Iren transforms from coin miner to AI cloud company… Iren becomes a 'ten-bagger'

Summary

- Iren announced a shift from a Bitcoin mining company to an AI cloud business, after which its stock rose 1077% from this year's low.

- The company is succeeding in the business transition with major customers such as Microsoft and NVIDIA GPU contracts, but most revenue still comes from Bitcoin mining.

- Securities firms say large-scale facility investment is needed for the cloud transition, and some caution that without such investment there is significant downside risk to the current stock price.

Hot Pick! Overseas Stocks

Iren, up 1077% from this year's low

Announced AI data center investment in May

Connecting owned GPUs to the cloud

Providing outsourced AI computation

Secured big-tech customers such as MS

Mining company or AI company?

Valuation 'polarized' depending on perspective

8 of 13 securities firms recommend buy

Iren, which transformed from a Bitcoin mining company into an artificial intelligence (AI) cloud business, has become a 'ten-bagger' (a stock that rose more than tenfold). Its stock price surged 1077% from this year's low. The swift announcement of a business shift amid the AI boom is seen as having been effective. However, Wall Street forecasts that large-scale investment in the cloud business must precede maintaining the current stock price.

6-month return 730%

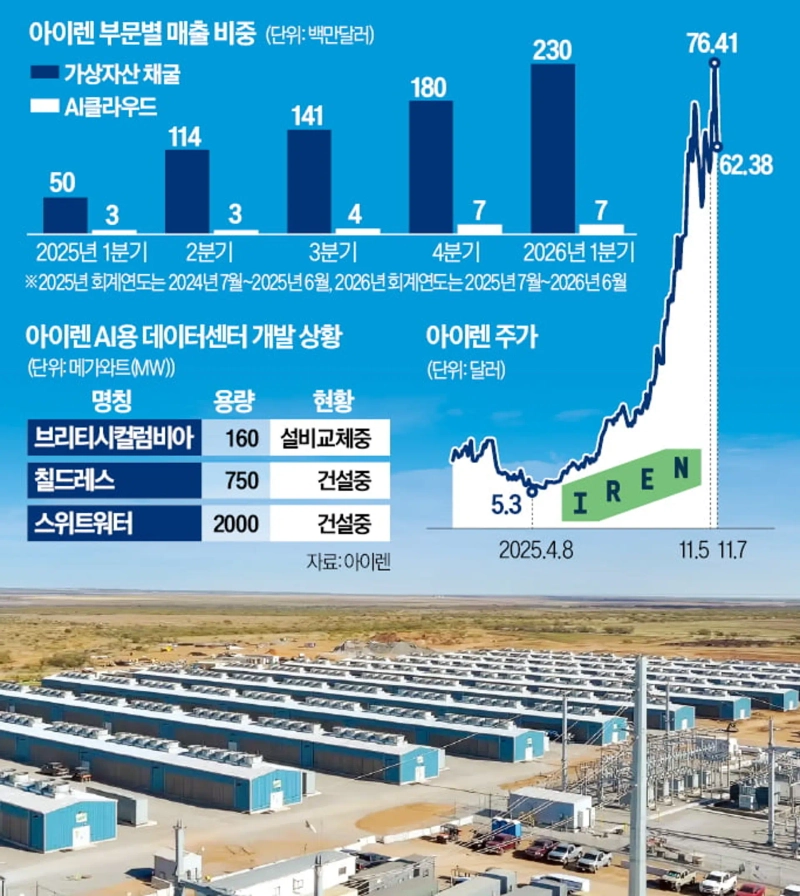

On the 7th at the Nasdaq, Iren closed at 62.38 dollars, down 6.84%. In the previous day's earnings release it reported revenue of 240 million dollars (about 348.3 billion won), up 355.1% year-on-year, but operational expenses amounted to a comparable 236 million dollars, raising market concerns. Despite this correction, the recent 6-month stock return stands at 730.63%. The stock has risen 1077% from this year's low (April 8). Domestic Seohak-gaemi investors who net-bought 612.73 million dollars' worth of Iren shares since September are estimated to have earned returns in the 20% range.

Iren started in 2018 as a virtual asset mining company that mined and sold Bitcoin using low electricity costs at renewable energy sites in the U.S. and Canada. Bitcoin mining remains Iren's core segment. For fiscal year 2025, of total revenue of 510 million dollars, 485 million dollars (96.8%) comes from here. In May, Iren announced it had completed investment in Bitcoin mining equipment and would invest in liquid-cooled AI data center business. The plan is to connect Iren data center graphics processing units (GPUs) to customers via the cloud and provide outsourced computation. It also disclosed plans to build and expand three data centers for this purpose.

Unlike hyperscalers that provide general-purpose clouds like Amazon Web Services (AWS) and Microsoft Azure, neoclouds focus solely on computation support. Iren is also smoothly transitioning its business, quickly securing large customers. Last month it announced that of the 23,000 NVIDIA GPUs it will hold through next March, contracts for 11,000 have already been signed. On the 3rd, it signed a 9.7 billion dollar deal with Microsoft.

"Bubble without AI investment"…cautions remain

Market views on Iren are sharply divided. Of 13 global securities firms that issued ratings, 8 recommended buy, while 5 recommended hold or sell. Their average target price was 68 dollars.

The core of the debate is whether to value Iren as a Bitcoin mining company or as a neocloud. Neocloud companies are valued at high valuations (price levels relative to earnings) due to surging AI compute demand and big-tech investment. The 12-month forward price-to-earnings ratio (PER) of Nevius, the leading listed neocloud, reaches 147 times. In contrast, virtual asset mining companies trade at relatively low valuations due to lower volatility in Bitcoin prices and more predictable earnings; Marathon Holdings trades at a PER of 6.5. As of the 3rd, Iren's PER is 102, and despite revenues concentrated in virtual asset mining, it is being valued as a neocloud.

Skeptics point out that Iren will find it difficult to complete the facility investments required for the cloud transition without large-scale rights offerings or corporate bond issuance. Reginald Smith, a J.P. Morgan analyst, said, "The current stock price reflects the value assuming it has secured AI cloud demand of over 1 GW and completed all facility investments," and warned, "Considering that an additional investment of about 35 billion dollars is needed for this, downside risk is greater than upside potential." J.P. Morgan offered the lowest target price of 24 dollars among the 13 securities firms.

Jeon Beomjin reporter forward@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)