Editor's PiCK

[Market] Opinions split between 'doves vs. hawks' within the Fed over a rate cut in December… Bitcoin drifts around the $84,000 level

Summary

- It reported that within the Federal Reserve, doves and hawks are sharply divided over a rate cut in December.

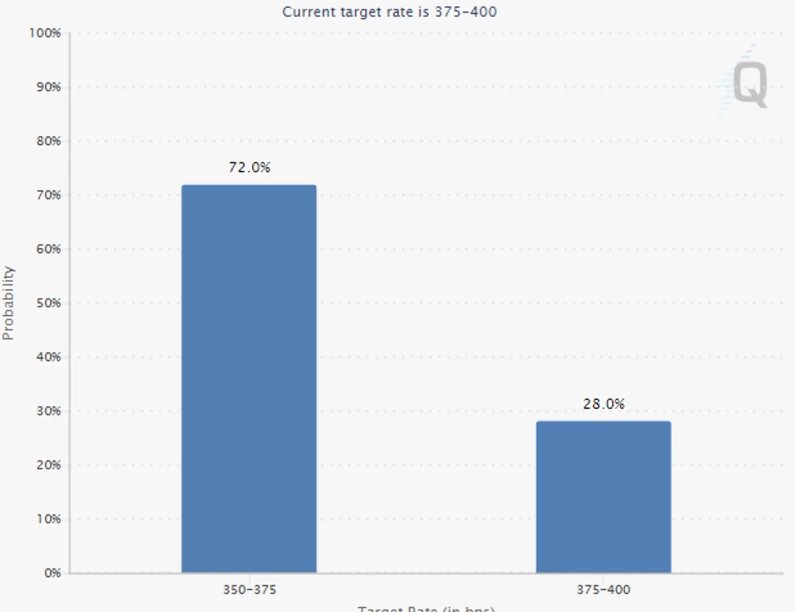

- The market said the probability of a December rate cut is 72%, a sharp increase from the previous day.

- With growing expectations of a rate cut, Bitcoin was trading at $83,993, up 7.48% from the previous day.

There is a sharp split of opinions within the Federal Reserve (Fed) over a potential rate cut in December. Bitcoin (BTC) investors appear to be taking a breather.

On the 21st (KST), according to Walter Bloomberg, Lorie Logan, president of the Federal Reserve Bank of Dallas, said "inflation is too high" and that "it would be difficult to support a rate cut in December." Earlier the same day, Susan Collins, president of the Federal Reserve Bank of Boston, also stated that she is "cautious about cutting rates while inflation remains high."

These two Fed officials are classified as 'hawks' who are somewhat cautious about rate cuts within the Fed.

On the opposite side, doves made remarks leaving open the possibility of a rate cut.

Steven Myron, a Fed governor appointed by President Donald Trump, said, "If I held the casting vote, I would vote for a 25bp cut," appearing to strongly favor a rate cut.

Around 9 p.m. that day, John Williams, president of the Federal Reserve Bank of New York, also said, "There is still room for rate cuts."

According to the Chicago Mercantile Exchange (CME) FedWatch, the market sees about a 72% chance of a Fed rate cut in December. This is 32.9 percentage points higher than the previous day (39.1%).

As prospects for a rate cut brightened, the leading crypto asset Bitcoin also managed to rebound. As of 11:12 PM, Bitcoin was trading at $83,993, up 7.48% from the previous day. Earlier that day, Bitcoin briefly fell below $81,000 intraday, but as the probability of a rate cut rose, buying pressure increased.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)