S&P "Korea's credit rating stable for the next 3 years…IT and shipbuilding competitiveness high"

Summary

- Standard & Poor's (S&P) said Korea's credit rating will remain stable for at least 3–5 years.

- It assessed that Korea's information technology (IT) and shipbuilding are highly competitive, and that this supports the economic growth trajectory.

- September's current-account surplus recorded a record high and the external balance is sound, factors that support the credit rating.

Sovereign credit rating report analysis

8 IBs raise next year's growth rate to 1.9%

September current-account surplus $13.4 billion 'record high'

International credit rating agency Standard & Poor's (S&P) said "the Korean economy is growing relatively quickly" and assessed that "(Korea's) credit rating will be maintained stably for at least 3–5 years."

According to financial circles on the 6th, S&P said in a sovereign credit rating regular update report issued on the 30th of last month that "(the trajectory of Korea's economic growth) will support the 'AA' credit rating in the long term." This report is the first assessment report issued after the April credit-rating report that maintained Korea's rating at 'AA'.

S&P explained that "Korea's credible monetary policy framework is a credit strength" and that "the actively traded won and a robust external balance are also factors supporting the credit rating." Regarding the Lee Jae-myung administration's expansionary fiscal stance, it analyzed that "there is a high chance that the government fiscal deficit will be larger than expected," but "it does not appear that such changes will weaken the credit rating." Regarding domestic companies, it said they "hold a leading position in the information technology (IT) sector and are also very competitive in other industries such as shipbuilding."

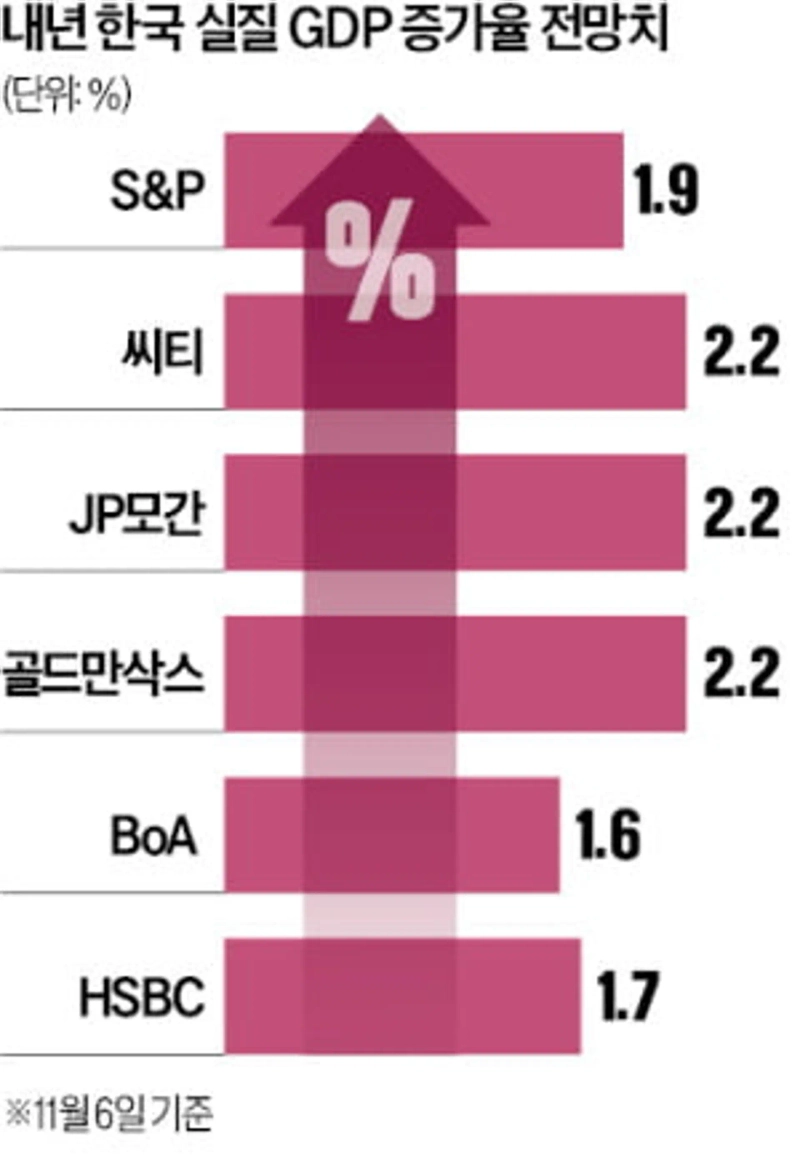

S&P lowered Korea's real gross domestic product (GDP) growth forecast for next year to 1.9%, down 0.1% percentage point from April. This is 0.1–0.3% percentage points higher than the forecasts of the Ministry of Economy and Finance (1.8%) and the Bank of Korea (1.6%), and aligns with recent forecasts by global investment banks (IBs). According to the International Financial Center, the average real GDP growth for Korea presented by eight major IBs as of last month was 1.9%. This is 0.1% percentage points higher than at the end of September one month earlier (1.8%). Three firms — J.P. Morgan, Goldman Sachs, and Citi — expected 2.2% growth.

On the day, the Bank of Korea said the current account balance in September recorded a surplus of $13.47 billion, the largest ever for September. This represents an increase of $2.18 billion from the same month last year ($11.29 billion). The cumulative current account balance for January–September stood at $82.77 billion, up 23% from the same period a year earlier.

Nam Jeong-min / Lee Gwang-sik, reporters peux@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to virtual assets](https://media.bloomingbit.io/PROD/news/4bde9dab-09bd-4214-a61e-f6dbf5aacdfb.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)