[Analysis] "Signal of Global Liquidity Re-expansion…Exchange Stablecoin Holdings Hit a Record High"

Summary

- It was analyzed that major countries' stimulus measures and the expansion of global liquidity could have a positive impact on the crypto asset market.

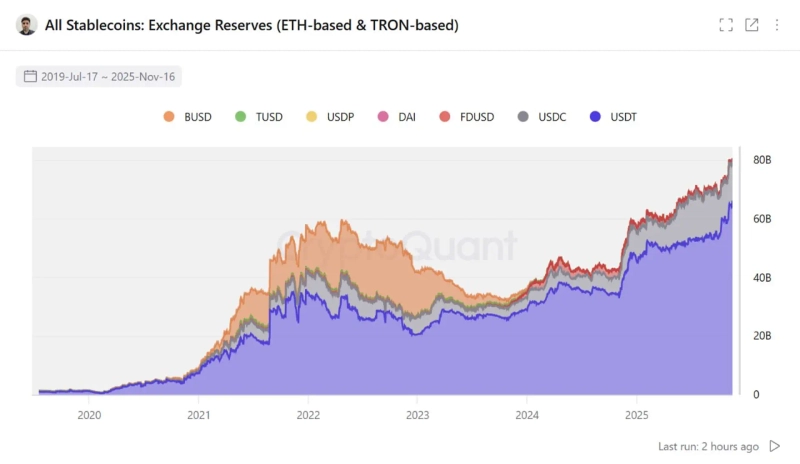

- Exchange stablecoin holdings have hit an all-time high, and standby buying pressure is accumulating.

- It stated that in past bull markets, stablecoin accumulation repeatedly led to spot market rallies.

An analysis says that as major countries around the world simultaneously implement stimulus measures, the world is entering a phase of renewed liquidity expansion. The fact that exchange stablecoin holdings have reached an all-time high, accumulating standby buying pressure, also supports this trend.

On the 18th (local time), XWIN Research Japan, an author at CryptoQuant, said, "The $110 billion stimulus package announced by the Japanese government is a signal of global liquidity expansion beyond a simple domestic economic response," adding, "discussions of a $2,000 direct support program in the U.S., China's approval of $1.4 trillion in stimulus, Canada's resumption of quantitative easing (QE), and other major countries' policies are showing the same direction."

He added, "With the Fed signaling the end of quantitative tightening (QT) in December, there have been more than 320 rate cuts worldwide over the past 24 months, and global M2 has hit an all-time high."

On-chain indicators also reflect this macroeconomic trend. The author explained, "Exchange stablecoin holdings have surpassed the peaks of 2021 and mid-2025 and reached an all-time high," and "in particular, USDT·USDC have led the increase, and other stablecoins such as FDUSD have also expanded." He assessed that this "means that a large amount of standby buying capital (dry powder) that has not yet been deployed to the market is accumulating."

The author also analyzed, "In past bull markets, there was a pattern where stablecoins quietly accumulated on exchanges and then moved into the spot market, triggering a rally. The same flow repeated in 2021, 2023, and early to mid-2025." He continued, "The current macro environment and on-chain data show very similar conditions," and diagnosed, "Stablecoin accumulation indicates that liquidity has not disappeared, and major market participants are quietly accumulating in preparation for a future market rebound."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Blooming Lunch] Yoon Hye-jun: “From McKinsey to crypto… I was drawn to the technology and the people”](https://media.bloomingbit.io/PROD/news/bd78ac04-4bf7-41c5-82db-4dd8e6d93409.webp?w=250)