Editor's PiCK

"Calls to keep rates unchanged" growing at the Fed… December cut odds 'fifty-fifty'

Summary

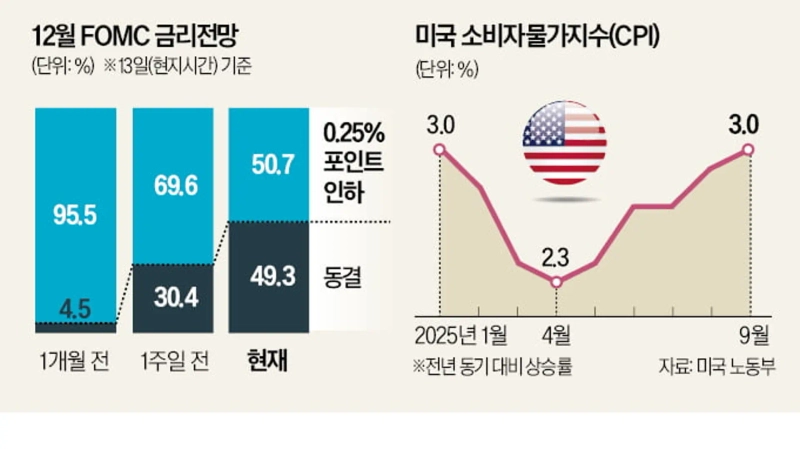

- Fed officials emphasized the need to keep the benchmark rate unchanged, saying the probability of a December rate cut has fallen from 95% to 50%.

- Fed voting members said that, due to rising inflation and a lack of data, monetary policy should remain cautious.

- As expectations of a rate cut weakened, New York stocks and government bond prices fell together.

Inflation rising and data gaps… U.S., caution spreads

Cut odds 95%→50%

Presidents of Federal Reserve Banks with voting rights

"We must be cautious to bring inflation down"

As rate cut prospects diminish

New York stocks and government bond prices fall

With the U.S. central bank (Fed) set to decide on the benchmark rate in December, Fed officials have been issuing successive remarks that the benchmark rate should be kept at the current level (annual 3.75~4%). They argue that inflation remains elevated and, because a federal government shutdown has prevented the collection of sufficient data, the rate should be kept unchanged for the time being. Market expectations that the December benchmark rate will be cut have fallen to the 50% level. A month ago it was 95%.

◇ "Limited room for monetary policy easing"

Alberto Musalem, president of the St. Louis Federal Reserve Bank, who has a vote at next month's monetary policy meeting, said at an event in Evansville, Indiana on the 13th (local time) that "since the inflation rate still exceeds the Fed's target level, further rate cuts should be approached cautiously." The U.S. Department of Labor reported that the September Consumer Price Index (CPI) rose 3% year on year. It was lower than expected but higher than the target (2%).

He added, "We need to act carefully to ensure monetary policy does not become overly accommodative." He judged that the Fed's decision to cut the benchmark rate at the October Federal Open Market Committee (FOMC) meeting was intended to support the labor market, but to control inflation the rate should be kept at a restrictive level. He voted in favor of the 0.25%-point rate cut at the October meeting. He will also have voting rights at the FOMC meeting on the 9th–10th of next month.

Beth Hemac, president of the Cleveland Fed, who will have voting rights at monetary policy meetings from next year, also said at an Economic Club discussion in Pittsburgh, Pennsylvania that "to return inflation to the target level, it is necessary to keep monetary policy at a somewhat tight level." She especially warned that the effects of the tariff policies of the Donald Trump administration could make price increases more visible going forward. She diagnosed that companies that had been absorbing tariff costs are now finding ways to pass those costs on to consumers.

Neel Kashkari, president of the Minneapolis Fed, also said in an interview with Bloomberg that he did not agree with the Fed's decision to cut the benchmark rate at the October FOMC meeting. Susan Collins, president of the Boston Fed, who is known for her typically cautious tone, said the previous day that "in the currently very uncertain environment, it seems appropriate to keep the benchmark rate at its current level for the time being to balance risks between inflation and employment," expressing a negative view on further rate cuts.

◇ The probability of a December cut is 50%

With views among Fed officials clearly divided, Wall Street is also finding it hard to gauge the Fed's decision. According to the Chicago Mercantile Exchange (CME) FedWatch tool, the interest rate futures market currently prices a 50.7% chance that the benchmark rate will be lowered by 0.25%-point. A month ago, ahead of the October FOMC meeting, the probability of a cut was 95.5%. The probability of a hold has risen to 49.3%.

CNBC reported that Fed officials voiced concerns about cutting rates because uncertainty has increased due to the federal government shutdown. They are worried about making policy decisions without sufficient data while the labor market shows signs of slowing and inflation remains above the target. The October CPI is expected to be difficult to calculate due to the shutdown's effects.

However, Bloomberg reported that "there are many members who are more concerned about labor market weakening, so it is unclear whether hawkish members will become the majority at the FOMC." Fed Governor Steven Myron has maintained the view that the pace of rate cuts should be accelerated.

As confidence in rate cuts waned, the three major U.S. stock indexes in New York all closed down that day, and the two-year U.S. Treasury yield rose by 0.03%-point to 3.59% per annum. Thierry Wizman, FX and rates strategist at Macquarie Group, said of the split in views within the Fed that "Chair Jerome Powell may be forced to choose to hold the benchmark rate in December or, even if he cuts rates, be compelled to strongly signal that the subsequent cutting cycle will come to an end."

Han Kyung-je, reporter / New York = Park Shin-young, correspondent hankyung@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)