Editor's PiCK

San Francisco Fed president who has no disagreement with Powell "supports a rate cut in December" [Fed Watch]

Summary

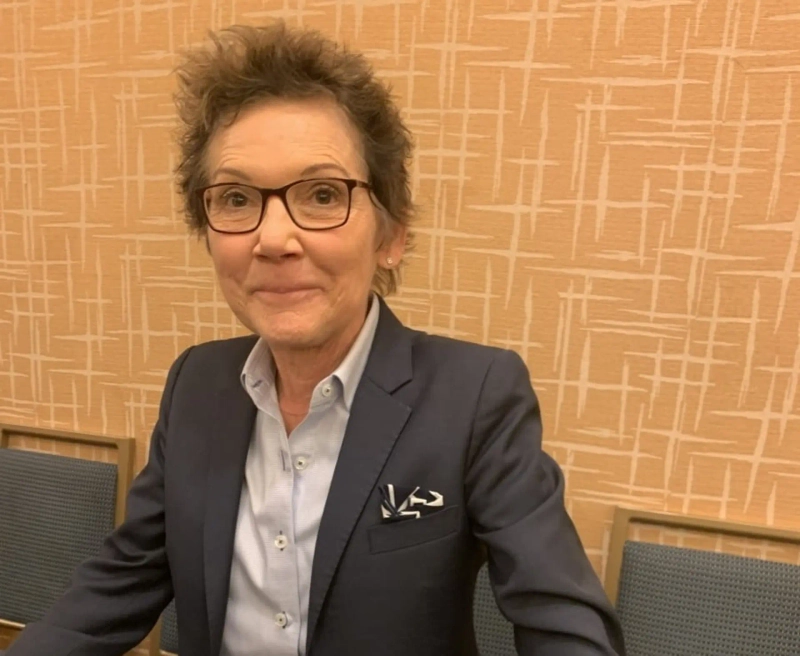

- Mary Daly, president of the San Francisco Fed, publicly said she supports a rate cut to the benchmark interest rate in December.

- She emphasized the need for a preemptive rate cut, citing recent labor market fragility and the reduced risk of inflation re-escalation.

- Markets have seen a surge in the probability of a December rate cut, drawing investors' attention to the outcome of the next FOMC meeting.

"The US labor market is currently sufficiently fragile"

"Cutting now does not mean we cannot raise rates next year"

Mary Daly, the president of the Federal Reserve Bank of San Francisco, who had shown almost no public differences of opinion within the US central bank (Fed), has signaled support for a December cut to the benchmark interest rate and warned of risks from a weakening labor market. As a centrist-moderate key figure within the Fed has called for a preemptive cut, this is expected to have a considerable impact on next month's FOMC rate decision.

In an interview with the Wall Street Journal (WSJ) on the 24th (local time), President Daly said, "I am not very confident that we can respond proactively to the labor market situation," and added, "The current labor market is sufficiently fragile and there is a risk of a sudden and nonlinear deterioration." By contrast, she assessed that tariff-driven price increases that were a concern earlier this year have been weaker than expected, lowering the possibility of inflation re-escalating.

Daly does not have a vote on this year's FOMC, but she is regarded as an official whose policy stance has been almost the same as Chair Powell. It is very unusual for her to publicly express a differentiated opinion.

Within the Fed, opinions are split over whether to cut rates further at the December 9–10 FOMC meeting next month or to hold rates steady and watch the data more.

President Daly said she believes returning to the Fed's 2% inflation target is possible without an increase in the unemployment rate, and emphasized that if unnecessary increases in unemployment occur in that process, "that would indeed be a policy failure."

She said the US economy has recently maintained a "low employment/low layoffs" balance, but she is concerned that the risk of that balance breaking down in a negative direction is growing. Daly warned, "If firms judge that 'growth in production is weaker than expected' and cut employment or undertake additional layoffs, the labor market would be placed in a very fragile situation."

The Fed has lowered its policy rate to an annual 3.75~4.00% by cutting the benchmark rate at the last two meetings, with the aim of preemptively defending against a weakening labor market. However, some members oppose further cuts, pointing to price pressures from tariffed goods and strong domestic US services prices as evidence of the risk of inflation becoming entrenched again.

The market probability of a December rate cut has surged in recent days. The probability of a 0.25% cut, which was 42.4% a week ago, rose to 84.4% on the day. John Williams, president of the New York Fed, also said last week that "there is room for rate cuts in the short term." He emphasized that "not imposing unnecessary risks on the labor market is as important as achieving the inflation goal."

Daly drew a line at the claim by some that "if we cut now, it will be difficult to raise rates again next year." She said, "We should not assume that our hands will be tied next year. If the economy weakens further, additional cuts are possible, and if necessary, we should raise rates again."

On the widening differences within the Fed, Daly said, "Given the current uncertainty, differences of opinion are natural and healthy." She also said, "If everyone had the same opinion now, we would be falling into groupthink. Our mission is not to 'maintain consensus' but to 'make the right judgment.'"

She said, "I view the risks of cutting rates as relatively low," and added, "Conversely, I view the risks of not cutting rates as higher."

New York=Correspondent Park Shin-young nyusos@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] “Airdrops also taxable”... Authorities to adopt a ‘comprehensive approach’ to crypto assets](https://media.bloomingbit.io/PROD/news/d8b64ab3-376a-41c1-a0a8-5944ff6b90c7.webp?w=250)

![[Market] Bitcoin slips below $75,000…Ethereum also falls under $2,200](https://media.bloomingbit.io/PROD/news/eaf0aaad-fee0-4635-9b67-5b598bf948cd.webp?w=250)