Korbit opens coin lending service…24 virtual assets available for borrowing

Summary

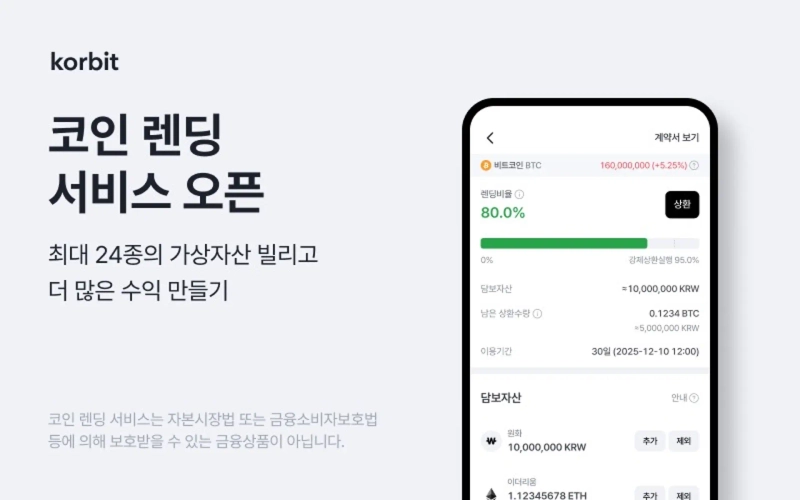

- Korbit announced it opened a 'coin lending' service where up to 24 virtual assets can be borrowed.

- Users can borrow up to KRW 1,000,000,000 using multi-collateral, and it reported increased flexibility in asset management.

- It said that by immediately deducting each asset's Korean won-denominated value at repayment, it minimized risk and the impact of price fluctuations.

Domestic virtual assets (cryptocurrencies) exchange Korbit (Korbit) said on the 17th that it officially opened its 'coin lending' service, which allows borrowing up to 24 virtual assets.

Korbit users can borrow up to 24 coins using a total of 12 assets as collateral, including Korean won, Bitcoin (BTC), and Tether (USDT). Individual borrowing limits are up to KRW 1,000,000,000 depending on conditions.

Korbit supports users to utilize multiple types of coins as collateral. It increased flexibility in asset management through a multi-collateral feature.

Even in the event of forced repayment, rather than selling collateral or loaned assets at market price to repay, it applies a method that calculates the Korean won-denominated value of each asset and immediately deducts it. Through this, it minimized the impact on price fluctuations within the exchange and also reduced user risk.

Lee Jung-woo, Korbit CTO/CPO, said, "We endeavored to both ensure convenience and stability for users while faithfully complying with the guidelines on virtual asset lending by virtual asset service providers. We will continue to pursue user-centered service innovation with user protection as the top priority."

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io