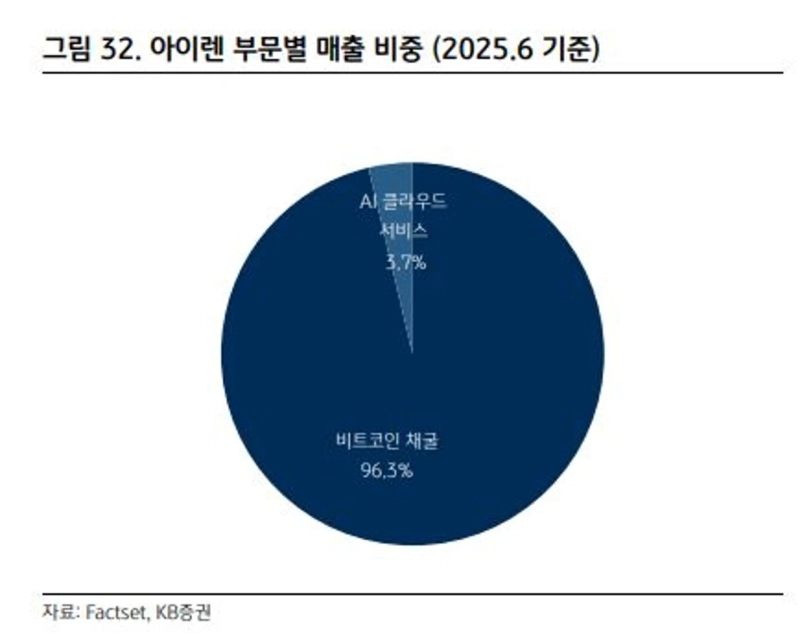

Iren started in 2018 as an Australian Bitcoin mining company. They built large-scale facilities in renewable energy production areas such as Texas in the United States and British Columbia in Canada and conducted business mining Bitcoin with low electricity costs and selling it on the market. Bitcoin mining remains Iren's core business: in fiscal 2025, of total revenue of $501 million, $485 million, or 96.8%, is expected to come from this.

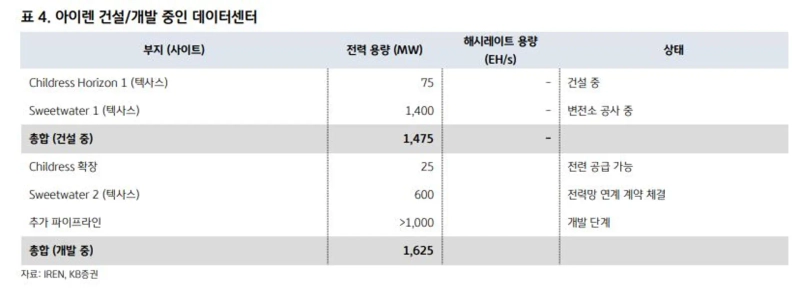

Iren's corporate value surged in earnest with business expansion in May. Iren announced it would raise its hash rate, which refers to the speed of Bitcoin mining, to 50 exahashes (EH/s) and then expand its business centered on liquid-cooled AI data centers.

To this end, it also announced plans to remodel existing facilities and add and expand a total of four data centers in Canada and Texas. External companies can perform computations in Iren's data centers via an online cloud without their own data centers.

As AI demand surged and even the world's largest big tech companies like Google and Microsoft faced computing resource issues, the value of so-called 'neo-cloud' companies, including Iren, has also soared. Neo-cloud companies provide high-performance GPU infrastructure specialized for AI computing through the cloud.

Unlike 'hyperscalers' that provide general-purpose cloud services familiar to consumers, such as Amazon Web Services (AWS) and Microsoft Azure, neo-clouds focus solely on compute support. It is notable that most companies, including Iren, Nebius, CoreWeave, and Crusoe, have converted the GPUs they used for cryptocurrency mining directly to AI computing use.

Iren has also been smoothly transitioning to the cloud business, acquiring large customers in quick succession after the switch. Last month, it announced that of the 23,000 NVIDIA GPUs it will have by March next year, 11,000 have already been contracted for use. Considering the contract with Microsoft, the data center utilization rate — Daniel Roberts, Iren's CEO, said, "The contract with Microsoft shows that Iren has established its position as a trusted supplier in the AI cloud industry and has discovered a new demand base in hyperscalers."

Cloud or mining... the 'core business' debate that will determine the stock price

Opinions in the securities industry on Iren are sharply divided. Among 13 global securities firms that issued investment ratings, 8 recommended buy or overweight, and 5 recommended neutral or sell. Their average target price was calculated at 68 dollars. This is the same level as the closing price of 67.75 dollars on the 3rd.

The core of the debate is whether to value Iren as a 'Bitcoin mining company' or a 'neo-cloud company.' Neo-cloud companies are valued at high valuations (price relative to earnings) due to explosive AI computing demand and big tech investment. Nebius, which signed an infrastructure contract of $17.4 billion with Microsoft last month, is representative. Its market capitalization is $30.2 billion, and its 12-month price-to-earnings ratio (PER) is 156 times.

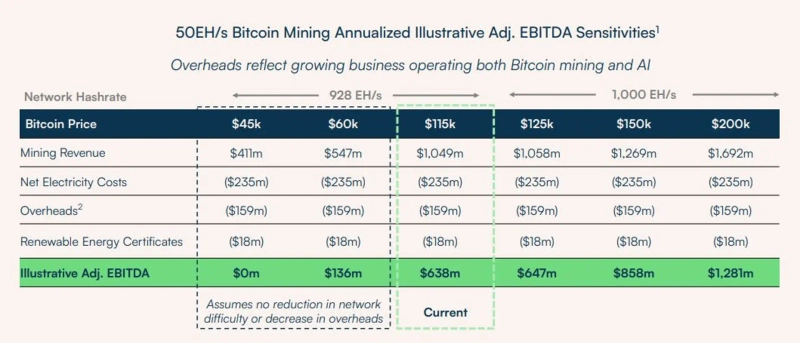

On the other hand, crypto mining companies' stock prices are determined strictly by mining capacity and Bitcoin price. Because Bitcoin prices are unlikely to rise severalfold within a year like in the past, and because of a predictable earnings structure, they trade at relatively low valuations. Marathon Digital Holdings, the leading crypto mining company, trades at a PER of 10, while competitors Cipher Mining and CleanSpark trade at 32 and 14 respectively.

As of the 3rd, Iren's PER is 173, and the market already values it as a neo-cloud company. However, skeptics are concerned that Iren will find it difficult to complete the facility investments needed for the cloud transition without choices that would harm shareholder interests or financial soundness, such as large-scale rights offerings or bond issuance. Increases in electricity costs, declines in crypto prices, and data center contract rates that have not yet approached 100% are also cited as risk factors. For fiscal 2025, Iren's cloud business revenue is $16 million, accounting for only 3.2% of total revenue.

Reginald Smith, a JP Morgan analyst, expressed concern, saying, "Iren's current stock price reflects the value when it has secured AI cloud demand of more than 1 gigawatt and completed all the facility investments for it," and "Considering that an additional investment of $35 billion would be needed for this level of facility expansion, downside risk is greater than upside potential for the stock price." JP Morgan gave the lowest target price among 13 securities firms at $24.

Beomjin Jeon forward@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)