[Analysis] "Bitcoin implied volatility shrinking…Possibility of returning to a trading range"

Summary

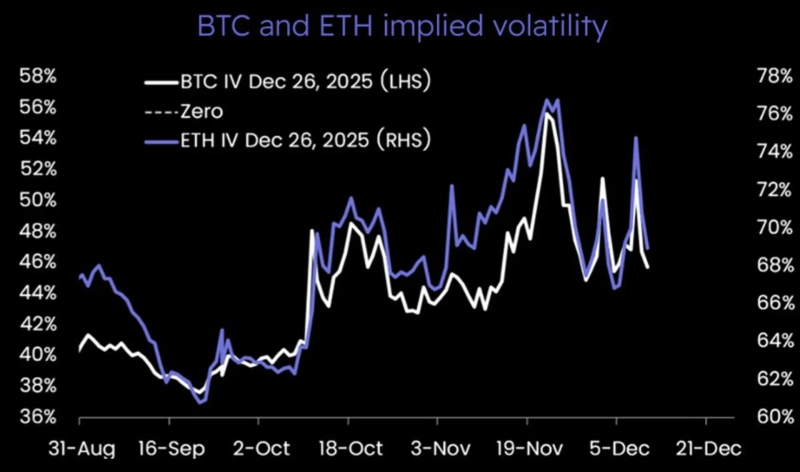

- Matrixport said that Bitcoin implied volatility has been continuously shrinking and that the likelihood of a meaningful upside breakout by the end of this year is low.

- Analysis suggested that if new inflows through Bitcoin ETFs do not strengthen, Bitcoin prices are likely to remain rangebound.

- The market said that, due to the decline in implied volatility, the chance of a surprise rebound at the end of this month is being gradually assessed as lower.

Despite expectations for a U.S. interest rate cut, there is analysis that Bitcoin (BTC) prices could be trapped in a trading range again.

Crypto analytics firm Matrixport said on the 10th (local time) via its official X account, "(Bitcoin's) implied volatility has been continuously shrinking," adding, "This also lowers the likelihood of a meaningful upside breakout by the end of this year." Matrixport said, "Today's scheduled Federal Open Market Committee (FOMC) meeting is the last key catalyst (this year), but after this, volatility is likely to be lower during the holiday period."

If inflows through exchange-traded funds (ETFs) do not strengthen, Bitcoin prices are likely to remain rangebound this month. Matrixport analyzed, "If new inflows into Bitcoin ETFs do not become a driving force for directionality, the market could return to a range-bound flow," adding, "This is generally associated with further declines in volatility." It continued, "In fact, such an adjustment is already underway," adding, "As implied volatility falls, the market is gradually lowering its assessment of the possibility of a surprise rebound at the end of this month."

Meanwhile, as of 5:18 p.m. (Korea Standard Time) that day, Bitcoin was trading at 92,695.97 dollars on CoinMarketCap, up 2.39% from the previous day. Compared with a week ago, it is down 0.26%.

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)