Editor's PiCK

Up 1000% in a Year… This Coin Called the 'Encrypted Bitcoin' [Hwang Du-hyun's Web3+]

Summary

- The privacy coin Zcash (Zcash) has recently surged over 1000% in a year, drawing market attention.

- Zcash uses zk-SNARKs technology to keep transaction details completely private and is responding to regulatory risk with a selective privacy structure.

- The industry predicts the revival of the privacy narrative and expects privacy coins could be investment assets with 1000x profit opportunities.

Institutionalization of crypto assets raises demand for privacy coins

Zcash surges… evaluated as the 'encrypted Bitcoin'

Industry notes "last 1000x profit opportunity"

Responding with 'selective privacy' amid regulatory risks

The privacy coin Zcash (ZEC) has been drawing market attention as it shows a sharp rally. Industry participants analyze that this recent surge is not merely speculative upside but signifies the return of a 'privacy narrative.' They assess that demand for privacy is re-emerging as crypto markets move toward institutionalization.

Zcash has risen about 700% on Binance's Tether (USDT) market since last September. Over the same period, the price jumped from $74 to over $700, and market capitalization entered the global top 20. The cumulative rise this year has exceeded 1000%. After touching $750 intraday on the 7th, Zcash was trading in the $470 range on Binance at 8:40 p.m. (local time) on the 11th.

Digital asset solutions firm Galaxy said, "Zcash has risen nearly eightfold since September," and assessed that "after years of underperformance, its rise has brought privacy features back to the center of the market."

Beyond transparency limits... "Zcash, the 'encrypted Bitcoin'"

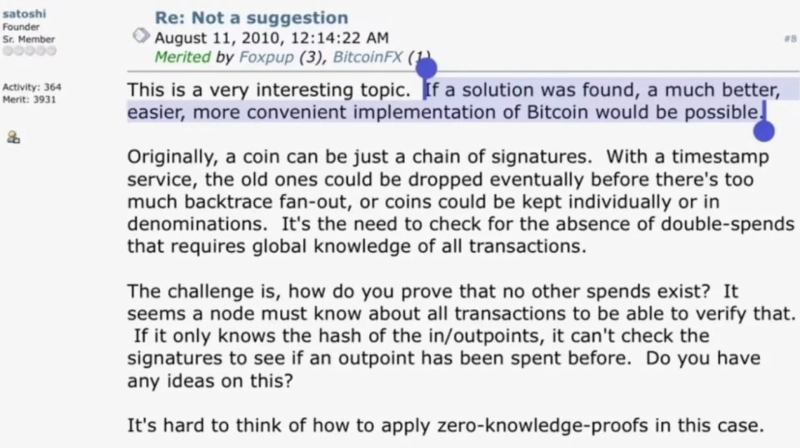

Satoshi Nakamoto, the Bitcoin developer, acknowledged Bitcoin's privacy limitations in a forum 15 years ago. Bitcoin (BTC), as a trustless digital currency, has transparency as an advantage, but as institutionalization progresses it faces the limitation of lacking privacy. Satoshi Nakamoto also recognized the structural limitation that Bitcoin's anonymity is limited, saying all transaction records are publicly visible.

Zcash was created to address this problem. Though derived (forked) from Bitcoin's code, it was designed to keep sender/receiver and amount completely private rather than making transaction information public. The core is zero-knowledge SNARKs (zk-SNARKs) technology. It's a cryptographic method that proves a transaction is valid without revealing transaction details — it proves only that the right to transact exists while hiding specific details. In this process, a user can mathematically prove they have sufficient balance and that no double-spending occurred.

If another privacy coin, Monero (XMR), uses ring signatures as a probabilistic obfuscation method that mixes multiple senders, Zcash is seen as having higher technical reliability because it secures privacy through mathematical proofs. CoinDesk Research explained that "SNARKs are like a sealed certificate," likening it to presenting an accountant-stamped envelope proving income above a threshold instead of showing the payroll directly.

Zcash continues to roll out upgrades. Last year it implemented 'NU6' to enhance fund management transparency, and this year it plans to introduce 'Project Tachyon' to increase transaction processing speed. Galaxy evaluated, "Tachyon is an scalability upgrade comparable to Solana's Firedancer."

Its economic structure is also similar to Bitcoin. Total issuance is capped at 21 million, and it follows a halving structure where block rewards are halved every four years. After the recent November halving, block rewards decreased to 1.5625 ZEC, and the inflation rate fell to about 3.5%. Part of the mining rewards is allocated to a community fund, with developers, foundation, and community jointly managing network development.

CoinDesk Research analyzed that "Zcash is an 'encrypted Bitcoin' with solid privacy technology," and "Zcash is evolving into a new monetary model that combines privacy and reliability."

Murt Mumtaz, CEO of Helius, said, "Bitcoin secured legality, Ethereum (ETH) and Solana (SOL) secured scalability," adding, "the remaining final puzzle is privacy." He stated, "Zcash is the first project to bring zero-knowledge proofs to practical use, and now, with the maturity of the technology and market demand coinciding, this is the turning point for the spread of privacy finance," forecasting that "privacy coins could become assets where crypto investors can expect more than 1000x returns for the last time."

Why 'privacy' now

Analysts say Zcash's rally reflects not just a price event but a cultural shift in the crypto industry. They argue that the market, which had been moving from decentralization toward institutionalization, is returning to the origin point of 'privacy.'

According to Andreessen Horowitz (a16z)'s recently published '2025 Crypto Report,' Google search interest in privacy-related terms has surged this year. The industry views this phenomenon not as a mere tech trend but as a signal that users are beginning to recognize privacy again as a core value of crypto assets.

Galaxy said, "Institutionalization of crypto accelerated after approval of spot Bitcoin ETFs," adding, "While institutional capital poured in, criticism has grown that Bitcoin is now controlled by centralized custodians." It continued, "Privacy coin investors are reverting to cypherpunk principles in an era where on-chain surveillance has become commonplace," and assessed that "Zcash's rise symbolizes the revival of 'privacy value' long neglected by the industry."

Recent U.S. court cases are also cited as factors reinforcing this movement. On the 7th, Kion Rodriguez, co-developer of the Bitcoin privacy wallet 'Samourai Wallet,' was sentenced to five years in prison on charges of operating an unlicensed money transmission business. This was the maximum possible sentence and was reportedly requested by the Trump administration's Department of Justice.

Crypto media Decrypt analyzed, "The ruling appears to have strengthened social consensus for privacy protection," and said, "Zcash's surge is the market reflecting that trend."

Regulatory risk remains… seeking a breakthrough with 'selective privacy'

However, the biggest risk for privacy coins remains regulation. They directly clash with international regulatory trends aiming to ensure transaction traceability such as Know Your Customer (KYC) and Anti-Money Laundering (AML) rules.

The European Union (EU) plans to fully ban the use of privacy coins on regulated platforms by 2027 through the Markets in Crypto-Assets (MiCA) regulation. The European Commission classified assets that cannot be traced for transactions as contrary to financial transparency principles and labeled privacy-centric coins as high-risk assets. Accordingly, exchanges and service providers (CASPs) within Europe will be prohibited from listing privacy coins or offering them as payment methods.

Domestically, transactions in privacy coins are also impossible under the Act on Reporting and Use of Certain Financial Transaction Information. The Financial Services Commission classified "crypto assets whose transaction records are difficult to trace and pose a high risk of money laundering" as 'dark coins' and banned virtual asset service providers from handling them. In practice, major domestic exchanges suspended support three years ago when Litecoin (LTC) implemented the MimbleWimble upgrade to strengthen privacy features.

Neobank OneSave said, "Privacy coins are technically innovative, but if they fail to meet AML·KYC requirements, their use within the institutional framework is difficult," advising, "Startups should carefully review legal consistency when integrating privacy assets into payroll or payment systems."

Accordingly, Zcash and Litecoin adopted a 'selective privacy structure.' Zcash operates transparent addresses and shielded addresses in parallel to respond to regulation, while Litecoin allows users to choose privacy features during transactions.

Global crypto exchange Bitget said, "Zcash has gained regulatory flexibility by adopting optional privacy protections," and assessed, "This gives it a favorable position over other privacy coins. Zcash can offer a valuable opportunity to protect itself from a future where financial information is under threat."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)