Editor's PiCK

It's abnormal that it's rising now…'Will it reach 1,500 won?' Seohak gaemi meltdown

Summary

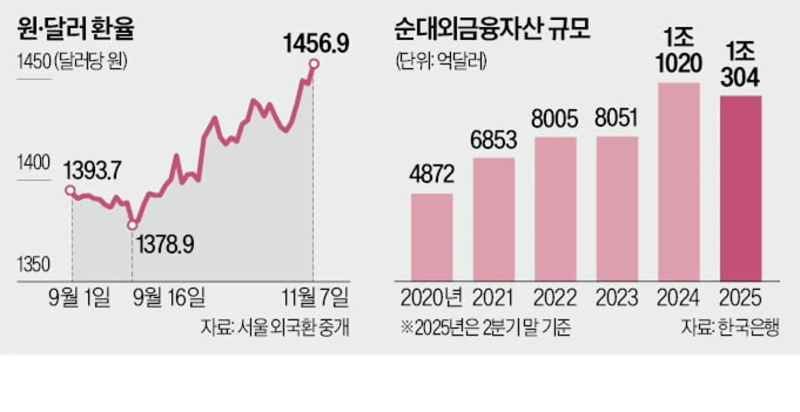

- Recently, the won·dollar exchange rate surpassed 1,450 won for the first time in seven months, and won weakness is persisting.

- The outflow of foreign investors from the stock market and increased overseas investment by companies and individuals were cited as structural factors behind the won weakness.

- Experts warned of a short-term entry into the 1,480-won range and that the exchange rate could rise to 1,500 won by year-end.

"Only factors weakening the won are abundant"…Exchange rate breaks through 1,450 won

1,456.9 won…Highest in 7 months

Sharp rise on small shocks, no reaction to downward factors

"Exchange rate could reach 1,500 won"

The won·dollar exchange rate surpassed 1,450 won for the first time in seven months. Amid growing risk aversion due to concerns over weak U.S. employment, the outflow of foreign investors from the domestic stock market for the fifth consecutive day strengthened the won's weakness.

On the 7th at the Seoul foreign exchange market, the won·dollar exchange rate (as of 3:30 p.m.) closed the week at 1,456.90 won, up 9.20 won from the previous day. The rate opened at 1,448.10 won, 40 jeon higher than the previous day, and widened its gains. At one point in the morning it rose to 1,458.50 won. That weekly closing level was the highest in seven months since April 9, when U.S.-China tensions intensified (1,484.10 won).

U.S. employment consulting firm Challenger, Gray & Christmas (CG&C) announced on the 6th (local time) that U.S. corporate layoffs totaled 153,074 last month, the largest for October since 2003. As concerns about a U.S. economic downturn emerged, the risk asset won took a heavy hit.

In the domestic stock market, foreign investors net sold 479.1 billion won worth of listed stocks on the KOSPI, and the KOSPI closed the session down 72.69 points (1.81%) at 3,953.76. Foreigners have maintained their selling streak for the fifth consecutive day since the 3rd.

Foreign investors who had been scooping up domestic semiconductor stocks such as Samsung Electronics and SK Hynix began realizing profits from the 3rd and continued selling for five days. There are concerns that this trend may persist for some time as volatility in global markets increases amid worries about an AI bubble.

Experts say there is no sharp remedy to reverse the won's weakness in the short term. Structural weakening factors such as increased overseas investment by Seohak gaemi and domestic companies continue, and the supply-demand burden from annual USD 20 billion investment to the U.S. overlaps, raising concerns that the 1,400-won range may become the "new normal." Moon Da-woon, a researcher at Korea Investment & Securities, predicted, "There is a short-term possibility of entering the 1,480-won range."

The government says it has minimized the impact on the foreign exchange market by limiting cash investments to the U.S. to USD 20 billion per year, but many experts view that the resilience of foreign exchange reserves could be impaired and that a negative impact on the won's value is inevitable.

Moon Da-woon of Korea Investment & Securities said, "As a U.S. shutdown drags on and fears of a strong dollar persist, the 1,440 level, which was considered a psychological resistance, has been breached and market expectations are tilting toward won weakness," adding, "There is a short-term possibility of entering the 1,480-won range."

U.S. private employment indicators worsen and trigger a sharp rise…Seohak gaemi investment this year surged fourfold

Companies also hold export proceeds in dollars…Annual USD 20 billion investment to the U.S. is also a burden

The won·dollar exchange rate jumped nearly 10 won on the 7th due to risk aversion from concerns over deteriorating U.S. employment and the exodus of foreign investors from the market. However, many point out that an exchange rate level well above 1,450 won is difficult to explain by these temporary factors alone. Structural factors from increased overseas investment by companies and individuals have raised the overall exchange rate level, raising concerns that a high exchange rate is becoming entrenched.

◇ Exchange rate rises even when foreigners buy stocks

According to the Seoul foreign exchange market, the won·dollar exchange rate has surged by nearly 30 won so far this month. The rate was 1,428.80 won at the end of last month and rose to 1,456.90 won on the day. The rapid rise in the exchange rate is analyzed as being caused by foreigners repeatedly realizing profits and exiting the KOSPI.

On the day, the release of data indicating worsening U.S. employment fueled the exchange rate's rise. Amid a U.S. government shutdown delaying the release of government employment data, a private consulting firm reported large-scale layoffs by U.S. companies, triggering risk aversion. The decline in share prices of U.S. AI-related companies also reinforced the risk-off trend.

Expectations that the U.S. Federal Reserve (Fed) will cut its policy rate at next month's Federal Open Market Committee (FOMC) meeting in response to worsening employment caused the dollar index to fall slightly, but it was judged insufficient to reverse the won's weakness.

The fact that the exchange rate rose above 1,450 won on the day is also analyzed as being related to the recent months in which the exchange rate did not fall even when foreign investors were massively entering the domestic market. Normally, when foreigners invest in the domestic market, demand to convert dollars into won increases and the exchange rate falls, but last month the exchange rate rose from the 1,400-won to 1,430-won range even as the KOSPI surged.

◇ Structural won weakness continues

Experts analyze that the exchange rate's resistance to falling reflects a structural problem of continued dollar outflows. As Seohak gaemi and corporate overseas investments increase, demand to sell won and obtain dollars continues, making it difficult for the exchange rate to decline.

According to the Bank of Korea, Korea's net external financial assets stood at USD 1.0304 trillion at the end of the second quarter. Although this is slightly lower than at the end of last year (USD 1.102 trillion), it is up 27.9% from the end of 2023 (USD 805.1 billion) and more than twice the level in 2020 (USD 487.2 billion). Lee Hee-eun, a manager at the Bank of Korea who wrote a related report, explained, "The increase in net external assets has negative aspects such as weakening the domestic capital market investment base due to capital outflows and putting pressure on won weakness due to increased dollar demand."

Analysts also note that companies are increasingly holding export proceeds in dollars rather than converting them, as overseas investment rises. Moon Da-woon of Korea Investment & Securities said, "As expectations of won weakness have taken hold, it appears that the dollar-selling demand of exporters has also weakened."

The confirmation of annual USD 20 billion scale investment to the U.S. is also a burden on the foreign exchange market. The foreign exchange authorities argue that investing abroad and financing through dividends and interest from assets managed overseas has no impact on the domestic foreign exchange market, but many view that it will inevitably have some form of impact. Lee Yun-soo, a professor of economics at Sogang University, said, "Since the amount to cover foreign exchange reserves is being invested in the U.S., it can be seen that the room for exchange rate intervention has decreased."

◇"Exchange rate will rise further"…Forecasts of 1,500 won

Experts expect the exchange rate to rise further in the near term given these factors. Park Hyung-jung, an economist at Woori Bank, said, "The year-end exchange rate could rise to 1,500 won," and added, "Decisions will have to be made with this high exchange rate level as a base for the time being." Korea Investment & Securities raised its fourth-quarter average exchange rate forecast from the previous 1,390 won to 1,420 won in a report released that day, and suggested a short-term upper bound of 1,480 won.

Shinhan Investment and DS Investment Securities projected that due to Korea's low growth fundamentals and increasing overseas investment, the exchange rate will remain in the 1,400-won range next year as well.

Reporter Kang Jin-gyu josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)