Korean retail investors buy U.S. big tech on dips…investment in crypto stocks has sharply declined

Summary

- Korean retail investors have reportedly concentrated large purchases on major stocks such as Meta and NVIDIA during the recent AI big tech correction.

- By contrast, buying interest in crypto-related stocks has noticeably declined, and investors have shifted more toward buying directly in the coin market as sentiment weakened.

- As a result, ETFs with high weightings in AI big tech and crypto have underperformed market averages recently.

Top net purchases this month

Meta ranks first with net purchases of 817 billion won

Bought Nvidia, Palantir, Alphabet

Increased buying instead when prices corrected

Market slump including Bitcoin crash

Crypto-related stocks like Bitmain shunned

Recently, as skepticism about an AI bubble caused related stocks to temporarily fall, Korean retail investors concentrated purchases on U.S. big tech stocks. Large amounts also flowed into leveraged exchange-traded funds (ETFs) that track AI-related stocks/sectors by 2–3 times. Brokers said investors judged the AI stock pullback to be a "temporary decline." However, despite the weak market, buying interest did not flow into crypto-related stocks.

◇ Net inflow of 810 billion won into Meta alone

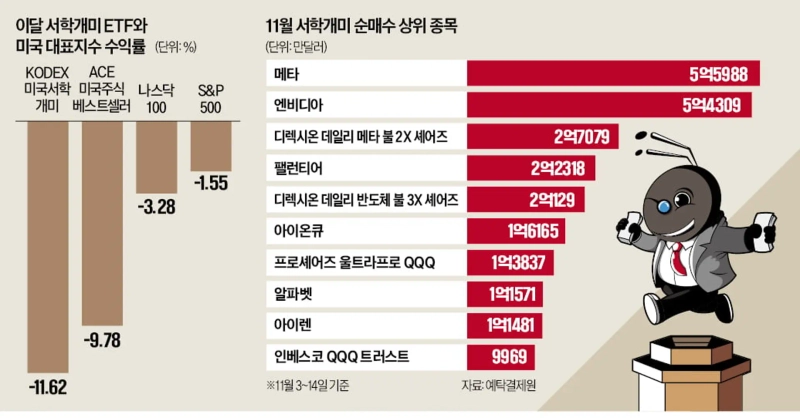

According to the Korea Securities Depository on the 17th, among the top 10 stocks that domestic individual investors net-bought the most this month (March 3–14), six were U.S. AI big tech stocks. The top was Meta, with net purchases of $559.88 million (about 817 billion won). Semiconductor giant and the world's largest by market capitalization, NVIDIA, followed, receiving $543.09 million during the period. Palantir and Alphabet saw net inflows of $223.18 million and $115.71 million, respectively.

Many Korean retail investors also put money into leveraged ETFs. $270.79 million flowed into "Direxion Daily Meta Bull 2X Shares" (METU), which tracks Meta's daily returns at twice the rate, and $201.29 million flowed into "Direxion Daily Semiconductor Bull 3X Shares" (SOXL), which tracks the Philadelphia Semiconductor Index at three times, ranking them 3rd and 5th, respectively.

These "Seohakgaemi picks" experienced sharp recent corrections. Concerns grew over successive large-scale investment announcements by tech companies. Meta's stock has fallen about 6% so far this month. NVIDIA and Palantir fell 6.08% and 13.19%, respectively. Leveraged ETFs METU and SOXL fell 12.29% and 18.66%, respectively.

A head of equities at an asset management firm said, "AI-related stocks have swung for similar reasons in the past but ultimately rebounded," adding, "Strong earnings and assessments of long-term growth have consistently drawn bargain hunters."

◇ Buying of crypto assets has cooled

Unlike in the past, buying into crypto-related stocks has weakened. Among this month's top 10 net purchases by Korean retail investors, only Iren ranked within the top 10 (9th). This contrasts with last month when Iren (3rd), T-Rex 2X Bitmain Daily Target (4th), and Bitmain (6th) were included in the top 10. The continued market slump, with Bitcoin falling below $100,000 per coin, is to blame. An industry source said, "Rapid adjustments in crypto prices have dampened investor sentiment," and "bargain hunters are shifting to buying directly in the coin market rather than investing indirectly in related stocks."

As U.S. big tech and crypto weakened, ETFs that had filled portfolios with "Seohakgaemi picks" have also seen poor returns. ETFs related to Seohakgaemi listed on the Korea Exchange are 'KODEX U.S. Seohakgaemi' and 'ACE U.S. Stock Bestseller.' Over the past week they fell 8.74% and 5.11%, respectively. Passive ETFs that invest in market benchmark indices such as the Nasdaq-100 and S&P 500 fell only around 1% over the same period.

KODEX U.S. Seohakgaemi invests in 25 overseas stocks that domestic investors have high weighting in, while ACE U.S. Stock Bestseller selects 10 stocks based on overseas stock balances, net purchase settlement amounts, and trading volume. Both have high weightings in AI big tech and crypto-related stocks. For KODEX U.S. Seohakgaemi, NVIDIA and Tesla each account for 20%. Palantir, Apple, and Google are also included at around 7–8%. ACE U.S. Stock Bestseller has NVIDIA, Palantir, and Microsoft at weights of about 15–22%. It also holds many crypto-related stocks such as Circle and Coinbase.

Reporter Yang Ji-yoon yang@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)