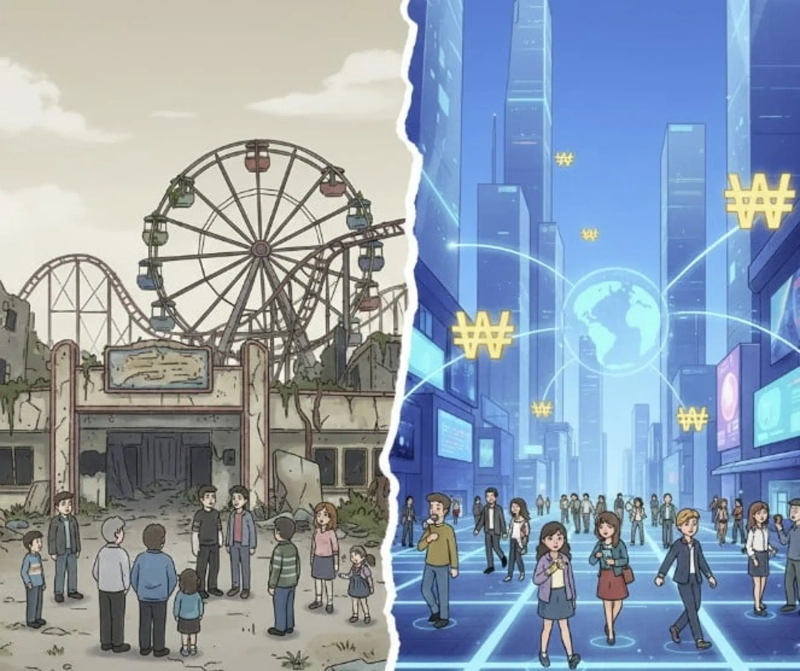

"It'll End Up Like a Public Theme Park"... The Crossroads for Won Stablecoins [Hankyung Koala]

Summary

- The essence of stablecoins is as a medium of exchange for the digital asset market, with 94% used in that market.

- He stated that won stablecoins that fail to gain the market's choice will not be sustainable even if legalized.

- He stated that stablecoins will continue to appear in various forms such as dollar, euro, yen, and won, and that the principle of survival of the fittest will operate.

Kim Min-seung's ₿official

The definition of stablecoins varies widely depending on the observer. To anti-money laundering experts they are a new high-tech means of money laundering, to Wall Street and the U.S. Securities and Exchange Commission (SEC) they are a "new platform to which a significant portion of finance will move within the next two years." To the White House they are a "tool that will drive dollar hegemony and demand for government bonds," and to legal experts they are something confusing—foreign exchange, a cash equivalent, or a virtual asset.

Merchants see them as an alternative that can dramatically reduce payment processor fees. For incumbent banks they are a direct threat to the financial network. For people in countries like Turkey, Brazil, and Nigeria they are a more stable store of value than deposits in their domestic currency, and for overseas workers they are a remittance method that allows sending money to family back home quickly and cheaply without banks.

The Answer Is in the Market

Beyond the various interpretations of stablecoins, the core that runs through all discussions is the 'market.'

Stablecoins were not systematically created by governments or central banks, but are the result of the public discovering convenience through numerous coin experiments. Anonymous individuals tried various coins, recognized the value of stablecoins, and over about a decade the market grew on its own.

Now, dollar stablecoins chosen by the market alone have grown to $280 billion in supply and nearly $1 trillion in monthly trading volume. And the main use of these stablecoins is as a medium of exchange in the digital asset market. 94% of stablecoins are used in the digital asset market, and only 6% are used in the real economy.

This gives us an important implication. Whether or not they support government bond demand, whether or not they can be abused for money laundering, whether or not they replace existing payment systems, stablecoins will inevitably continue to be used. Despite regulatory neglect, the digital asset market has grown to trillions of dollars, and within that market stablecoins have been chosen as a medium of exchange and have already formed a vast ecosystem.

Until the second Trump administration took office, governments worldwide had forcibly separated the digital asset market from mainstream finance through a 'financial separation' policy. The digital asset market was dismissed as 'off-limits' by mainstream finance, and what happened there was treated as 'not important.' Even as decentralized finance without KYC developed brilliantly, the mainstream dismissed it as 'bad' or merely a 'minor deviation' used for crime or money laundering. And as the U.S. and Trump sought to integrate this world with the real economy, the world has been startled by the size of the digital asset market and the trading volume of stablecoins.

Early stablecoins had the advantage of enabling value transfer without expensive, slow banks and the disadvantage that lack of regulation made money laundering possible. The current uses of stablecoins have become much more complex and diverse. They can be coins traded by artificial intelligence (AI), serve as a payment intermediary between financial institutions, or become consumer payment methods that replace credit and debit cards.

But all of this is only the 6% ancillary function. The essence has not changed. The essence of stablecoins is as a medium of exchange in the digital asset market. It has been so and will continue to be so. How stablecoins are used in the off-chain real economy is only an ancillary function that governments and mainstream finance can understand. The essence, which accounts for 94%, is the global on-chain digital asset market that has grown massively in the face of mainstream neglect. The U.S. 'on-chain-ization of finance' is an initiative to move the existing financial market here.

What the Market Chooses Survives

Look back at the ICO frenzy around 2017. Failed coins had something in common. They were coins defined and designed by people who did not understand the coin market or blockchain, arbitrarily deciding 'this is what a coin should be.' They were not sustainable and disappeared because they were not chosen by the market. The opposite examples are the coins that, even during the recent altcoin winter, were chosen by the market and grew significantly. They are coins whose products are actually used, generate revenue, and have that revenue reflected in value.

The same applies to stablecoins. Won stablecoins are also coins and must be chosen by the market to be sustainable. That means that coins not chosen by the market will inevitably perish.

An Inevitable Future

Stablecoins are the point where the $3–4 trillion of value on blockchains meets the real economy. Unless the entire digital asset sector collapses, stablecoins will continue to appear in the forms of dollar, euro, yen, and won. That is an inevitable future. And the market will always show the principle of survival of the fittest. We must create a won stablecoin that will be chosen by the market. We should not legalize a won stablecoin that the market will ignore and that will perish.

There was a report that many 'theme parks' developed as national projects in the Gyeongbuk area with trillion-won budgets attracted only sixteen visitors over three days. The future of won stablecoins should not be like this.

Kim Min-seung, head of the Korbit Research Center...

He is a founding member and the head of the Korbit Research Center. He explains complex events and concepts occurring in the blockchain and virtual asset ecosystem in an accessible way and helps people with different perspectives understand each other. He has experience in blockchain project strategy planning and software development.

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)