Exchange rate touches 1,470 won…Lee Chang-yong "Overly sensitive to external variables"

Summary

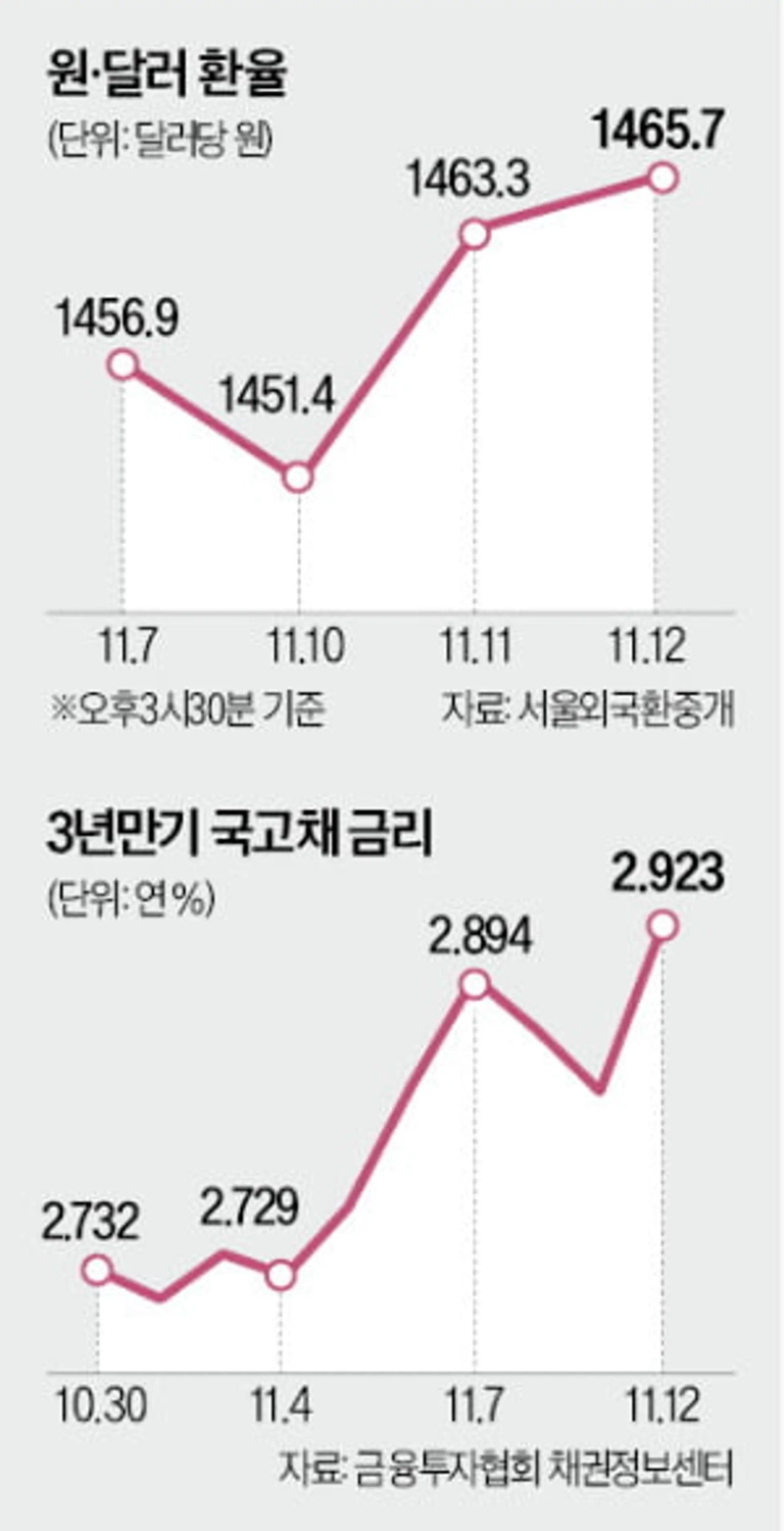

- The won-dollar exchange rate rose to 1,470 won, with the won weakening due to the outflow of foreign investors and yen weakness.

- Bank of Korea Governor Lee Chang-yong said the market is overreacting to external uncertainty and expressed willingness for verbal intervention, after which the exchange rate plunged intraday.

- Government bond yields, including the 3-year government bond yield, all hit year-to-date highs, and market interpretations that the interest-rate cut cycle has ended affected the market.

Exchange rate rose to martial-law level…Lee's verbal intervention caused an intraday 2-won plunge

Above 1,400 won for 31 consecutive trading days

Foreigners' net selling on the KOSPI for consecutive days

Won weakness continues amid yen weakness as well

Government bond yields also hit year-to-date highs

Lee Chang-yong's mention of 'direction change'

Interpreted as end of interest-rate cut cycle

3-year government bond yield surged to the 2.9% range

The won-dollar exchange rate touched 1,470 won during trading on the 12th. The outflow of foreign investment and yen weakness pulled down the value of the won, driving the exchange rate up to levels seen when political uncertainty peaked and emergency martial-law was declared at the end of last year. Bank of Korea Governor Lee Chang-yong expressed concern, saying, "The market appears to be reacting excessively sensitively to external uncertainty."

Intraday high of the 1,470 won range for the first time in seven months

On the day, in the Seoul foreign exchange market the won-dollar exchange rate (as of 3:30 PM) closed the week at 1,465.70 won, up 2.40 won from the previous day (the won fell in value). The rate opened at 1,461 won per dollar, down 2.30 won, but soon turned to an upward trend. It briefly touched 1,470 won in the afternoon. It was the first time since April 9 that the intraday high reached the 1,470 won range, after seven months.

The rise in the exchange rate that day is analyzed as being due to foreign investors' withdrawal from the domestic stock market. Foreigners sold a net 427.8 billion won worth of securities on the KOSPI that day. Demand from domestic investors for overseas investment, including 'Seohaek-gaemi', was also reported to be robust. In terms of global currency values, the won moved in step with yen weakness. The yen-dollar rate continued its upward trend in the 154 yen per dollar range. This was influenced by remarks from Prime Minister Sanae Takaichi prioritizing economic stimulus over fiscal soundness.

Recently the exchange rate has been moving at levels similar to the period when political uncertainty was high due to the declaration of emergency martial-law. On the day of the martial-law, December 3 last year, the won-dollar rate rose to as high as 1,442 won intraday, and through the end of April this year it moved in the 1,410–1,480 won range for about five months. Political unrest eased and the rate fell to the 1,300 won range in May, but since last month through that day it has shown an upward trend above 1,400 won for 31 consecutive trading days.

In an interview with Bloomberg in Singapore that day, the governor cited volatility in U.S. AI-related stocks, a U.S. government shutdown, dollar strength, Japanese policy uncertainty, U.S.-China trade relations, and the Korea-U.S. investment package as factors weakening the won. He then said, as his personal view, "It seems the market is reacting overly sensitively to these uncertainties."

He also made a verbal-intervention-style remark, saying, "Authorities have the will to intervene in the market if excessive volatility occurs." Immediately after this remark became known, the exchange rate plunged nearly 2 won intraday.

Government bond yields rose across the board

Government bond yields rose across the board. In the Seoul bond market that day, the 3-year government bond yield closed at an annual 2.923%, up 0.092% percentage points from the previous day (bond prices fell), marking a year-to-date high. The 10-year yield rose 0.081% percentage points to an annual 3.282%, and the 5-year yield rose 0.097% percentage points to an annual 3.088%.

The governor's interview comment about data-driven monetary policy—saying, "The strength, timing, and even direction change of rate cuts depend on the data"—served as a spark for the surge in yields. While he prefaced with the premise that "considering a negative (minus) output gap, the official stance is to maintain an accommodative monetary cycle," the market interpreted the mention of a 'direction change' as meaning 'the interest-rate cut cycle is over.'

The Bank of Korea said in this regard that the comment "came out in the theoretical sense that monetary policy is based on data" and warned against overinterpretation, saying, "It should be interpreted with weight towards maintaining an accommodative monetary cycle."

Reporter Kang Jin-kyu josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)