[Analysis] "Exchange·ETF Bitcoin trading volume slowdown… structural bear market not yet"

Summary

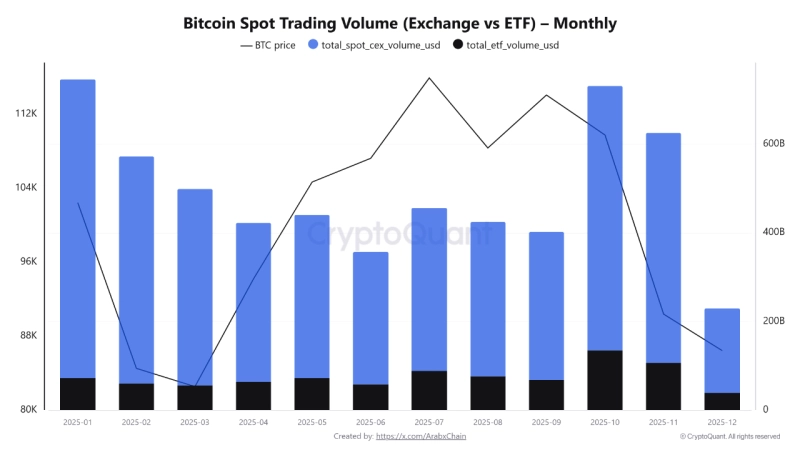

- It reported that Bitcoin trading volumes on centralized exchanges and ETFs have clearly declined since mid-December.

- The analysis said that both institutional investor-driven ETF demand and centralized exchange trading volumes have slowed, weakening market momentum.

- However, the December decline in trading volumes is not a signal of structural weakness, and it said Binance's recovery of liquidity is a key axis for judging market momentum.

So far this month, Bitcoin (BTC) trading volumes on centralized exchanges (CEX) and exchange-traded funds (ETF) have been showing a downward trend.

Arab Chain, a CryptoQuant contributor, said on the 17th (local time) via CryptoQuant, "Entering mid-December, Bitcoin trading volumes across centralized exchanges and ETFs are clearly decreasing." Arab Chain noted that "(in particular) ETF trading volume is about $39 billion, showing a clear decline compared with the active flows observed in early November," adding that "this means demand from institutional investors who use ETFs as a primary investment vehicle has slowed."

Arab Chain also emphasized the decline in centralized exchange volumes. Arab Chain said, "(In mid-December) the total volume on centralized exchanges is about $191 billion," and "in early November centralized exchange volume reached $263 billion, and ETF volume also exceeded $50 billion." It added, "This shows that November was a period marked by increased risk-asset appetite and notable liquidity inflows."

The analysis is that market momentum is weakening due to reduced institutional demand. Arab Chain said, "The gap in trading volumes between November and December means the market is moving from a strong momentum phase to a phase of adjustment and caution," and "preferences for entering new positions have also decreased both on centralized exchanges and ETFs."

However, Arab Chain's diagnosis is that the market has not entered a structural bear market. Arab Chain said, "(It is not yet necessary to interpret the December decline in volumes as a signal of structural weakening)," and analyzed that "(the decline in volumes) is reasonably seen as a temporary slowdown following a recent overheated phase." It added, "(In particular) Binance remains one of the most sensitive indicators for judging whether liquidity is recovering," and "Binance remains a key pillar in forming Bitcoin market momentum."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)