[Analysis] "Exchange Bitcoin Holdings at an All-Time Low…Typical Accumulation Phase"

Summary

- It reported that cryptocurrency exchanges' Bitcoin holdings have reached an all-time low.

- Over the past three months, Bitcoin reserves have decreased significantly, leading to interpretations that this is a typical accumulation phase.

- In particular, Binance's Bitcoin reserves also showed a clear decline in December, indicating it reacts sensitively to market flows.

The amount of Bitcoin (BTC) held by cryptocurrency exchanges has hit an all-time low.

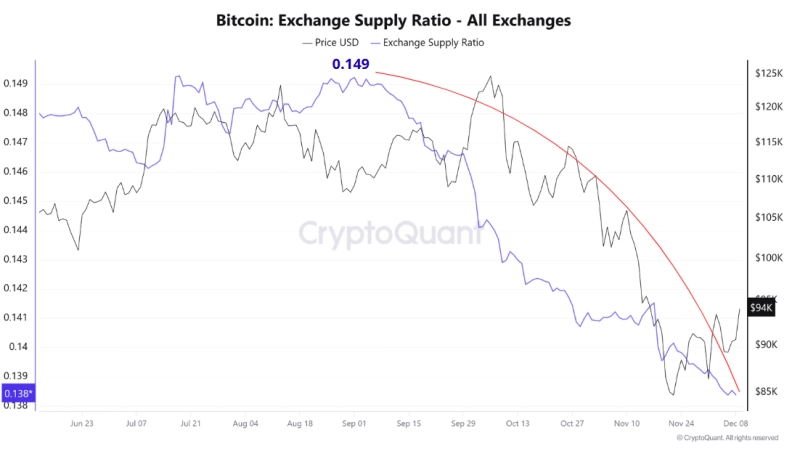

Arab Chain, a CryptoQuant contributor, said on the 10th (local time) via CryptoQuant that "the 'Exchange Supply Ratio,' which shows the proportion of Bitcoin available for trading across all exchanges, has been on a sharp decline since early September." Arab Chain said, "The overall exchange supply ratio fell from about 0.149 in September to 0.138 in December, marking a record low," adding, "It means the amount of Bitcoin available for trading in the actual market is continuing to decrease."

It also mentioned the Bitcoin holdings of Binance, the world's largest cryptocurrency exchange. Arab Chain analyzed, "In particular, Binance's (Bitcoin) supply ratio shows more pronounced volatility than other exchanges," and said, "The supply ratio surged in mid-last month due to a large inflow of Bitcoin, then quickly fell this month as holdings flowed out."

The recent trend in exchanges' Bitcoin supply ratio can be interpreted as an accumulation phase. Arab Chain said, "The total Bitcoin reserves held by all exchanges decreased from 2,972,000 coins at the beginning of September to 2,763,000 coins in December, a decline of about 209,000 coins over the past three months," explaining, "Such large-scale withdrawals are a typical accumulation-phase pattern in which investors move Bitcoin to personal wallets for long-term holding."

Binance's Bitcoin reserves are also declining. Arab Chain said, "Binance's Bitcoin reserves increased in November due to large inflows but turned to a clear decline in December," adding, "This means Binance is the platform that reacts most sensitively to market flows, and movements within Binance are closely linked to the decisions of institutions and large investors."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)