Inflation still persistent but U.S. labor market shows signs of rapid cooling…Fed caught in a dilemma [Fed Watch]

Summary

- It reported that U.S. inflation remains persistent while the labor market is showing signs of significant contraction.

- Ahead of the December FOMC meeting, hawkish and dovish remarks from Fed officials are mixed, making debate over the policy rate decision unavoidable.

- In recent rate futures markets, the probability of a December policy rate hold has risen, and investors need to watch the opposing risks of inflation and labor-market weakening.

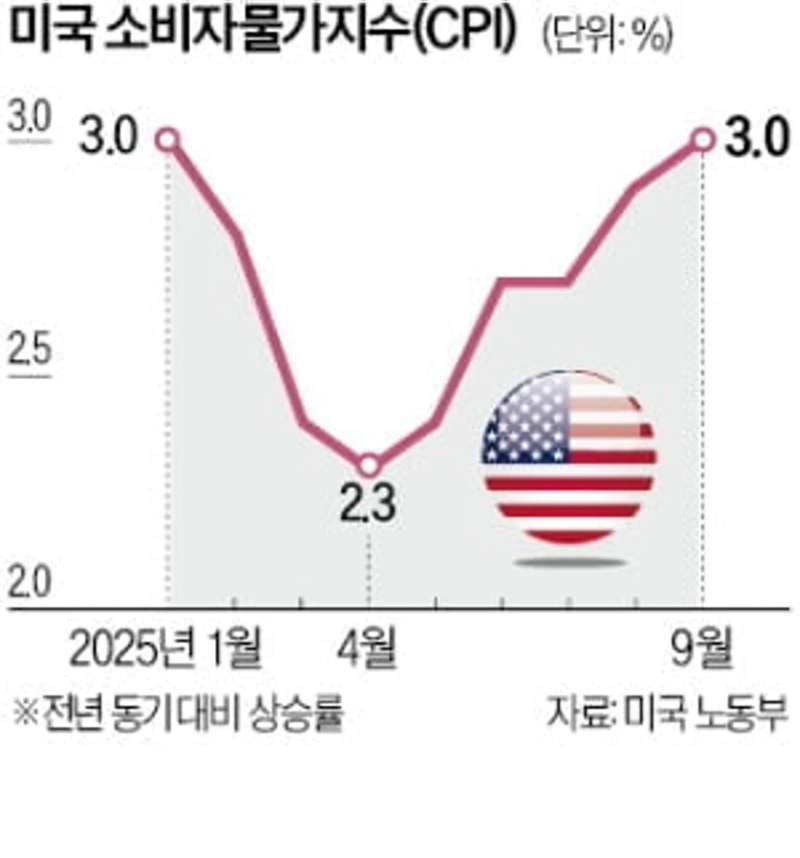

U.S. consumer price index (CPI) still exceeds the Federal Reserve's (Fed) target of 2%, while the U.S. labor market is showing signs of rapid contraction in many places. Alongside major companies' announcements of large-scale layoffs, data showed that the number of restructurings in October was the highest since the financial crisis, excluding the special circumstances of the COVID-19 pandemic.

The Fed's dilemma deepened as it must decide the direction of the policy rate at the FOMC meeting on the 9th–10th of next month. With hawkish and dovish remarks from Fed officials mixed ahead of the meeting, the upcoming meeting is expected to be unavoidably contentious.

October layoff notices surge

On the 17th (local time), Bloomberg reported that the Federal Reserve Bank of Cleveland recently announced a surge in the number of large-scale layoffs U.S. companies had announced in October. The Cleveland Fed counted that a total of 39,010 Americans received advance layoff notices under the Worker Adjustment and Retraining Notification (WARN) Act last month, the highest level in more than 20 years apart from the financial crisis (2008–2009) and the COVID-19 pandemic (2020).

Employment data firm Challenger, Gray & Christmas (CG&C) reported on the 6th that October layoffs (153,074) were the largest since 2003. Cumulative layoffs from January to October this year also rose 65% year-on-year to 1,099,500, the largest since 2020 and exceeding last year's total layoffs (761,358). Not only did the number of layoffs increase, but the number of companies announcing layoff plans also rose. Layoffs were particularly notable in technology, retail, and services.

Indeed, Verizon announced on the 13th that it plans to cut up to 15,000 employees, and last month Amazon announced 14,000 layoffs. Restructuring announcements by tech companies such as Salesforce, Microsoft, and Intel have continued throughout the year. As a result, unemployed people gathered in Bryant Park near Manhattan's Fifth and Sixth Avenues. The area, home to major big-tech firms and recruiting platforms, has emerged as a place for job seekers to prepare for reemployment.

"Big differences likely at December FOMC"

Fed officials offered differing views on how to interpret the extent of labor-market slowing. Those focused on employment argue that excessive tightening could cause a recession, while those concerned about inflation say additional rate cuts are risky because tariff-driven price pressures may continue. Last week, some Fed officials, including Alberto Musalem, president of the Federal Reserve Bank of St. Louis, explicitly said rate holds are needed because of inflation.

Christopher Waller, Fed governor, said in a speech at an event in the U.K. that "underlying inflation is close to the Fed's target and the labor market is weak," and that "I support an additional 0.25% percentage point cut in the policy rate at the December meeting." He particularly expressed concern that more companies are planning layoffs. He judged that weak consumer confidence, slowing wage growth, and weak demand for big-ticket items like housing and automobiles could restrain a renewed surge in inflation.

Philip Jefferson, Vice Chair of the Federal Reserve, said in a public speech the same day that "the current level of monetary policy is somewhat restrictive, but we have moved it toward a neutral level that neither stimulates nor restrains the economy," and that "the changing risk balance emphasizes the need to slow the pace of rate cuts."

Nick Timiraos, the Wall Street Journal reporter often called the 'unofficial spokesman' for the Fed, said of Jefferson's remarks, "This well illustrates the Fed's dilemma," adding that "the opposing threats of persistent inflation risk and a weakening labor market call for opposite prescriptions." He also said the next rate decision meeting is likely to be unusually contentious. This is because the three Fed governors appointed by U.S. President Donald Trump are likely to oppose holding rates steady.

Kevin Hassett, Chair of the White House National Economic Council (NEC), said on CNBC that artificial intelligence (AI) could significantly boost labor productivity and cause a temporary stagnation in the labor market. However, he did not view the labor slowdown as structural. On CNBC he said, "Employment indicators are sending mixed signals," and "by contrast, real activity such as production and exports is showing a very positive trend." He also forecast that "there may be a period when the labor market is temporarily quiet, that is, a phase in which hiring is stalled."

According to the CME FedWatch tool, current rate futures markets reflect a 42.9% chance that the policy rate will be cut by 0.25% percentage point in December. Conversely, the probability of a rate hold is 57.1%, a sharp rise from 37.6% a week earlier.

Reporter Han Kyung-je / New York = Correspondent Park Shin-young

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)