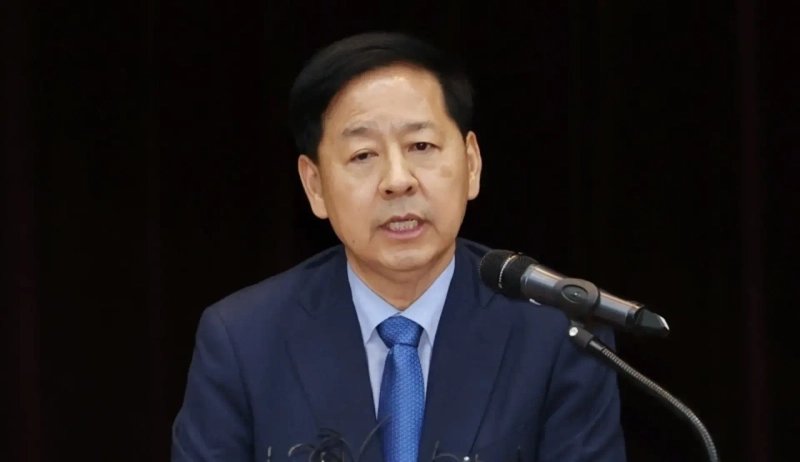

Koo Yoon-chul "Concern over expanding foreign exchange uncertainty… actively utilize available measures to respond"

Summary

- Financial and monetary authorities expressed concern over the expansion of foreign exchange market uncertainty and held a market situation review meeting.

- Participants assessed that the demand base for government bonds is solid, while warning of increased uncertainty as the won–dollar exchange rate exceeded 1470 won.

- Deputy Prime Minister Koo Yoon-chul stated he would actively utilize available measures to address uncertainty in the foreign exchange market.

Heads of financial and monetary authorities expressed concern over the widening uncertainty in the foreign exchange market and stated they would actively utilize available measures.

On the 14th, Deputy Prime Minister and Minister of Economy and Finance Koo Yoon-chul held a market situation review meeting with Bank of Korea Governor Lee Chang-yong, Financial Services Commission Chairman Lee Eok-yeon, and Financial Supervisory Service Governor Lee Chan-jin to assess financial market trends.

Participants evaluated that "the domestic stock market shows short-term volatility but is generally stable, and although government bond yields rose in the bond market due to changes in market expectations about future interest rate trends, the demand base for government bonds is solid considering inclusion in the World Government Bond Index (WGBI) next year."

However, regarding the foreign exchange market, they expressed concern that "uncertainty is expanding, with the won–dollar exchange rate at one point exceeding 1470 won due to residents' increased overseas investment," and agreed that "structural improvement of foreign exchange supply and demand is necessary."

They added, "If the foreign exchange supply-demand imbalance due to overseas investment persists, market participants' expectations of a weak won could become entrenched, significantly affecting the downward rigidity of the exchange rate," and said, "There is a need to actively utilize available measures to respond."

Lee Song-ryeol Hankyung.com reporter yisr0203@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)