Summary

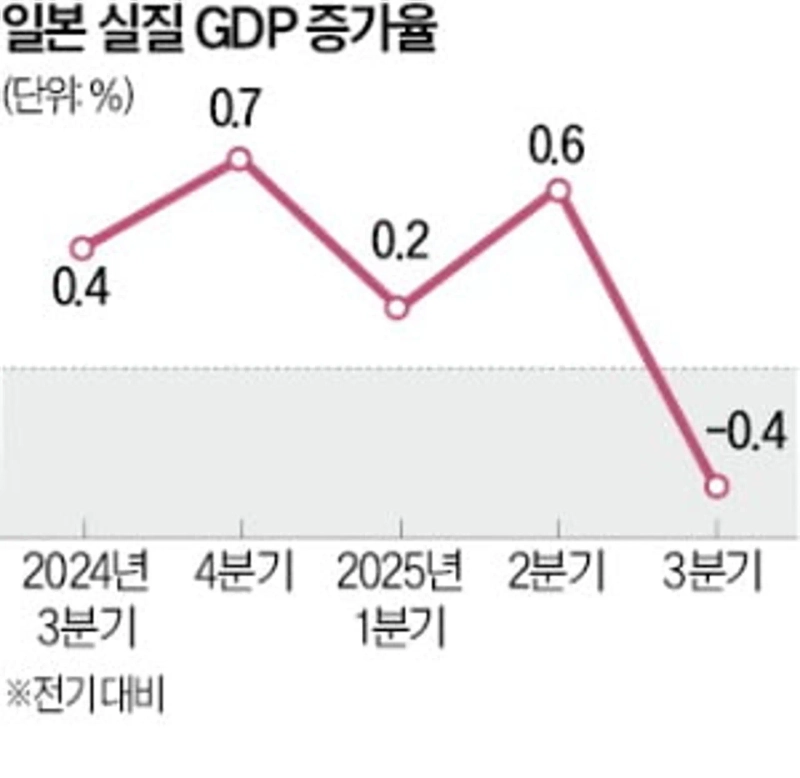

- Japan's economy recorded negative growth for the first time in six quarters as Q3 real GDP decreased by 0.4% due to US tariff increases.

- In the bond market, the 10-year government bond yield hit its highest level in 17 years, and worsening public finances and declining credibility could lead to a weaker yen and increased inflationary pressures.

- The Japanese government is showing intent to push a large supplementary budget and a growth strategy, but it was pointed out that achieving stable growth may be difficult due to weakening economic fundamentals.

Q3 real GDP down 0.4%

Tariff rise leads to weak exports such as autos

"Likely to return to positive in Q4"

10-year government bond yield hits record high

Japan's economy contracted for the first time in six quarters. It is the fallout from weak exports, including automobiles, due to US tariff increases.

The Cabinet Office of Japan announced on the 17th that real gross domestic product (GDP, preliminary) for Q3 (July–September) fell 0.4% from the previous quarter. On an annualized basis it was -1.8%. Thus, the growth rate, which had recorded five consecutive quarters of gains since Q2 last year, returned to negative in Q3 this year.

Exports fell 1.2%, turning negative for the first time in two quarters. The decline in automobile exports due to US tariffs had a large impact. Spending by foreign visitors to Japan also fell 1.6%, declining for the first time in four quarters. Reduced visits by Hong Kong residents due to July earthquake rumors had an effect.

Private consumption, which accounts for more than half of GDP, rose 0.1% and business fixed investment also increased 1.0%. Minister of State for Economic and Fiscal Policy Minoru Kiuchi said of Q3 GDP, "There were temporary factors causing the decline," and "there is no change in the perception that the economy is gradually recovering."

The economic growth rate for Q4 (October–December) is expected to return to positive. Mizuho Research & Technologies said, "The decline in exports to the United States is expected to pull GDP down by about 0.2% on an annual basis," adding, "While tariff effects will be prolonged, the likelihood of a sharp collapse in export prospects is low." A trade agreement with the United States has also been concluded, and the tariff shock is expected to ease from Q4.

The cabinet of Sanae Takaichi is expected to demand a large supplementary budget on the grounds of the Q3 negative growth. According to the Nihon Keizai Shimbun, the Takaichi cabinet is planning a comprehensive economic package of 17 trillion yen to be decided on the 21st, with a supplementary budget of 14 trillion yen to support it. Excluding fiscal year 2020 during the COVID-19 pandemic, it would be the largest in history.

The Takaichi cabinet plans to realize a "strong economy" through bold investment. It is formulating a "Japan Growth Strategy" targeting next summer. Minister Kiuchi holds as a doctrine the "high-pressure economy" view that if demand persistently exceeds supply through fiscal expansion and monetary easing, the long-term growth rate will also rise.

The bond market is sounding warnings over the Takaichi cabinet's "money printing." In Tokyo's bond market that day, the yield on the benchmark 10-year government bond surged to 1.730%. It is the highest level in 17 years since June 2008. Concerns over worsening public finances prompted bond selling to spread and bond prices to fall. The Yomiuri Shimbun pointed out, "If a decline in fiscal credibility causes the yen to fall further, import prices will rise and upward pressure on inflation could strengthen," adding, "Economic measures could instead lead to hardship for the public."

A bigger problem is that the underlying strength of the Japanese economy is declining. On a per capita GDP basis adjusted by purchasing power parity, Japan was overtaken by Taiwan in 2009 and by South Korea in 2015. This year it is expected to fall behind Poland as well. The Asahi Shimbun pointed out, "While aging has an impact, it is gradually falling behind on indicators that show 'prosperity.'"

The Japanese government sees the need for growth that consistently exceeds 1% annually even after the 2030s, when the effects of population decline will fully materialize, in order to secure the sustainability of public finances and social security. However, there are criticisms that this will be difficult to achieve if the current situation continues. The Asahi said, "Since the second Abe Shinzo administration, successive governments have presented growth strategies as flagship policies and introduced various measures," adding, "the reality is that clear results have not emerged."

Tokyo=Correspondent Kim Il-gyu black0419@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)