Editor's PiCK

[Analysis] "Bitcoin enters 'deceleration phase' as liquidity and on-chain weaken"

Summary

- XWIN Research Japan said the cryptocurrency market, including Bitcoin, has clearly entered a deceleration phase.

- In particular, the decrease in USDT market cap growth and the lowest number of active Bitcoin wallets indicate market liquidity contraction and deteriorating investor sentiment.

- They emphasized that with thinner liquidity there is a possibility of increased price volatility, and the market may be quietly rebalancing before the next phase.

Bitcoin (BTC) and other cryptocurrency markets have entered a slowdown phase, according to an analysis.

A CryptoQuant contributor for XWIN Research Japan said on the 17th (local time) via CryptoQuant that "the cryptocurrency market has clearly entered a slowdown phase." XWIN Research Japan said "Bitcoin's Fear & Greed Index fell to 11, entering the 'extreme fear' zone," and "investor sentiment has cooled significantly, and most expectations for a short-term bullish move have disappeared."

XWIN Research Japan highlighted liquidity indicators. He said, "Stablecoin supply increased rapidly in the second half of this year, but the recent rate of increase has noticeably slowed," noting "in particular, Tether (USDT)'s 60-day market capitalization increase narrowed from $15.38 billion in November to $4.83 billion recently, decreasing by nearly two-thirds." He added, "This suggests that new capital inflows are gradually drying up," and "as year-end approaches, seasonal factors that slow market participation and capital inflows are adding to thinner overall liquidity."

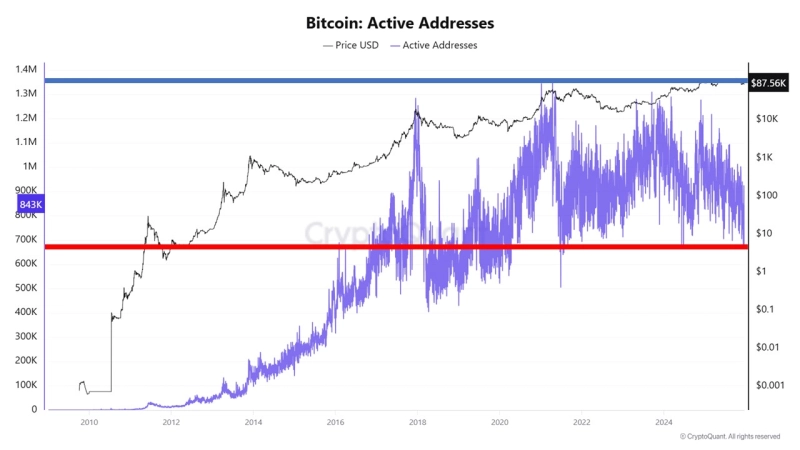

He also mentioned on-chain indicators. XWIN Research Japan said, "The number of active Bitcoin wallets has fallen to its lowest level in the past year," meaning "even if price volatility occurs, fewer market participants are actually engaging in transactions." He analyzed, "Short-term speculative demand has largely disappeared, and only participants with a more long-term perspective or clear strategies remain in the market."

XWIN Research Japan emphasized that "as liquidity thins, price volatility could rather increase." He said, "(The recent environment) is a phase where market noise decreases and the real supply-demand structure becomes clearer," and "the spread of fear and liquidity contraction may look negative on the surface, but it could be a quiet process of rebalancing before the market moves to the next phase."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)