Editor's PiCK

U.S. spot Bitcoin ETFs see $867.35 million in net outflows... second-largest on record

Summary

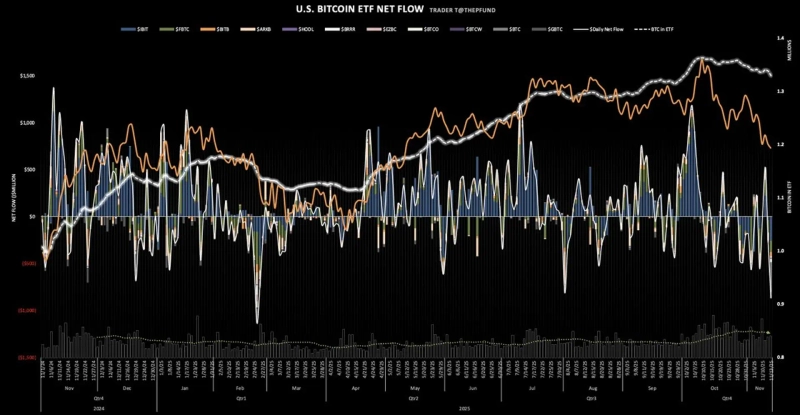

- It reported that U.S.-traded spot Bitcoin ETFs saw total net outflows of $867.35 million.

- This is the second-largest fund outflow since the launch of spot Bitcoin ETFs, and Grayscale Mini Trust (BTC) alone saw $318.2 million exit.

- During the same period, it said that spot Ethereum ETFs also saw $259.77 million in outflows, indicating outflows across major ETFs.

Large amounts of funds have exited spot Bitcoin (BTC) and Ethereum (ETH) ETFs.

According to data from Trader T on the 13th (local time), U.S.-traded spot Bitcoin ETFs saw total net outflows of $867.35 million. This is the second-largest amount since the launch of spot Bitcoin ETFs.

The ETF with the largest net outflows was Grayscale Mini Trust (BTC), which saw $318.2 million leave. BlackRock (IBIT) had $257.18 million, Fidelity (FBTC) $119.93 million, and Bitwise (BITB) $47.03 million in net outflows. ARK Invest (ARKB) saw $15.68 million exit, while Invesco (BTCO) and Franklin (EZBC) had $30.80 million and $5.69 million leave, respectively. VanEck (HODL) also experienced net outflows of $8.34 million.

Spot Ethereum ETFs also registered total net outflows of $259.77 million. BlackRock (ETHA) had $137.37 million and Fidelity (FETH) $14.25 million in net outflows, while Invesco (QETH) saw $4.42 million leave, Grayscale ETHE $67.91 million, and Grayscale Mini (ETH) $35.82 million.

Meanwhile, among Bitcoin ETFs, Valkyrie (BRRR) and WisdomTree (BTCW), and among Ethereum ETFs, Bitwise (ETHW), 21Shares (CETH), Franklin (EZET), and VanEck (ETHV) showed no net flows.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)