NVIDIA couldn't stop the 'AI bubble' either… What's with the 'Kkokkomu' Big Tech [Im Hyun-woo's Economic VOCA]

Summary

- It reported that NVIDIA's third-quarter revenue and earnings per share exceeded market expectations and reached record highs.

- It stated that a circular deals structure has formed among big tech firms, which leads to concerns about sales inflation and an AI bubble.

- Experts pointed out that such circular deals can act as a virtuous cycle in upmarkets but raise concerns about a vicious cycle in downturns.

NVIDIA paying money to sell chips… 'Win-win' or 'Bubble'?

Circular deals(circular deals)

'AI bubble' talk has unsettled global stock markets as U.S. semiconductor firm NVIDIA released its results. NVIDIA's fiscal third-quarter (Aug–Oct) revenue was a record $57 billion, up 62% year-on-year. Earnings per share (EPS) were $1.3, also beating market expectations. NVIDIA said that if its current growth continues, fourth-quarter (Nov–Jan) revenue could reach $65 billion. The spotless scorecard seemed to soothe AI bubble concerns, but it did not completely dispel them. At the center of the controversy are 'circular deals'.

Customer and investor… Big tech linked tail to tail

Circular deals refer to a structure in which companies buy and sell semiconductors, infrastructure, AI models, etc., becoming customers and investors of one another. Some evaluate this as a "natural phenomenon during the expansion of the AI ecosystem," while others warn that "if one business falters, a chain reaction could occur."

NVIDIA struck a strategic partnership with OpenAI last September. The deal involves NVIDIA investing up to $100 billion in OpenAI, and OpenAI purchasing millions of NVIDIA chips. In October, another semiconductor firm, AMD, also partnered with OpenAI. AMD agreed to sell AI chips worth tens of billions of dollars to OpenAI and granted OpenAI an option to buy up to 10% of AMD's shares at a low price.

The Wall Street Journal (WSJ) said, "To optimistic investors it may look like a 'win-win,' but for skeptics who doubt the AI bubble it provides another reason for concern." In other words, it is a structure that could inflate sales by paying money while selling products.

Data-center leasing company CoreWeave presents a similar situation. NVIDIA holds a 5% stake in CoreWeave and sells chips to CoreWeave. NVIDIA promised to buy all of CoreWeave's unsold cloud computing capacity through 2032. CoreWeave's largest customer is Microsoft, which is also an investor in OpenAI.

![NVIDIA couldn't stop the 'AI bubble' either… What's with the 'Kkokkomu' Big Tech [Im Hyun-woo's Economic VOCA]](https://media.bloomingbit.io/PROD/news/af4b9a16-f2e8-4f43-8891-2da5fb4ce6b6.webp?w=800)

"Resembles vendor financing from the dot-com bubble era"

Some point out that the circular deals tying big tech together resemble the 'vendor financing' of the dot-com bubble around 2000. Back then, telecom equipment vendors supported capital-poor telecom companies' infrastructure investments using loans, guarantees, and other means. Reciprocal transactions caused equipment vendors' sales to surge, but the problem emerged after the bubble burst. When telecom companies fell into financial trouble and cut investments, equipment vendors were left with bad debts and massive losses.

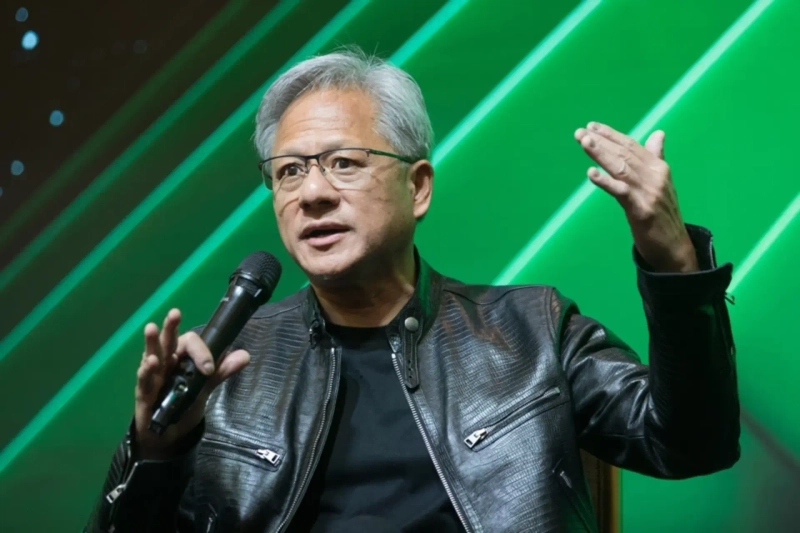

There is a counterargument that current transactions among AI companies are not traditional vendor financing because purchases did not involve loans. Jensen Huang, NVIDIA's CEO, said, "Companies buy our chips because of quality, not as an investment." The WSJ noted, "Circular deals are not necessarily problematic," but added, "they can act as a virtuous cycle in a rising market but become a vicious cycle in a downturn."

Reporter Im Hyun-woo tardis@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)