Editor's PiCK

Warning of "structural vulnerability" despite Bitcoin rebound…"Downward pressure ↑ if below $96,000"

Summary

- On-chain analytics firm Glassnode said the Bitcoin market is structurally vulnerable and that demand slowdown and weakness continue.

- It was analyzed that if it does not hold above $96,100 within the year, downside pressure could increase.

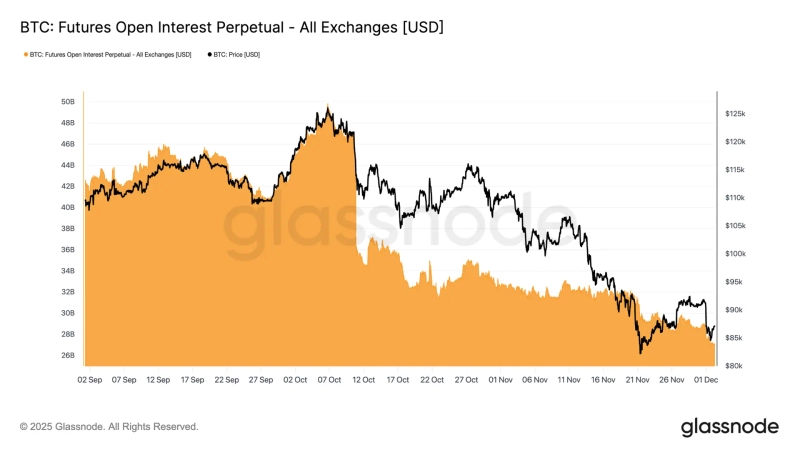

- ETF fund net outflows and shrinking futures open interest are among off-chain indicators that also show investors' risk-off sentiment is spreading.

Bitcoin (BTC) prices have recently rebounded, but analysis shows the market remains structurally vulnerable. It is pointed out that if Bitcoin does not break above $96,000 within the year, downside pressure could increase.

On-chain analytics firm Glassnode said in its weekly report on the 4th (local time) that "Bitcoin continues to trade in a structurally vulnerable environment where on-chain weakness and demand slowdown coincide," and "while prices briefly stabilized above the 'True Market Mean', the overall market structure resembles the pattern seen in Q1 2022."

Glassnode emphasized that "more than 25% of (Bitcoin) supply is in loss." Glassnode noted that "realized losses among (investors) are increasing, and sensitivity to macroeconomic shocks is also rising," adding, "Although significantly weaker compared to early this year, positive capital momentum remains one of the few positive signals preventing a deeper decline."

Looking at off-chain indicators, Glassnode also analyzed that 'risk-off (avoidance of risky assets)' sentiment is spreading. Glassnode said, "ETF flows have turned to net outflows, spot CVD (cumulative volume delta) has 'rolled over'," and "futures open interest (OI) has been steadily shrinking." It added, "Funding rates are close to neutral, so there are neither strong bullish signals nor aggressive short pressures," and "options are priced cheaply relative to realized volatility, indicating investor caution rather than a recovery in risk asset appetite."

Glassnode said it is important for Bitcoin to hold above $96,100 within the year. Glassnode stated, "Maintaining (above $96,100) is key to stabilizing market structure and mitigating year-end downside vulnerability," and "unless macroeconomic shocks disrupt market equilibrium, holding the core 'average purchase price (cost-basis)' range will be necessary to maintain stability."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)