Summary

- It reported that recently gold prices and gold-related ETFs have been showing a full-fledged rebound thanks to expectations of a rate cut.

- It noted that domestic and international major gold mining company ETFs and gold-related products posted one-week returns of up to 10%%, making investment returns notably high.

- Global investment banks forecast a long-term uptrend in gold prices, suggesting the possibility of rising to between 5,000 and 5,300 dollars per troy ounce next year.

Gold mining company ETFs post 10% weekly returns

Gold price breaks $4,200…full-fledged rebound

Stocks and exchange-traded funds (ETFs) related to gold are showing a rebound. As the possibility of a December rate cut has emerged, buying interest is flowing in as gold prices rise, analysts say.

○ Gold price, poised to break record highs

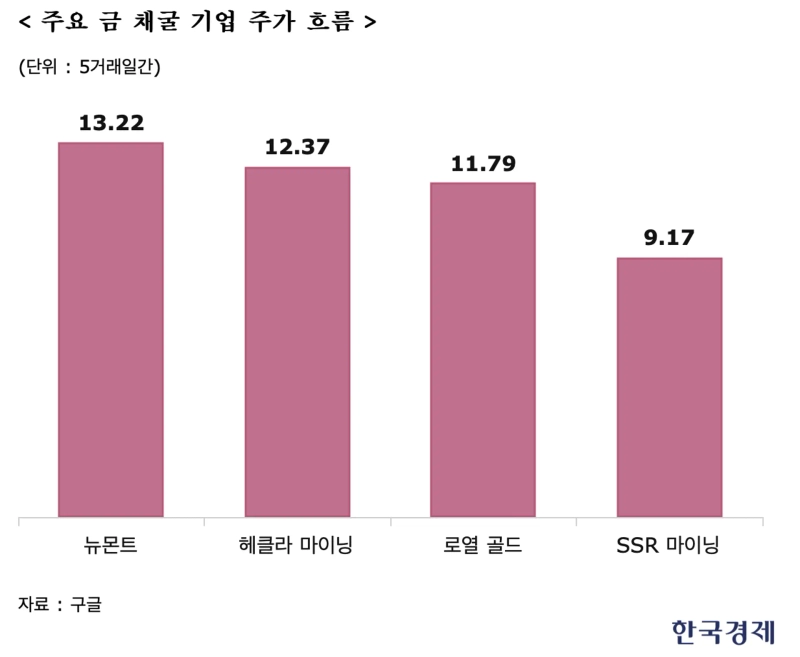

Newmont, the world's No. 1 gold mining company, closed at 93.07 dollars in New York on the 12th (local time), up 3.53%. The stock, which had surged 155% through Oct. 20 this year, fell about 17% over a two-week period (Oct. 20–Nov. 4) as rate-cut expectations waned. However, as the possibility of a rate cut recently gained prominence, it has risen nearly 13% over the last five trading days. Precious metals miner Hecla Mining rose 12.37% over the same period, while Royal Gold (11.79%), SSR Mining (9.17%), and NovaGold Resources (8.58%) also widened gains.

Gold prices are once again approaching a breakthrough of prior highs. According to Bloomberg, as of 7:40 p.m. that day (U.S. Eastern Time), the spot price of gold stood at 4202.58 dollars per troy ounce. It has topped the 4,200-dollar level again after about three weeks and is approaching this year's record high of around 4,300 dollars. Expectations that U.S. benchmark rates may be cut next month due to a deteriorating U.S. labor market have pushed up gold prices. Reuters reported, "With economic indicators emerging as the shutdown ends, expectations are arising that the U.S. central bank will cut the benchmark rate further."

In fact, according to the Chicago Mercantile Exchange (CME) FedWatch tool, the market is pricing in a 66.9% chance of a rate cut next month. That is a 4.9 percentage-point increase over the week. The decline in U.S. Treasury yields has also fueled the rise in gold prices. The 10-year U.S. Treasury yield fell 3.4 basis points (bp = 0.01%p) to an annualized 4.083%. On the same day, the price of silver also hit its highest level since Oct. 17 at 53.58 dollars per troy ounce. As a real asset, gold becomes more attractive as an investment in a low-interest-rate environment and amid economic uncertainty.

○ Global gold mining ETFs…top returns

In the domestic ETF market, returns on gold-related products are rising noticeably. In particular, the one-week (Nov. 5–Nov. 12) return of 'HANARO Global Gold Mining Companies', which includes many major U.S. and Canadian gold miners such as Newmont and Agnico Eagle Mines, reached 10%. It is earning the highest returns among the major gold ETFs. Generally, when the price of gold rises, mining companies' profitability improves, which is positive for performance. During the period, 'KODEX Silver Futures(H)' (8.36%) and 'ACE Gold Futures Leverage (Synthetic H)' (6.36%) also showed solid returns. 'SOL International Gold' and 'KODEX Gold Active' likewise posted returns in the 5% range.

Retail investors net-bought 70.4 billion won worth of 'ACE KRX Gold Spot' over the week. 'TIGER KRX Gold Spot' also attracted 23.9 billion won. Over a one-month basis, 429.7 billion won and 193.5 billion won flowed in, respectively. This is interpreted as investors judging that gold prices will continue their long-term uptrend.

Major global investment banks expect gold prices to remain strong next year. They say its appeal as a core asset will grow amid inflation and unstable international conditions. UBS on the 10th forecast that gold prices could rise to 5,000 dollars per troy ounce at some point next year or in 2027.

JP Morgan recently raised its target price to 5,300 dollars. Alex Wolf, head of global macroeconomics and bond strategy at JP Morgan, said, "Additional buying could flow in, centered on emerging countries with low gold holdings," adding, "Although gold is unlikely to completely replace the dollar, the allocation to gold investments will increase."

Reporter Jo Ara rrang123@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)