Summary

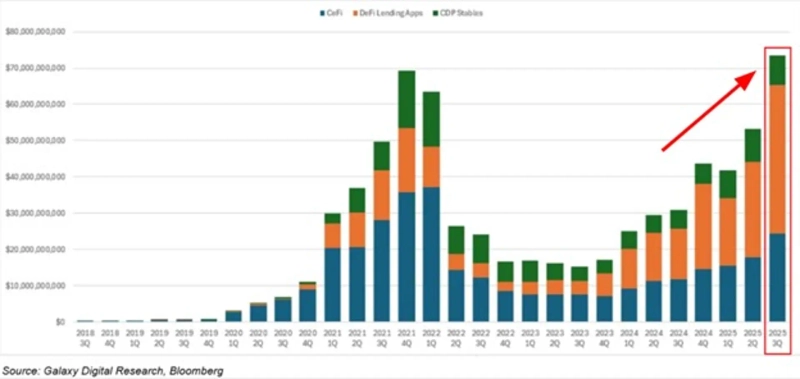

- It stated that total crypto asset lending in Q3 this year was US$73.6 billion, a record high.

- It reported that this figure surpasses the previous record in Q4 2021 (US$69.4 billion).

- It assessed that after the approval of the Bitcoin spot ETF, the lending market expanded rapidly, and with a sharp increase in the proportion of leveraged trading, volatility and large-scale liquidation events occurred.

The scale of crypto asset (cryptocurrency) lending and leverage has surged to record highs.

On the 8th (local time), according to the Kobeisi Letter, total global crypto asset lending in Q3 2025 was US$73.6 billion (about KRW 107 trillion), up 35% from the previous quarter. This surpasses the previous record in Q4 2021 (US$69.4 billion).

The Kobeisi Letter said, "The crypto lending market has shown a recovery since the approval of the US Bitcoin spot ETF in Q1 2024, expanding to nearly three times its size in about a year and a half," and "as a result, the proportion of leveraged trading has increased sharply, causing recent widespread market volatility and large-scale liquidation events," it assessed.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)