Summary

- Bitcoin has plunged more than 7% this month, intensifying weakness in risk assets.

- Some analysts suggested that Bitcoin is undervalued compared to gold.

- JPMorgan projected that if Bitcoin's market capitalization increases, Bitcoin's price could rise to about $170,000.

Risk-asset weakness amid AI bubble concerns

"Role being taken by stablecoins"

JPMorgan says "Could reach $170,000"

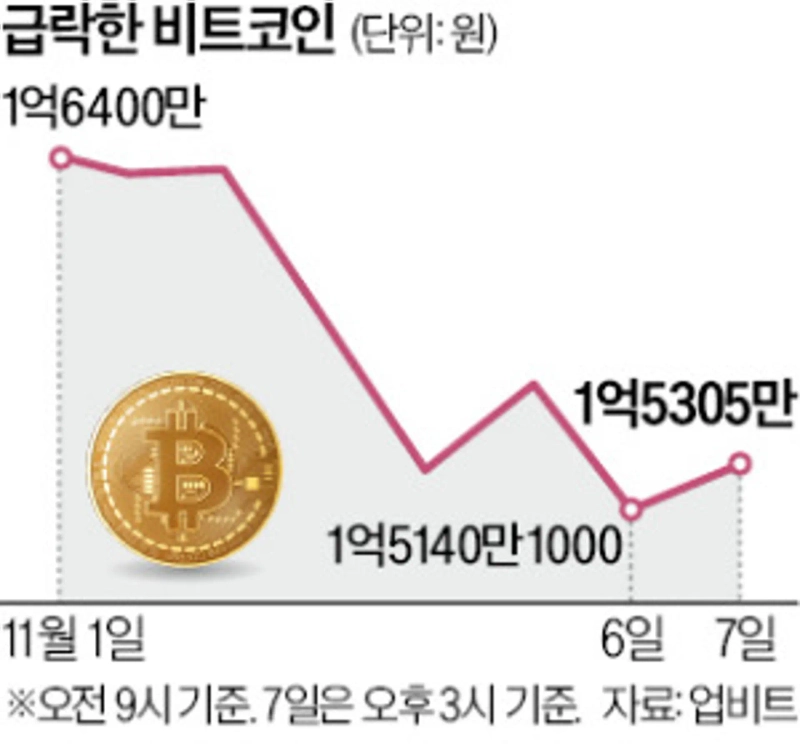

Bitcoin has plunged more than 7% this month and is trading in the 150 million won range for the first time in about a month and a half. Altcoins (cryptocurrencies other than Bitcoin) such as Ethereum have also shown weakness. While short-term pessimism is spreading, some analysts say it is undervalued compared to gold.

On the 7th, according to domestic cryptocurrency exchange Upbit, Bitcoin recorded 151,401,000 won at 9 a.m., down 2.95% from 24 hours earlier. It has fallen 7.8% so far this month. In early last month, Bitcoin was breaking records domestically and flirting with 180 million won, but it plunged more than 15% in a month. In the global market it traded at $90,000 at one point and has now barely recovered to $100,000.

The weakness in Bitcoin's price is because AI bubble concerns have affected risky assets overall. In particular, Bitcoin tends to be coupled with AI-related tech stocks (synchronization). Bloomberg said, "Bitcoin, considered a gauge of speculative momentum, is once again falling in step with the stock market."

Declines in altcoins such as Ethereum, XRP, and Solana have been steeper. Ethereum traded at 4,957,000 won, down 3.47% that day. It is the first time Ethereum has been in the 4 million won range in three months since August. XRP was down 5.78% at 3,309 won, and Solana fell 4.72% to 232,000 won.

Outlooks for Bitcoin's price are mixed. Cathie Wood, CEO of Ark Investment, said in an interview with U.S. CNBC, "Some of the roles Bitcoin was expected to play are being taken by stablecoins," and added, "Existing forecasts that Bitcoin would reach $1.5 million by 2030 (about 2.17 billion won) could change."

JPMorgan argued, "Bitcoin's current volatility is about 1.8 times that of gold," and "this means Bitcoin requires 1.8 times more risk capital than gold." JPMorgan analyzed, "By that standard, Bitcoin's market capitalization would need to be about 67% larger than the current ($2.1 trillion) to be similar to gold," and "if that happens, Bitcoin's price could rise to about $170,000."

Reporter Mi-hyun Jo mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)