[Analysis] "Bitcoin open interest increases even amid weakness…macroeconomic variables should be watched"

Summary

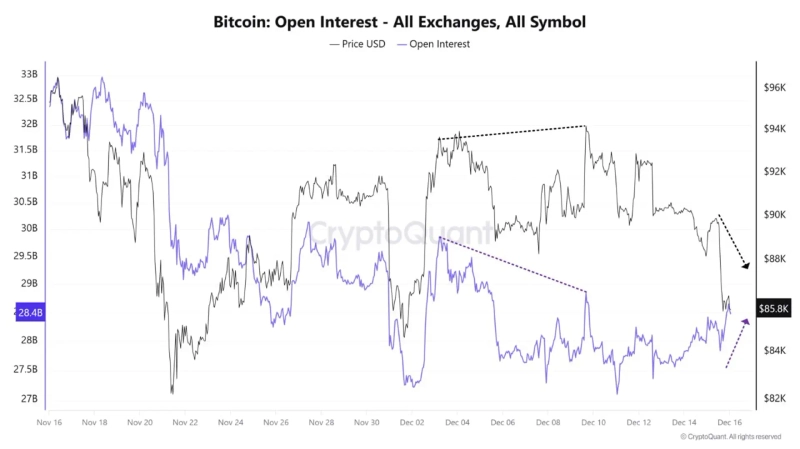

- It reported that open interest increased even as the Bitcoin price plunged.

- It analyzed that traders expanded long positions even in a down market, and a short-term trend reversal could be expected.

- It emphasized that the macroeconomic indicators scheduled to be released this week could have a significant impact on Bitcoin's short-term volatility.

On that morning, even as the leading crypto asset Bitcoin (BTC) plunged, open interest was found to have increased. Open interest refers to the size of positions accumulated in the futures market and is an indicator that shows the investment demand in the crypto futures market.

On the 16th (Korea time), MAC.D, a CryptoQuant contributor, wrote in a report, "On that day, while the Bitcoin price was falling, open interest showed an upward trend. At the same time, the funding rate also rose," and analyzed, "This means traders increased their bets on long positions even during the decline." A rise in the funding rate indicates that traders betting on the asset's upside outnumbered those betting on the downside.

The contributor explained, "That open interest increased even as prices fell means that risk-taking position entries are increasing," and "If this flow continues, there is room to interpret it as a signal that could point to a short-term trend reversal."

However, the contributor emphasized the need to watch macroeconomic indicators. He said, "This week, major macroeconomic events are scheduled one after another, including the U.S. nonfarm payrolls, unemployment rate, CPI, and PCE releases, as well as Japan's interest rate decision," and added, "In such an environment, macroeconomic indicator announcements are more likely to have a greater impact on short-term volatility than Bitcoin's own market indicators."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.