"Big Tech's manipulation of GPU lifespans is fraud"…'Bubble theory' resurfaces

Summary

- Michael Burry asserted that Big Tech companies have artificially extended the useful life of data center equipment to understate depreciation expense.

- He said that if depreciation is reflected accurately, Nvidia and the Big Tech industry could suffer direct hits such as reduced financial capacity and weakened AI demand.

- Big Tech firms countered that 5–6 year useful lives are reasonable, citing the multi-purpose use of older-generation GPUs.

AI investment depreciation debate ignited by 'The Big Short' Michael Burry

New products every year…value of existing equipment 'plummets'

Google·MS extend [useful life] from 3 years to 6 years

"Artificially extending lifespans to hide losses"

Also claims that it's just speculation by short sellers

"Cloud, scientific simulation, etc.

AI semiconductors can be used for other purposes"

On the 10th (local time), hedge fund investor Michael Burry, famous for large-scale short selling during the 2008 financial crisis, alleged that Big Tech companies have artificially extended the useful life (accounting period of use) of data center equipment to distort depreciation expenses. Currently shorting Nvidia, he this time targeted the Big Tech companies that are major customers of Nvidia semiconductors.

◇"Reducing useful life to 3 years would wipe out USD 1.1 trillion of market cap"

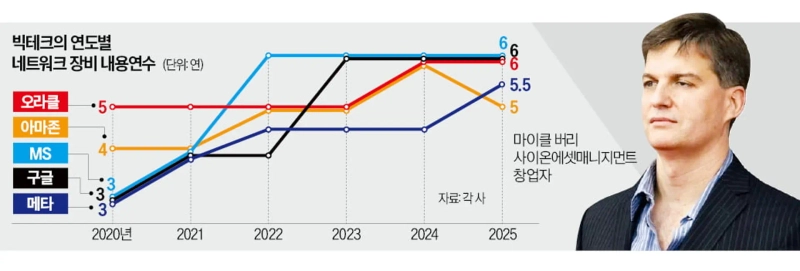

On that day, Burry disclosed changes in the useful life of network and computing equipment announced by Alphabet, Amazon, Oracle, Microsoft (MS), and Meta over the past five years, and criticized that "artificially extending useful lives to lower depreciation is one of the most common frauds in modern society." Google and MS extended useful lives from 3 years in 2020 to 6 years this year, and Meta extended from 3 years to 5 years and 6 months. Based on this, Burry diagnosed that "they will understate depreciation expense by USD 176 billion (about KRW 256 trillion) between 2026 and 2028."

This was interpreted as targeting the reality that Nvidia releases new AI chips every year, causing the value of existing equipment to fall rapidly. Nvidia has shortened its latest GPU release cycle from the previous 18–24 months to one year since last year. It released 'Blackwell Ultra' this year and plans upgrades next year with 'Rubin', 'Rubin Ultra' in 2027, and 'Feynman' in 2028. Compute performance rises from Blackwell (10 petaflops) to Blackwell Ultra (15 petaflops) — a 1.5x increase — and when upgraded to Rubin (50 petaflops) it improves by 3.3x. An investment industry source said, "Depreciation of machinery and equipment does not necessarily have to be linked to product release cycles," but added, "Burry's argument emphasizes that in industries with fast technology cycles, excessively applying extended depreciation carries a high risk of overstating profits."

◇"Older-generation GPUs can still be widely utilized"

If depreciation were reflected as Burry claims, Nvidia and tech companies would inevitably suffer direct blows. Big Tech companies, which have recently issued corporate bonds and even relied on vendor financing (VF) due to cash shortages, could see their financial capacity constrained. The AI bubble centered on Nvidia could deflate due to weakening demand.

Earlier, Barclays estimated that reducing the useful life of network and computing equipment for Alphabet, Meta, and Amazon to 3 years would reduce earnings per share (EPS) by 5~10%. The Economist applied the same criteria to the five companies including Oracle and MS and analyzed that annual pre-tax total profit could decrease by USD 26 billion (about KRW 38 trillion), and market capitalization could fall by USD 780 billion (about KRW 1,100 trillion).

This controversy stems from the potential conflict of interest between Nvidia, the supplier of AI chips, and Big Tech, the demand side. OpenAI also expressed concern. Sarah Friar, OpenAI's chief financial officer (CFO), said at an event on the 5th, "We always want cutting-edge chips, but right now computing resources are limited, so we use AI chips like Nvidia's A100 that are 6–7 years old," and added, "Shorter development cycles make financing much harder." Currently operating at a loss, OpenAI signed an agreement in September to receive funding from Nvidia in order to purchase Nvidia AI chips again.

However, there are counterarguments that Burry's claims are conjecture aimed at realizing short positions. Big Tech argues that 5–6 year useful lives are reasonable because GPUs are used for many purposes beyond AI training. High-performance AI chips are often reused from 'training' for AI model development to 'inference' for practical use.

Technology investor Richard Zack compared it to "handing a gaming laptop down to a family member to use for email and document work." Google, Amazon, MS, and others also repurpose older-generation GPUs for various business uses such as cloud databases, scientific simulation, and video transcoding (file format conversion).

Silicon Valley = Kim In-yeop, correspondent inside@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)