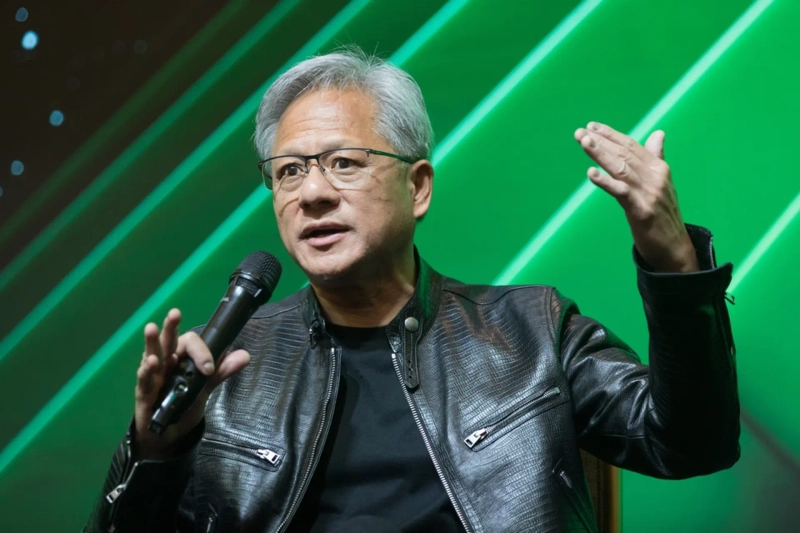

NVIDIA's Jensen Huang "Preparing for a big year with memory partners next year"

Summary

- NVIDIA said it is preparing a big year next year with its memory partners.

- The industry interpreted that diverse memory demand such as HBM, LPDDR, GDDR is surging with the growth of the AI accelerator market.

- The domestic semiconductor industry is entering a structural growth phase due to long-term contracts, mitigation of industry volatility, and projections of sharp profit increases for Samsung Electronics and SK Hynix.

NVIDIA, the powerhouse in artificial intelligence (AI) semiconductors, is expected to keep the memory semiconductor "supercycle" from fading easily as it once again posts record results. Analysts say the semiconductor business of Samsung Electronics and SK Hynix, which used to fluctuate with economic cycles, is entering a structural growth phase.

Jensen Huang, NVIDIA's chief executive officer (CEO), said on the Q3 (Aug–Oct) earnings conference call on the 19th (local time), "In the past, AI did not use memory itself, but now the amount of information that must be remembered is enormous," and added, "We are preparing a big year next year with our memory partners."

NVIDIA receives memory semiconductors from Samsung Electronics, SK Hynix, and Micron. Industry participants interpreted Huang's remark as a signal that demand is surging not only for high-bandwidth memory (HBM) used in AI accelerators but also for various memories such as low-power DRAM (LPDDR) and graphics DRAM (GDDR).

As NVIDIA's next-generation AI accelerator 'Rubin' begins production next year, the domestic semiconductor industry is expected to start full-scale supply of HBM4 (6th-generation product). Rubin will be equipped with eight HBM4 stacks, each reportedly priced nearly 50% higher than the previous HBM3E 12-layer product.

LPDDR, which was mainly used in smartphones, is also seeing expanded demand. This is because the next-generation memory module 'SOCAMM' is being installed on 'Vera', the central processing unit (CPU) used in NVIDIA data center servers. SOCAMM contains 256 LPDDR chips.

With big tech companies, including NVIDIA, moving to pre-purchase memory semiconductors through 2027, the domestic semiconductor industry's growth is expected to be prolonged. An industry source said, "Not only HBM but also memories like LPDDR and GDDR will be tied up in long-term contracts."

Supplying under long-term contracts allows manufacturers to reduce extreme earnings volatility caused by industry fluctuations. In other words, the 'memory cycle'—earning tens of trillions of won in one or two years and plunging into losses for 2–3 years—could disappear.

The industry expects SK Hynix's operating profit to surge from 42 trillion won this year (average of securities firms' estimates) to 71 trillion won next year and remain in the 70-trillion-won range in 2026. Samsung Electronics' operating profit is projected to jump from the 37-trillion-won range this year to the 76-trillion-won range next year, more than doubling.

Ui-myung Park uimyung@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)