"Bitcoin recovers to $90,000, derivatives long positions expand…year-end volatility in focus"

공유하기

- Glassnode said that after Bitcoin (BTC) price recovered to $90,000, leveraged long positions in the derivatives market are increasing again.

- They reported that perpetual futures open interest increased by about 2% and the funding rate rose, strengthening bullish sentiment in the market.

- Glassnode assessed that position reshuffling and increased leverage demand ahead of year-end imply the possibility of expanded short-term volatility.

- The article was summarized using an artificial intelligence-based language model.

- Due to the nature of the technology, key content in the text may be excluded or different from the facts.

Since Bitcoin (BTC) price recovered to $90,000, leveraged long positions in the derivatives market have been increasing again.

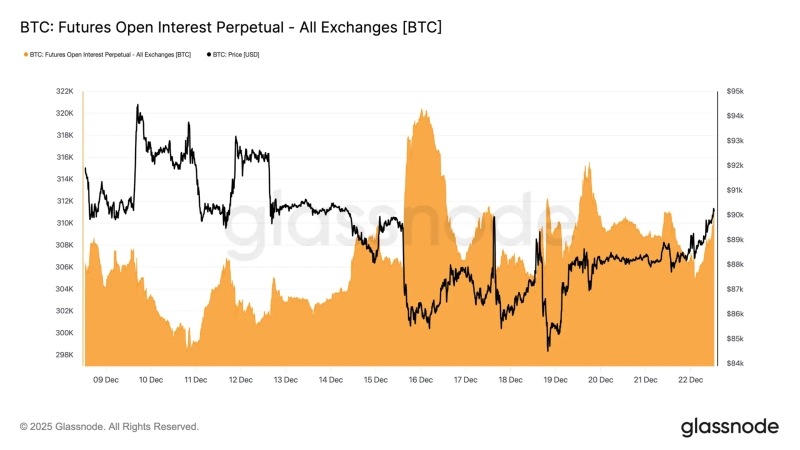

On the 22nd, on-chain data analytics firm Glassnode said on X (formerly Twitter), "Since the Bitcoin price recovered above $90,000, perpetual futures open interest increased from 304,000 BTC to 310,000 BTC, an increase of about 2%."

During the same period, the perpetual futures funding rate also rose from 0.04% to 0.09%. Glassnode explained that "this suggests that the construction of leveraged long positions is increasing again."

Glassnode said, "Perpetual futures traders are reshuffling positions in preparation for the possibility of additional price swings ahead of year-end," and assessed that "the combination of price recovery and a simultaneous increase in leverage demand implies the potential for expanded short-term volatility."

Meanwhile, open interest refers to the number of contracts of positions that traders in the derivatives market have not liquidated. An increase in the scale of open interest means that capital is flowing into the market. Generally, as open interest increases, the likelihood of greater coin price volatility rises.

Also, in the perpetual futures market, a positive funding rate implies bullish sentiment in the market, while a negative rate indicates bearish sentiment.