'Team NVIDIA,' which dispelled AI bubble talk, to increase chip production

Summary

- NVIDIA requested that TSMC allocate additional production lines for AI accelerator chips.

- Next year, AI data center capital expenditures are expected to reach 878 trillion won, which is expected to greatly expand related demand.

- HBM suppliers such as Samsung Electronics and SK Hynix are also expanding production capacity, intensifying supply competition across the industry.

NVIDIA asks TSMC to increase production

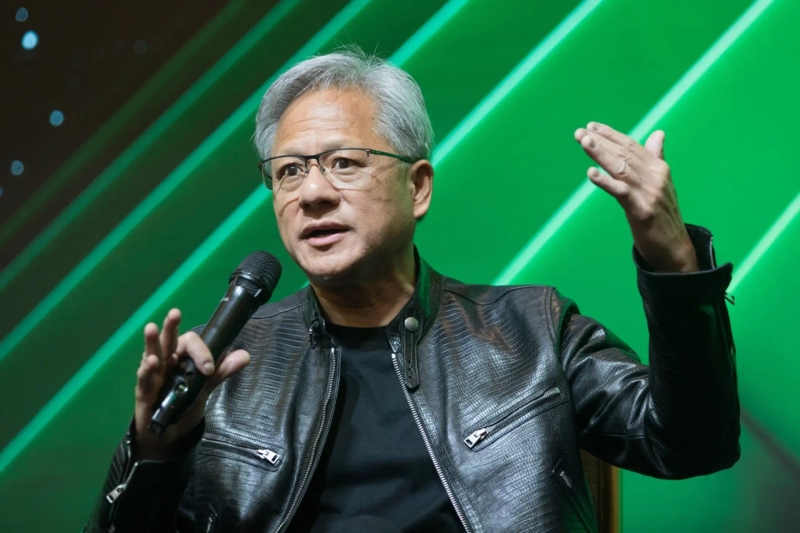

Jensen Huang: "Demand for the latest AI chips is strong"

Request to allocate additional foundry lines

Big tech all-in on AI data centers

878 trillion won next year alone…investment competition

Stable procurement of HBM becomes important

SK Hynix and Samsung also speed up expansion

NVIDIA, the world's No. 1 artificial intelligence (AI) accelerator maker, has asked Taiwanese foundry TSMC to allocate additional production lines. As big tech firms such as Microsoft and Google plan to invest $602 billion (878 trillion won) in AI next year, demand for AI accelerators is expected to expand significantly. It also raises the likelihood that production volumes for high-bandwidth memory (HBM) supplied by SK Hynix and Samsung Electronics for NVIDIA AI accelerators will increase.

Strong demand for AI accelerators

According to the semiconductor industry on the 9th, Jensen Huang, NVIDIA's chief executive officer (CEO), who visited Taiwan on the 8th, asked TSMC chairman Wei Zhejia for additional production lines for AI accelerators. Jensen Huang told reporters that "demand for the latest AI accelerators is very strong," acknowledging the request for additional production lines. NVIDIA's share of TSMC's revenue this year is known to be about 11%, the second largest after Apple (about 25~27%).

According to Taiwanese media, TSMC plans to expand the 3-nanometer (㎚·1㎚ = one-billionth of a meter) line for the state-of-the-art AI accelerator 'Vera Rubin' that NVIDIA is scheduled to launch in the second half of next year, in response to Jensen Huang's request. TSMC's 3-nanometer line production capacity (based on wafer input) at its southern Taiwan science park is expected to increase from 100,000 to 160,000 per month.

TSMC to expand 3-nanometer process

Jensen Huang's request to TSMC for expansion reflects the growing demand for AI accelerators. Not only in the U.S. but also Chinese big tech companies are continuing to increase investment in AI data centers that use AI accelerators. According to TrendForce, capital expenditures by eight big tech firms — Microsoft, Google, Amazon, Meta, Oracle, Tencent, Alibaba, and Baidu — are estimated at $430.6 billion this year, up 65% from $260.9 billion last year, and expected to rise to $602 billion next year.

These companies have recently been competing to expand AI infrastructure. On the 7th, Meta announced it would "invest $600 billion in the U.S. AI industry over three years." Google also raised its capital expenditure target this year from $85 billion to up to $93 billion, saying "construction of data centers is needed to meet cloud customer demand."

HBM seen as cause of AI bottleneck

HBM suppliers such as Samsung Electronics and SK Hynix are also expanding production. HBM is an essential component in the latest AI accelerators. NVIDIA's flagship AI accelerator 'B200' is equipped with eight HBM3E (5th-generation HBM) units totaling 180GB.

Industry sources point to HBM supply shortages as one of the causes of bottlenecks in AI infrastructure expansion. Richard Wallace, CEO of semiconductor equipment maker KLA, explained on the 29th of last month that "the cause of AI infrastructure bottlenecks has shifted from advanced packaging to memory." When asked whether he was concerned about memory supply shortages, Jensen Huang said, "During periods of business growth, there can be supply shortages."

Samsung Electronics and SK Hynix are expanding HBM production capacity. Samsung, which formalized the possibility of HBM production increases at last month's earnings briefing, is reported to be preparing HBM4 (6th-generation HBM) production centered on its Pyeongtaek Plant 4. SK Hynix has also begun equipment installation at its new M15X plant in Cheongju, North Chungcheong, to expand HBM4 production.

Reporter Hwang Jeong-su / Silicon Valley = Correspondent Kim In-yeop hjs@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)