'Blocking debt with debt' became a debt republic… Korea's 'worst situation'

Summary

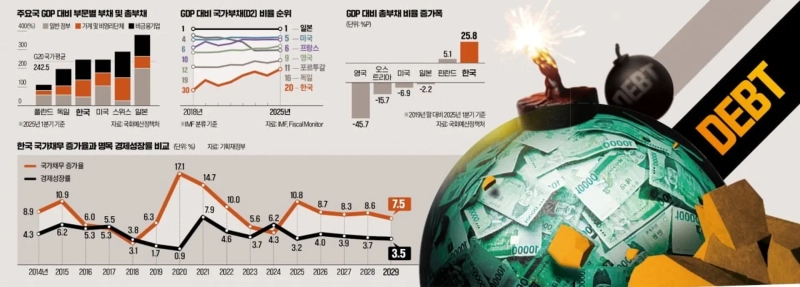

- Domestic total debt is increasing at the fastest pace among advanced countries, and the total debt ratio reportedly exceeded the G20 average for the first time.

- In particular, the increase in deficit-type debt and the expansion of debt blind spots such as public enterprise and government-guaranteed debt raise concerns about deterioration in national fiscal soundness.

- With debt reaching 2.5 times GDP and rising rapidly, investors should pay attention to macro risk factors such as growth rates and fiscal efficiency.

DEEP INSIGHT

Korea's total debt growth rate

Fastest among advanced countries

Largest increase in debt among OECD countries

The 'quality of debt' has also deteriorated sharply

Debt blind spots are also at dangerous levels

The combined total debt of our government, corporations, and households has risen at the fastest pace among advanced countries. Analysts say comprehensive debt management is needed because domestic and international economic and financial crises could turn private loan defaults into increases in national debt.

According to the Ministry of Economy and Finance and the National Assembly Budget Office on the 5th, as of the first quarter of this year, Korea's total debt-to-GDP ratio was 248%, surpassing the G20 average (242.5%) for the first time. Total debt, which was 4,533 trillion won in 2019, rose to 6,373 trillion won in the first quarter of this year, a 40.6% (1,840 trillion won) increase over five years. In particular, Korea's total debt ratio rose by 25.8 percentage points over five years, more than three times the increase of second-place Czech Republic (8.4%).

As of the first quarter, the government debt ratio (D2 basis, including non-profit public institutions) was 53.4%, ranking 20th among OECD member countries. It climbed ten places in seven years from 30th in 2018. This was because economic growth did not keep pace with the pace of debt increase. During the same period, corporate and household debt also increased by more than 1,600 trillion won. Meanwhile, of the 27 OECD member countries that released first-quarter data this year, 20 countries saw their total debt ratios decline.

Debt piling up at the speed of light… While advanced countries reduced debt, Korea increased

Growth rate squeezed by national debt… Korea turned into a debt republic

Calls are being made to systematically reexamine the rapidly increasing total debt among advanced countries, as the government's fiscal burden is growing due to measures such as the 150 trillion won National Growth Fund, the 200 billion dollar U.S. investment fund, and the largest-ever expansionary fiscal budgeting. In this situation, concerns are rising that if domestic or external economic and financial crises occur and private debt becomes distressed, it could lead to a sharp rise in national debt.

◇Triple increase in government, corporate, and household debt

According to the National Assembly Budget Office and the Ministry of Economy and Finance on the 5th, the ratio of total debt to GDP in the first quarter of this year was 248%, up 27.8 percentage points from 2019. Among the 27 OECD member countries that published first-quarter data, total debt increased in seven countries over the past five years. Of these, Korea's debt increase was the largest. The remaining 20 countries reduced total debt by actively withdrawing liquidity after overcoming the COVID-19 crisis.

The government debt ratio (D2 basis) also rose from 45.9% in 2020 to 53.4% in the first quarter of this year. During this period, the government debt ratio among advanced countries fell by an average of 12 percentage points, while Korea's rose by 7.5 percentage points. The increase in the debt ratio was the fifth largest among advanced countries. The top four—Singapore, Finland, Hong Kong, and New Zealand—are city-states or small economies, so among major advanced countries Korea's increase is effectively the largest.

Private debt also surged. Household debt, which was close to 100% (98.7%) of GDP in 2021, fell to 89.5% in the first quarter of this year, but the debt amount increased by 472 trillion won (25.8%). Corporate debt rose by 912 trillion won (46.8%), pushing the corporate debt ratio from below 100% of 2019 GDP to 111.3%.

Individual firms' debt ratios also rose from 115.6% in 2019 to 119.9% in 2024. This is analyzed as a result of aggressive borrowing to increase investment while operating profit margins remained stagnant.

Donghyun An, professor of economics at Seoul National University, said, "Except for a few large conglomerates, corporate profitability has deteriorated significantly, but the government refrained from restructuring due to concerns about rising unemployment," adding, "As a result, the number of marginal firms that survive by 'covering debt with debt' has rapidly increased." According to the Bank of Korea, the proportion of marginal firms whose interest coverage ratio has been below one for three consecutive years recently reached 17.1% of all externally audited firms, the highest in 14 years.

If household and corporate debt become distressed, the ratio of non-performing loans at financial companies will rise, causing a 'circulatory blockage' in the market where money does not circulate. After the 1997 foreign exchange crisis, the government injected 168.7 trillion won of public funds to resolve bad loans in the financial sector. Of this, 49 trillion won that could not be recovered was added directly to national debt.

◇Growth cannot keep up with the pace of debt increase

The reason the total debt ratio rose fastest among advanced countries is that the denominator, GDP, could not keep up with the pace of debt growth. In the 11 years from 2014 to 2024, nominal economic growth exceeded the growth rate of national debt in only three years. Even then, in 2017 and 2018, economic growth exceeded the national debt growth rate by only 0.2 percentage points and 0.7 percentage points, respectively. With the government announcing expansionary fiscal measures, the national debt growth rate is expected to exceed nominal growth by more than 4 percentage points in the years up to 2029.

The quality of debt is also deteriorating sharply. Financial-type debt is increasing moderately, while deficit-type debt is rapidly increasing. Deficit-type debt refers to debt issued to fill a gap when revenues are less than expenditures. It has no designated repayment source and must be repaid by taxes. Examples include government bonds, fiscal stabilization securities, and local government borrowings. Because they must be repaid with future taxes, they place a direct burden on fiscal soundness.

Financial-type debt is repayable on its own because it has designated repayment sources. Examples include bonds of housing and urban funds with repayment designated from project income or recoveries, foreign exchange stabilization fund bonds, and various guaranteed borrowings.

Financial-type debt increased from 316 trillion won in 2019 to 360 trillion won in 2024, an average annual increase of 2.7%. In contrast, deficit-type debt rose from 408 trillion won in 2019 to 815 trillion won in 2024, an average annual increase of 14.9%. It is projected to expand to 1,363 trillion won by 2029. The share of deficit-type debt in national debt rose from 56.4% in 2019 to 69.4% in 2024, and is expected to reach 76.2% in 2029.

The Budget Office warned, "The steep increase in deficit-type debt could increase the real repayment burden on the people and deepen rigidity in fiscal management due to rising interest expenditures."

◇Growing debt blind spots

Debt blind spots are also expanding, such as public enterprise debt, which is expected to exceed the 700 trillion won mark, rising from 497 trillion won in 2019 to 720 trillion won this year. Public enterprise debt is not reflected when calculating the government debt ratio, so it is classified as contingent and implicit government debt.

Another blind spot, government-guaranteed debt, is also increasing sharply. Government-guaranteed debt refers to debt that the government must repay if the debtor cannot. Because it is not confirmed debt, it is not included in national debt, but if the government has to repay it, it converts into national debt.

According to the 2026 budget proposal, government-guaranteed debt, which is 17 trillion won this year, will more than double to 39 trillion won by the end of next year. By 2029 it is expected to surge to 80.5 trillion won, or 2.6% of GDP.

The rise in government-guaranteed debt is mainly because the number of bonds issued by the Supply Chain Stabilization Fund, created to prepare for global supply chain crises, and the Advanced Strategic Industry Fund, established to support domestic firms in high-tech strategic competition, is increasing. Between 2025 and 2029, Supply Chain Stabilization Fund bonds are expected to increase by 17 trillion won and Advanced Strategic Industry Fund bonds by 42 trillion won. Bonds of the Korea Student Aid Foundation, guaranteed by the government since 2010, are also expected to grow to 16 trillion won by 2029. The Budget Office suggested, "The rapid pace of increase in government-guaranteed debt requires appropriate management measures."

Of course, many assess that the possibility of debts rapidly becoming distressed, as in the foreign exchange crisis, is low. Household debt is strictly managed through measures such as the debt service-to-income ratio (DSR), and corporate credit screening is different from 30 years ago. Nevertheless, with debt totaling 2.5 times GDP and increasing so rapidly, experts warn not to loosen vigilance. In the first quarter, households and corporations accounted for 80.9% (5,151 trillion won) of total debt (6,373 trillion won).

Professor An said, "Korea does not have a higher fiscal multiplier (fiscal efficiency) than other countries, so before increasing fiscal spending we must first check spending efficiency," adding, "We should decisively liquidate marginal firms to channel funds into new growth industries and curb housing prices to further reduce household debt."

Reporters Yeonghyo Jeong / Ikhwan Kim / Jeongmin Nam / Kwangsik Lee hugh@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)