Editor's PiCK

U.S. Ethereum Spot ETFs See Net Outflows for 8 Consecutive Trading Days

Summary

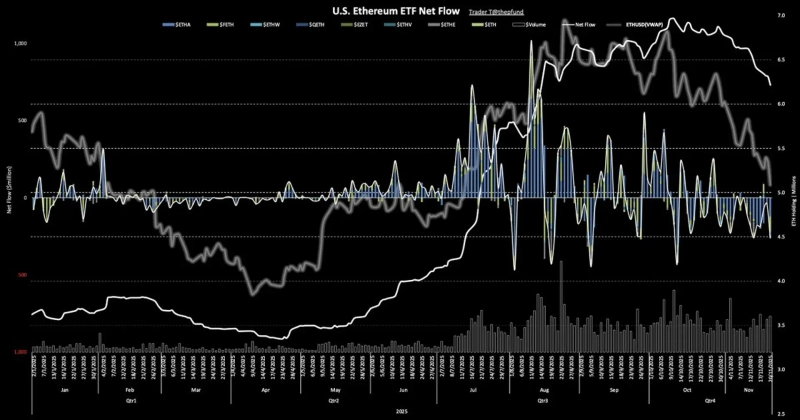

- It reported that U.S. Ethereum (ETH) spot ETFs have continued net outflows for 8 consecutive trading days.

- Notably, large capital outflows occurred from major ETFs such as BlackRock's 'ETHA' and Fidelity's 'FETH'.

- It reported that institutional capital outflows and Ethereum price declines are occurring simultaneously, intensifying the downward trend.

Net capital outflows from Ethereum (ETH) spot ETFs have continued for 8 trading days.

According to data from TraderT, on the 20th (local time), U.S.-traded Ethereum spot ETFs experienced a net outflow of $260,660,000 in a single day.

The largest outflow was from BlackRock's 'ETHA', which saw $121,670,000 withdrawn, and Fidelity's 'FETH' also saw $90,550,000 leave. These two products accounted for a large portion of the total outflows and led the downward trend. Bitwise's 'ETHW' and VanEck's 'ETHV' had $11,170,000 and $18,670,000 withdrawn, respectively. Grayscale's 'ETHE' also recorded a net outflow of $18,600,000.

Franklin's 'EZET', Invesco's 'QETH', 21Shares' 'CETH', and Grayscale Mini's 'ETH' saw no change.

With the possibility of a December rate cut fading and institutional capital outflows continuing, Ethereum's decline is deepening. On the day, based on the Binance Tether (USDT) market, Ethereum is trading in the $2,820 range, down 7% from the previous day.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)