Editor's PiCK

[Analysis] "Bank of Japan rate hike already priced in…Bitcoin sell-off phase"

Summary

- XWIN Research Japan said the possibility of a Bank of Japan rate hike has already been reflected in Bitcoin prices.

- They reported that on-chain data such as exchange Bitcoin net inflows and funding rates show selling pressure and investors' preemptive risk avoidance.

- They explained that in this cycle, expectations of a Bank of Japan's hawkish shift and yen carry trade liquidation have already been reflected in the market, and price adjustments are appearing preemptively.

The possibility of a rate hike by the Bank of Japan has already been priced into Bitcoin (BTC) prices, according to an analysis.

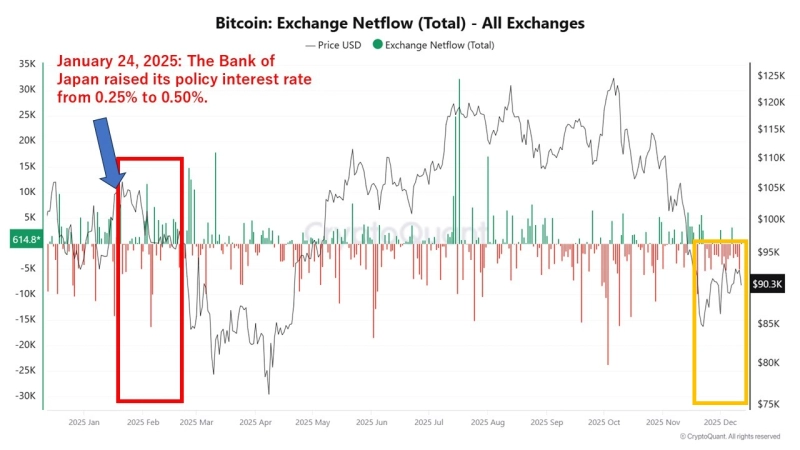

An XWIN Research Japan CryptoQuant contributor said on the 14th (local time) via CryptoQuant, "Ahead of the additional rate hike by the Bank of Japan scheduled for the 19th, the current market environment suggests that a downward adjustment may already be underway." XWIN Research Japan said, "This interpretation is confirmed not only by Bitcoin price movements but also by on-chain data."

XWIN Research Japan focused on 'exchange net inflows (netflow)'. He said, "In past Bank of Japan rate-hike phases, exchange Bitcoin inflows surged before and after the (rate) announcement, concentrating selling pressure at certain times," and, "By contrast, recently exchange inflows have already been increasing ahead of the event (rate hike)." He added, "This means the supply-demand deterioration is already progressing preemptively before the (rate) announcement," and, "Investors are preemptively reducing spot exposure and risk (in crypto) even before the Bank of Japan's rate decision."

He also mentioned the funding rate. XWIN Research Japan noted, "In past rate-hike periods, long (buy) positions were massively liquidated before and after the announcement, causing funding rates to plunge and the structure to shift to short (sell) position dominance," and, "Currently, however, the funding rate is already showing a downtrend before the event, indicating an unstable flow." He said, "This means leverage positions are being cleared in advance," and, "It is closer to reflecting preemptive caution rather than post-event panic."

XWIN Research Japan emphasized, "What is different in this cycle is that the Bank of Japan's 'hawkish shift' has been widely discussed for months." He said, "The unwinding of the 'yen carry trade' and global liquidity tightening were also anticipated variables," and, "As a result, the market shock was brought forward in timing, and signals that adjustments have already begun are appearing both in price movements and on-chain indicators."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)