Summary

- SoftBank Group said it sold its entire stake in NVIDIA for about $5.83 billion.

- The sale is interpreted as aimed at raising funds for AI investments such as OpenAI.

- Some argued the timing was inappropriate since NVIDIA is a key AI infrastructure company.

Purpose of securing large-scale AI investment funds

Some say "timing of sale was inappropriate"

SoftBank Group (SBG), led by Chairman Masayoshi Son, said on the 11th that it sold all of its NVIDIA shares last month.

According to the Nihon Keizai Shimbun and others, SoftBank Group announced this in its half-year financial results for fiscal 2025 (April 2025–March 2026). SoftBank Group sold all of its U.S. NVIDIA shares last month (32.1 million shares) for $5.83 billion (about ₩8.5 trillion). The company said this realized a profit of ¥354.4 billion (about ₩3.36 trillion).

There are various interpretations in the market about the sale of the NVIDIA stake. One analysis is that it was to raise 'ammo' for full-scale investments in artificial intelligence (AI), such as OpenAI. SoftBank had invested $10.8 billion in OpenAI up to September. It plans to invest an additional $22.5 billion next month. The fair value of the $10.8 billion already invested is estimated at $26.5 billion.

Some say the move indicates that SoftBank Group intends to concentrate more on OpenAI, which develops ChatGPT, than on NVIDIA. However, some experts argue that the timing of the sale was inappropriate given NVIDIA's role as a core infrastructure company in the AI era. There is a past case in which Son sold a 4.9% stake in NVIDIA in 2019 and the stock then surged. At the time SoftBank made $3.3 billion in profit, but Son later lamented that he had missed potential gains of $150 billion.

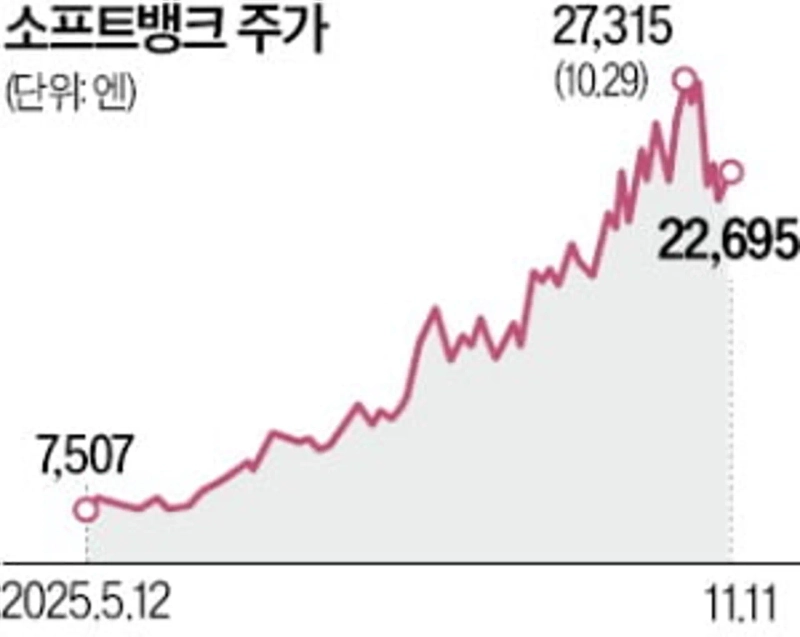

SoftBank Group's stock has been volatile recently. Riding the AI tailwind, it surged up to three times year-to-date in late October, but fell 20% in just one week. Some are worried about an 'AI bubble.' There are calls that SoftBank Group must present a plan to recoup returns from AI investments in order to lift the stock again.

Tokyo = Correspondent Il-gyu Kim kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)