Big Tech's astronomical 'AI borrowing' raises concerns over loan defaults… financial crisis déjà vu

Summary

- It reported that major Big Tech firms are actively utilizing corporate bond issuance and complex financing structures to fund AI investments.

- It said that excessive borrowing and overvaluation controversies have increased concerns about tech sector credit risk and potential bubble collapse.

- It reported that AI-related firms' financial soundness and market overheating signals are pronounced, and some investment institutions have downgraded their tech stock ratings.

AI bubble theory rekindled

(1) Excessive borrowing risk and overvaluation controversy

Big Tech corporate bond yields surge… AI bubble theory rekindled

AI investment funding

Excessive reliance on bonds

Spread with U.S. Treasuries

Largest since April

Michael Burry

"Profits overstated"

In the United States, the 'artificial intelligence (AI) bubble' debate is flaring up again. As major Big Tech firms take on excessive borrowing to expand AI investments, concerns about defaults have grown, with corporate bond yields surging. On Wall Street, some argue that AI companies' profits have been overstated.

The Wall Street Journal (WSJ) reported on the 11th (local time) that Big Tech firms are mobilizing new financing structures to shoulder astronomical AI investments. Meta, Oracle, OpenAI and others are reportedly creating a kind of "Frankenstein-like financial structure" mixing private equity, project financing (PF), and bond issuance to build massive data centers. The WSJ said, "Banks and asset managers have staked large sums on AI, but there is growing concern about whether such complex deal structures will hold up once the AI frenzy subsides."

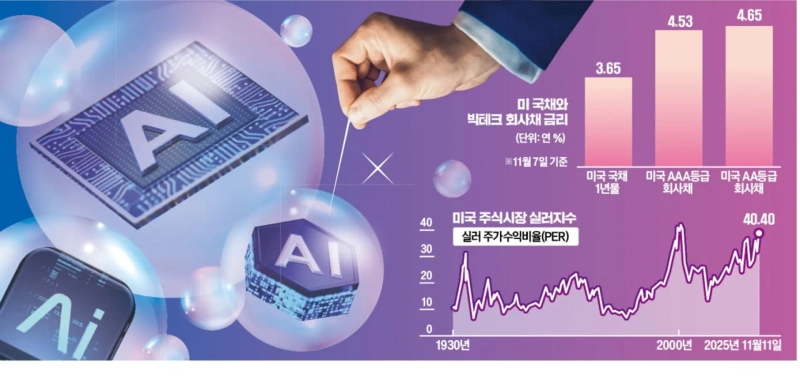

As Big Tech moved to 'yeong-kkeul' (borrowing to the hilt) in the corporate bond market to raise huge funds for building data centers and the like, corporate bond spreads widened. The spread between corporate bond yields and safe U.S. Treasury yields recently widened to 1% point on a 1-year basis. That is the largest level since the bond market gyrated after the imposition of U.S. reciprocal tariffs in April.

Michael Burry, the famed short-seller who predicted the 2008 financial crisis, argued that Big Tech firms are inflating profits by lengthening equipment useful lives.

Corporate bond issuance exceeds $200 billion… Alphabet $17.5 billion, Meta $30 billion

Rushed issuance to fund infrastructure… private equity, PF, and collateral intricately entwined

AI Big Tech stocks such as NVIDIA, Tesla, and Palantir plunged together on the New York stock market on the 11th (local time). The AI dominance race has spilled over into a 'war of money,' and excessive borrowing has emerged as a risk. With valuations already surpassing levels seen during the dot-com bubble, warnings say credit risk could trigger a burst of the bubble.

The looming shadow of a financial crisis

According to investment banks (IB) on the 12th, the current size of corporate bonds issued by U.S. tech companies is estimated at $200 billion (about 300 trillion won). That is double last year's level.

Google parent Alphabet issued $17.5 billion in corporate bonds on the 3rd, and Meta issued $30 billion on the 30th of last month. Meta's bond issuance was the fifth largest in history. Oracle also previously issued $26 billion in corporate bonds.

Morgan Stanley projected that $3 trillion (about 4,300 trillion won) will be needed for AI-related infrastructure investment through 2028. Desperate for funds, Big Tech firms are resorting to unprecedented fundraising methods beyond corporate bonds.

Meta established a joint venture (SPV) with private equity firm Blue Owl Capital to indirectly finance the development of the 'Hyperion' data center in Louisiana. xAI, led by Elon Musk, also secured $18 billion through an SPV.

SPVs have the advantage of raising funds without directly affecting Big Tech balance sheets. However, because the exact debt levels do not appear directly on balance sheets, there is a warning that the potential shock to the financial markets and the broader economy could be greater. The Wall Street Journal reported, "There is growing concern about how Frankenstein-like complex deals and collateral structures will function."

Shiller index at a 25-year high

Investment banks that have staked large sums on the AI industry are also increasingly concerned. Deutsche Bank is exploring ways to hedge risks. That includes shorting baskets composed of AI-related stocks or selling synthetic risk transfers (SRT), a type of credit derivative. SRTs, as the name implies, transfer the default risk of loans held by banks to external investors. During the 2008 financial crisis, Deutsche Bank also created and sold large volumes of credit default swaps (CDS) that sold only the default risk of subprime mortgages.

Wells Fargo downgraded its rating on tech stocks from "overweight" to "neutral" that day. It viewed U.S. tech stocks as excessively overvalued, trading at a trailing 12-month price-to-earnings ratio (PER) of over 46 times. The trailing PER for the S&P 500 index is about 29 times.

As the rally concentrated on some AI-related stocks, overheating warnings were detected across the board. The Shiller index, which indicates market overheating, surged to its highest level in 25 years since the dot-com bubble. Developed by Nobel laureate in economics Robert Shiller of Yale University, the index measures current price levels relative to the average earnings of S&P 500 companies over the past 10 years. It stood at 40.4 as of the 11th. A higher index indicates that the market is more overheated relative to economic performance and corporate earnings. The long-term average of the Shiller index is about 17.

Questions remain whether astronomical spending will translate into profits. JPMorgan analyzed that for the AI industry to deliver an annual return of 10% by 2030, it would need to achieve annual revenues exceeding $650 billion. JPMorgan said, "Such revenue would equal 0.58% of global gross domestic product (GDP), or would require each current iPhone user to pay $34.72 per month," adding, "the market could see a dramatic number of losers."

Michael Burry, who predicted the collapse of the U.S. subprime mortgage market in 2008, warned that Big Tech profits are overstated. Burry published the useful lives of network and computing equipment announced by Alphabet, Amazon, Oracle, Microsoft, and Meta over the past five years, claiming, "Big Tech artificially inflated AI data center profits and distorted their books." Burry has warned since earlier this year that the AI investment frenzy is reminiscent of the late-1990s dot-com bubble.

Choi Mansu / Kim Dong-hyun, reporters bebop@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)