Editor's PiCK

[Analysis] "Bitcoin selling pressure caused by short-term investors… dumped USD 1.89 billion"

Summary

- The Bitcoin decline was driven by short-term investors' selling; they deposited 24,700 bitcoins to exchanges.

- About 86.8% of the selling volume was for profit-taking, which exceeded USD 1.89 billion.

- Long-term investors reportedly remained on the sidelines during this decline without panic or active selling.

Analysis suggested that short-term investors who executed sell orders were behind the day's Bitcoin (BTC) correction.

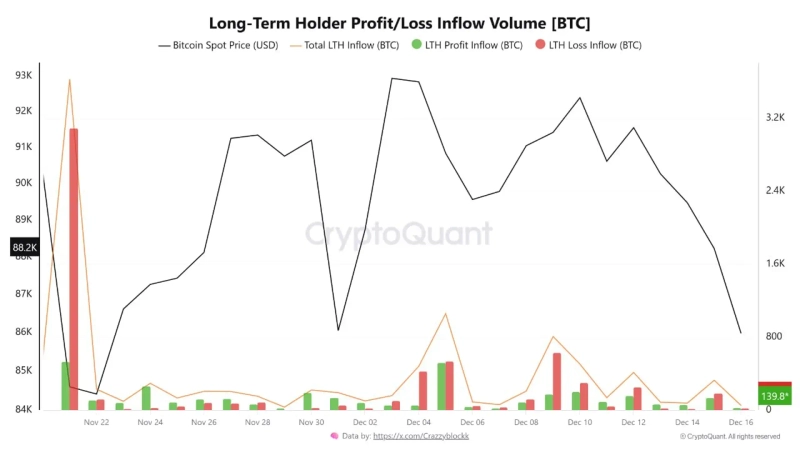

On the 16th (Korean time), Crazzyblockk, a CryptoQuant contributor, wrote in a report, "While Bitcoin fell from $88,200 to $86,000 that day, short-term investors deposited about 24,700 bitcoins to exchanges," adding, "Of these, 86.8% were profit-taking and 13.2% were stop-losses."

He continued, "In terms of dollar amount, deposits by short-term investors for profit-taking exceeded USD 1.89 billion and far outpaced loss-realization volumes," adding, "This indicates it was not panic selling driven by fear, but rather recent entrants realizing gains during the price rebound."

The contributor explained that this selling pressure stopped at the $86,000 level. He said, "As Bitcoin's price fell to around $86,000, short-term investors' deposits to exchanges plunged to about 3,900," adding, "This shows that short-term investors' selling was exhausted at that price."

By contrast, long-term investors appeared to choose 'waiting and watching' rather than selling during this decline. The contributor said, "Over two days, long-term investors' exchange deposits fell from about 326 to around 50, and no panic selling, fear-driven selling, or meaningful profit-taking flows were observed," explaining, "Despite the price adjustment, long-term investors mostly remained on the sidelines, showing that long-term conviction remains firm."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.