U.S. XRP ETF continues 13-day streak of net inflows…Net assets surpass $900 million

Summary

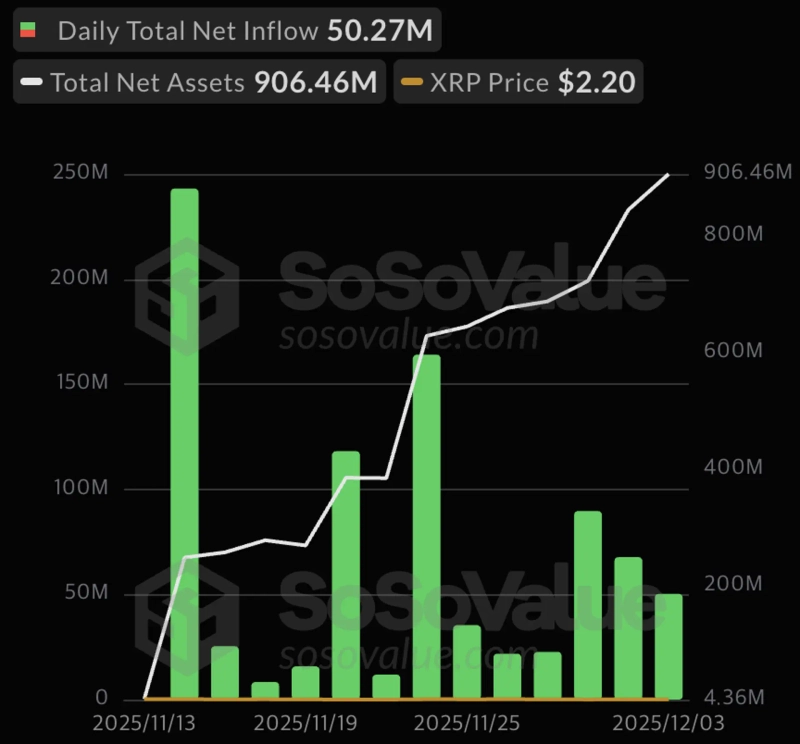

- SosoValue reported that the U.S. XRP spot ETF continued a 13-day streak of net inflows.

- CoinDesk said the XRP spot ETF's net assets amounted to $906 million and that it was close to surpassing $1 billion within a month.

- It reported that major investment banks (IBs) such as Fidelity, Franklin Templeton, and Invesco have applied to list XRP ETFs.

The U.S. XRP spot exchange-traded fund (ETF) has continued a 13-day streak of net inflows since its launch.

On the 4th (local time), on-chain analytics firm SosoValue reported that the XRP spot ETF recorded 13 consecutive days of net inflows from the 14th of last month through the 3rd of this month. As of that date, the cumulative net inflows into the XRP spot ETF were $874 million (about 1.3 trillion won).

The net assets of the XRP spot ETF were $906 million (about 1.33 trillion won) as of that date. CoinDesk said, "(The XRP spot ETF) is close to the milestone of surpassing $1 billion in net assets less than a month after launch," adding, "this is a signal of high adoption of XRP assets by traditional finance and securing liquidity."

New XRP ETFs are also expected to be launched one after another. According to the U.S. Depository Trust & Clearing Corporation (DTCC), major investment banks (IBs) such as Fidelity, Franklin Templeton, and Invesco have applied to list XRP spot ETFs.

Meanwhile, XRP was trading at $2.13 on CoinMarketCap as of 11:20 p.m. that day, down 1.24% from the previous day. Compared with a week earlier, it was down 2.12%.

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)